Bitcoin Miner Sales Still High, On-Chain Data Reveals Bearish Trend (3/19/25)

Jakarta, Pintu News – The latest on-chain data shows that Bitcoin (BTC) miners continue to make large deposits to exchanges, an indication that may have a negative impact on Bitcoin (BTC) price.

Net Flow from Miners to Exchanges Increases

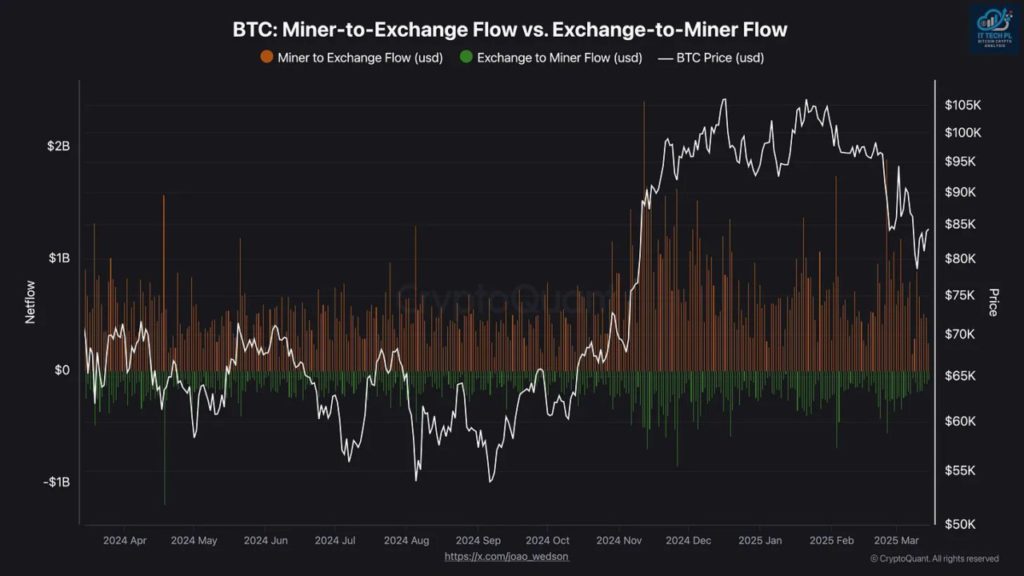

In a new post on X, CryptoQuant writer IT Tech discusses recent trends in the Flow from Miners to Exchanges vs Flow from Exchanges to Miners metric. This indicator measures, as the name suggests, the net flow between wallets associated with miners and centralized exchanges.

When the value of this metric is positive, it indicates that miners are making net token deposits to the platform. Typically, these chain validators transfer to exchanges when they want to sell, so trends like this can have a bearish impact on asset prices.

Also Read: Crypto Analyst Ali Martinez Explains Potential Catalysts for Cardano (ADA) March 2025 Price

Sales Trends During the Rally and Price Drop

As shown in the chart above, this indicator has recorded significant positive values since its rally in the last few months of 2024, indicating that miners have been making large deposits to the platform.

Although there were some net outflows during this period, the scale of the outflows was much smaller compared to the inflows. Given that the deposits were initiated when the rally was underway, it seems that the motivation behind them was to take profits.

Miners’ Response to Current Market Dynamics

Recently, even though the bullish momentum has decreased and the price of Bitcoin (BTC) has declined, inflows from miners have continued. This group may now simply be doing panic selling, fearing a bear market.

Miners are entities that routinely participate in distribution, as they have fixed operational costs in the form of electricity bills that they have to pay. Usually, these sales are not on a scale that cannot be absorbed by the market, so Bitcoin (BTC) does not tend to be affected much by them.

Conclusion

With market conditions constantly changing, it will be interesting to see what steps Bitcoin (BTC) miners will take next and whether or not their potential sale will affect the asset. Bitcoin (BTC) price is currently hovering around $83,400, up almost 6% in the last seven days.

Also Read: Ripple (XRP) Price Surge Predicted After Crypto Wallet Launch in March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Miner Selling Elevated, On-Chain Data Shows. Accessed on March 19, 2025

- Featured Image: The Conversation

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.