Bitcoin (BTC) Surges to $84.5K: Misguided Market Sentiment Analysis March 2025

Jakarta, Pintu News – Bitcoin (BTC) recently hit $84,500, showing once again how volatile market sentiment can be. Just a few days earlier, the price had dropped to $78,000, which triggered widespread bearish sentiment. However, as is often the case, fear-induced price drops are often followed by strong price recoveries.

Market Psychology and Bitcoin (BTC) Price Movement

Bitcoin (BTC) often moves contrary to common expectations. Retail traders tend to react emotionally, rather than strategically, which reinforces the classic pattern where fear leads to lows and greed leads to highs. In the last month, Bitcoin (BTC) moved in a critical price range, never dropping below $70,000 and not managing to break the psychological $100,000 mark.

When predictions of prices dropping below $70,000 appear, it often signals excessive fear. Conversely, when market expectations start to hit $100,000 or more, it often indicates a rising tide of greed. This shows how important it is to understand the psychological dynamics that affect the price of Bitcoin (BTC).

Also Read: Crypto Analyst Ali Martinez Explains Potential Catalysts for Cardano (ADA) March 2025 Price

Key Indicators and Market Predictions

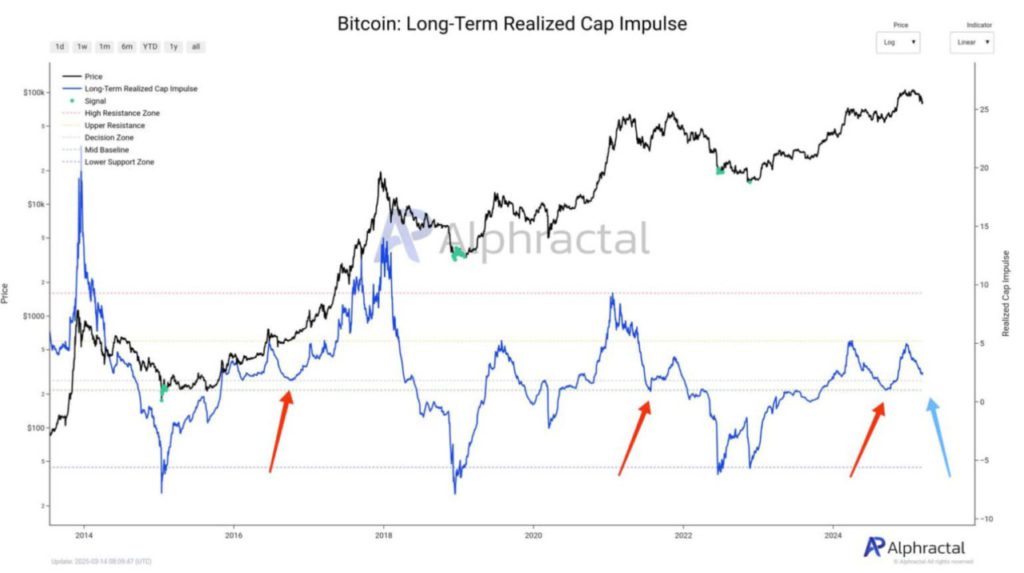

One important indicator that analysts monitor is the Long-Term Realized Cap. This indicator tracks long-term capital flows and has been a reliable support level in previous bull markets. If Bitcoin (BTC) holds above this level, there is a chance that the uptrend will continue.

However, if this level is broken, it could be the first sign of a prolonged decline. Technical analysis by Rekt Capital shows that Bitcoin (BTC) price action is filling the CME gap between $82,245 and $87,000, signaling further upside momentum. This confirms that weakening resistance could be a sign of further price gains.

Market Structure and Long-Term Capital Flows

More than just short-term price fluctuations, deeper structural trends provide a clearer picture of the strength of the Bitcoin (BTC) market. Long-Term Realized Cap Impulse, which tracks long-term capital movements, provides insight into supply and demand.

Unlike the daily fluctuations triggered by hype and fear, this metric highlights a fundamental shift in the market structure. Whether Bitcoin (BTC) is in a sustained uptrend or facing an upcoming correction, if the price remains stable above this threshold, the rally could gain more traction. However, failure to maintain this level could lead to a prolonged market decline.

Conclusion

Understanding the extremes of sentiment is key to effectively managing investments in the Bitcoin (BTC) market. Fear often creates prime buying opportunities, while excessive optimism tends to precede corrections. By understanding these dynamics, investors can make more informed decisions in the face of market volatility.

Also Read: Ripple (XRP) Price Surge Predicted After Crypto Wallet Launch in March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Bitcoin Rebounds to $84.5K. Accessed on March 18, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.