Selling Pressure Increases, Pi Network Faces Price Drops and Mass Fund Withdrawals

Jakarta, Pintu News – Pi Network (PI), one of the cryptocurrency projects that had attracted widespread attention, is now facing massive selling pressure. A sharp price drop of up to 44% in the last ten days is taking center stage, compounded by Binance’s decision not to include PI in the new token voting campaign.

These conditions saw investor confidence in the project plummet, prompting an unprecedented outflow of funds since the project began.

Investor confidence eroded by fund outflows

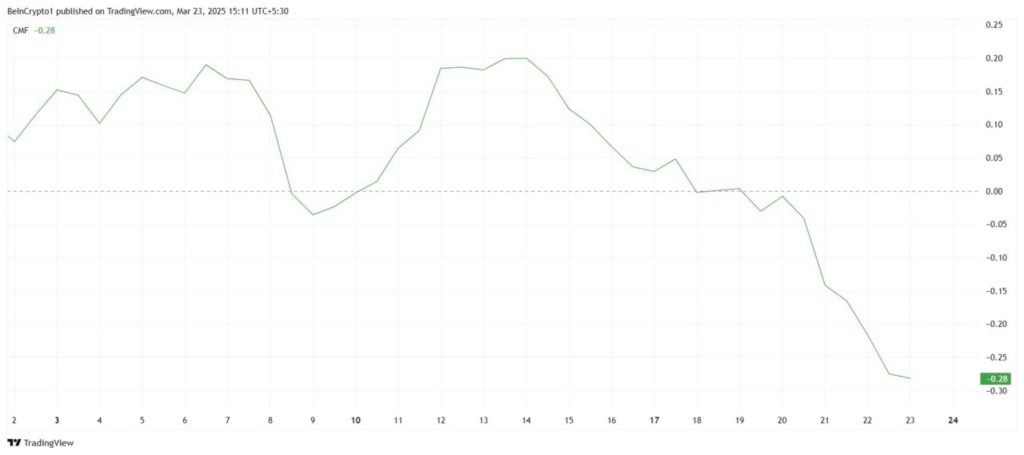

One of the key indicators reflecting this condition is the Chaikin Money Flow (CMF), which is currently at its lowest point in Pi Network’s history. A negative CMF indicates a very high capital outflow, reflecting investors’ loss of confidence in the future of this project. The more investors withdraw their funds, the more pressure the PI price will experience.

This decline in sentiment reflects not only the general state of the crypto market, but also the internal problems of the project. With confidence continuing to weaken, there is potential that the selling pressure will continue. If there are no positive catalysts in the near future, this outflow could leave a long-term impact on PI’s position in the cryptocurrency market.

Read More: Solana (SOL) Price Movement Faces Important Barriers and Supports March 2025

RSI Indicator Gives Potential Signals, but Not Convincing Yet

Although market pressure is still great, there are slight technical signals that point to a possible trend reversal. TheRelative Strength Index ( RSI) briefly bounced off the oversold zone earlier this week, which usually signals a chance of a price reversal. However, so far, the signal has not resulted in a significant price recovery.

With no significant growth despite the improved RSI, it appears that the bearish pressure from the crypto market still dominates. An improving RSI without any volume or price increase only indicates that the market is in a consolidation phase, not a solid trend reversal.

Critical Levels: Support at IDR14,996, Resistance at IDR23,197

The PI price is currently hovering around $1.00 or IDR 16,300, reflecting a 44% drop from its previous level in the last ten days. If the selling pressure persists, the price is at risk of dropping to the next support level at $0.92 or around IDR14,996. A further drop to $0.76 (approx. IDR12,388) could occur if the support fails to hold.

Conversely, if Pi Network is able to strengthen and break back through the $1.19 level (around IDR19,397) as support, this could open up opportunities for recovery towards $1.43 (IDR23,297). A return to above IDR19,000 would be the first positive signal in the price rebound attempt.

Outlook and Need to Watch Out for Additional Risks

Amidst high outflows and strong market pressure, Pi Network is now in a crucial phase. Investors’ decision to stay or leave the project will largely determine the fate of the PI price in the short term. In addition, Binance’s decision not to include the token in its vote-to-list campaign signals that there are doubts from major platforms about the validity of the project in the eyes of the global market.

For now, investors need to monitor key technical levels as well as observe sentiment dynamics in the Pi community. While there is potential for recovery, external and internal factors continue to make PI a high-risk asset, especially for short-term investors.

Conclusion

Pi Network is facing severe challenges with sharp price declines and massive withdrawals from investors. Although technical indicators such as RSI point to a chance of trend reversal, the strength of market pressure and loss of investor confidence are major obstacles. To survive and recover, the project needs clarity of direction and support from the community and the market in general.

Read More: Chainlink (LINK) Tests Critical Support, Potential Price Recovery on Investors’ Eyes

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network Oversold As PI Outflows Surge. Accessed March 24, 2025.

- Featured Image: Ebizmba

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.