Cardano (ADA) Getting Ready to Surge? Check out BBTrend Cardano’s Latest Indicator End of March 2025!

Jakarta, Pintu News – In the last month, Cardano (ADA) experienced a decline of almost 8%, but in the last 24 hours, the token managed to rise by almost 3%. With market capitalization reaching $26 billion and trading volume increasing 30% to $903 million, there are early indications that the bearish trend may be starting to reverse. This article will dig deeper into the key signals and price levels that will shape ADA’s outlook this week.

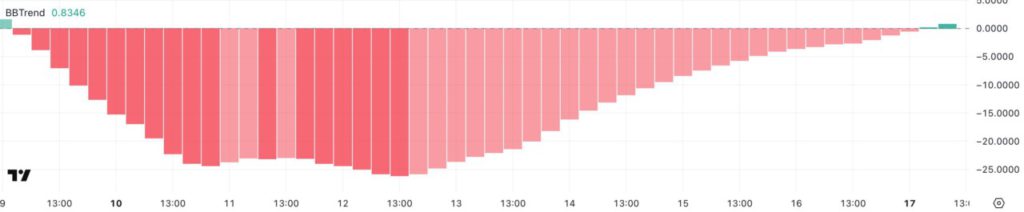

Cardano’s BBTrend Indicator is Now Positive

After experiencing six days in the negative zone, Cardano’s BBTrend has now turned positive with a value of 0.83. This signals a shift in momentum after the recent period of decline.

While this is still a relatively low reading, a change back into positive territory could be an early sign of increased buying pressure. BBTrend (Bollinger Band Trend) is a tool that measures the strength and direction of price movements relative to the Bollinger Bands.

Positive values indicate an uptrend, while negative values indicate a downtrend. As ADA’s BBTrend has not risen above 10 since March 8, the current reading of 0.83 indicates that although bearish pressure has eased, momentum is still weak. For stronger bullish signals, traders usually look for BBTrend to push above 10, which confirms a more decisive upward movement.

Also Read: Bitcoin Miner Sales Still High, On-Chain Data Reveals Bearish Trend (3/19/25)

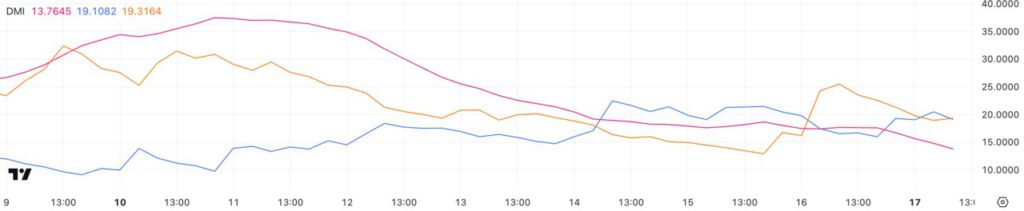

Cardano’s DMI Shows Decrease in Seller Control

Cardano’s DMI chart shows that its ADX has fallen to 13.7 from 17.5 in the past 24 hours, indicating a weakening in trend strength. Although the ADX still signals the presence of a trend, this lower reading indicates reduced momentum compared to the previous day. The Average Directional Index (ADX) measures the strength of a trend, regardless of its direction.

Readings above 25 indicate a strong trend, while readings below 20 often signal a weak or range-bound market. Currently, ADA’s +DI has risen to 19.1 from 15.96, while the -DI has fallen to 19.31 from 25.48, indicating that bearish momentum is fading as bullish pressure slowly builds.

With the +DI and -DI lines almost crossing, ADA seems to be in the early stages of trying to reverse from a downtrend to a potential uptrend, although a stronger ADX is needed to confirm a solid trend shift.

Cardano’s Upside Potential Above $1.10

Cardano’s EMA line has shown signs of consolidation in recent days, although its overall structure is still bearish. The short-term EMA is still below the long-term EMA. However, recent signals from the BBTrend and DMI indicators suggest that this trend may be shifting, with early signs of bullish momentum building.

If Cardano price manages to confirm the uptrend, it could first challenge resistance at $0.77. A break above this level could open the way towards $1.02 and even $1.17, marking the first time ADA has traded above $1 since March 3. On the other hand, if bearish pressure returns, ADA could retest support at $0.64, and a break below this could push prices as low as $0.58, visiting levels not seen since February 28.

Conclusion

With technical indicators pointing to a potential trend reversal, the chances for Cardano to start a recovery seem to be increasing. Investors and traders should continue to monitor indicators such as BBTrend and DMI to identify momentum changes and adjust their strategies according to dynamic market conditions.

Also Read: Ethereum (ETH) has the potential to surge sharply, analysts reveal similarities with 2020 trends

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Cardano (ADA) Bulls Gain, Sellers Weaken. Accessed on March 19, 2025

- Featured Image: Bitcoinsensus

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.