CAKE Crypto Price Update (3/18): PancakeSwap Skyrockets 40% – Is $3 the Next Stop?

Jakarta, Pintu News – As of March 18, 2025, PancakeSwap (CAKE) has risen 40% in the last 24 hours, with its revenue rising to $19 million in the last seven days, only losing out to Tether (USDT), Circle (USDC), and Jupiter (JUP).

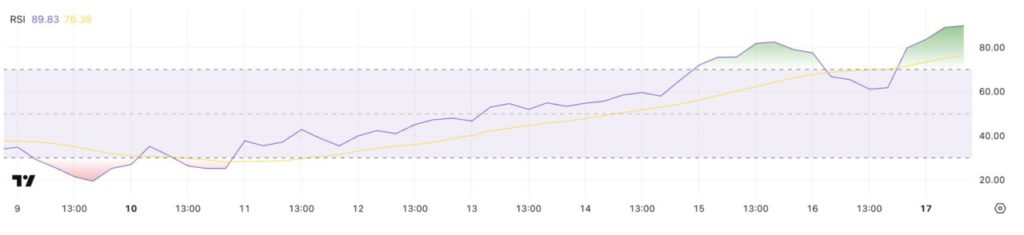

This latest price spike comes as the bullish technical signals are getting stronger. CAKE’s RSI reached its highest level since 2023, while the Ichimoku Cloud and EMA indicators point to further upside potential.

Here are the factors behind the CAKE rally and key levels to watch next, citing a report from BeInCrypto.

CAKE Crypto Price Update: PancakeSwap RSI Surges to Highest Level Since 2023

CAKE’s RSI is currently at 89.6, up sharply from 25.1 in just one week, marking the highest level since November 2023.

Read also: Shocking Prediction: XRP Price Could Hit $70? Here’s how various crypto analysts analyze it!

This significant rise indicates the presence of strong buying pressure recently, pushing the momentum indicator into extreme territory.

The Relative Strength Index (RSI) is a momentum oscillator commonly used to measure the speed and magnitude of recent price changes. This indicator ranges from 0 to 100, where values above 70 are generally considered overbought, while below 30 are considered oversold.

With CAKE’s RSI reaching 89.6, this signals that the token is in a deep overbought zone. This could be an indication of a potential price correction in the short term, as traders may start taking profits.

However, in a strong bullish trend, the asset can remain overbought for a long period of time before experiencing a reversal.

Ichimoku Cloud Shows Strong Bullish Signal

CAKE has broken the Ichimoku Cloud decisively, signaling a strong trend shift in a bullish direction.

The Tenkan-sen line (blue) has crossed the Kijun-sen (red), which is a classic bullish signal. In addition, the price remains well above both lines, confirming strong momentum.

The future cloud has turned green, indicating that the bullish sentiment could continue in the next few trading sessions.

However, with prices now away from the cloud and Tenkan-sen support, there is a possibility of a short-term correction or consolidation before further gains.

Read also: YZi Labs Supports Plume Network: The Future of Real-World Assets on Blockchain!

CAKE Potential to Rise Above $3 in the Near Future

The CAKE EMA line is showing signs that a golden cross could be forming soon, signaling a potential shift to a more sustainable bullish trend. This is in line with the increased attention to the BNB (BNB) ecosystem.

If this crossover occurs, the resulting momentum could push CAKE to test the resistance level at $2.65. If it manages to break this level, further upside opportunities open up with the next major targets at $2.95 and $3.41.

However, if the uptrend fails to hold and momentum weakens-although PancakeSwap remains the most dominant DEX on the BNB network-CAKE could return to support at $2.33.

If the price drops below this level, the correction could accelerate, with a potential further drop to $1.85 and even $1.38.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. PancakeSwap Surges 40% as Weekly Revenue Hits $19 Million. Accessed on March 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.