Bitcoin Investors Revive After a Long Sleep, Mobilizing $250 Million!

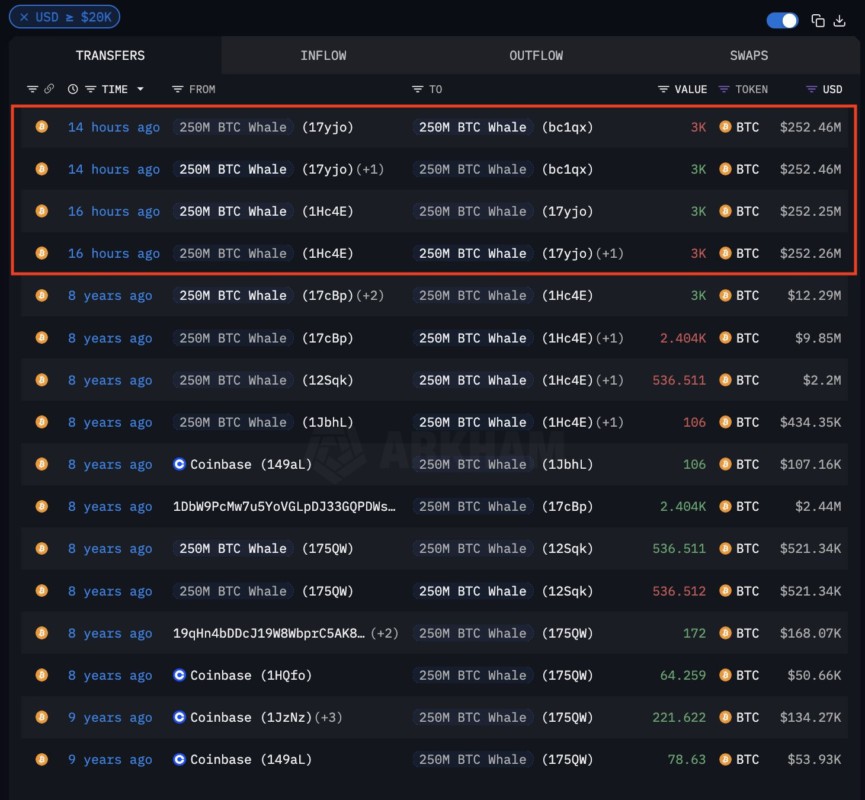

Jakarta, Pintu News – On March 22, a Bitcoin (BTC) wallet that had been dormant since 2016 suddenly sent 3,000 BTC, worth more than $250 million. This activity attracted widespread attention in the crypto space, given that the wallet had been dormant for almost a decade.

Why is this Bitcoin wallet active again after 8 years?

The Bitcoin (BTC) wallet in question was first created at the end of 2016, when the price of Bitcoin (BTC) was still below $1,000. The owner’s initial investment, estimated at around $3 million, has now grown into a vast fortune. During this period, Bitcoin (BTC) reached an all-time high of nearly $110,000 in January 2025.

Although the price has dropped to around $84,274, the return on investment (ROI) of this wallet remains outstanding. Analysts noted that the funds were moved to other wallets, rather than to exchanges, which suggests that the owners may be restructuring rather than preparing to sell. This has eased concerns about a possible massive sale that could disrupt the market.

Read More: Solana (SOL) Price Movement Faces Important Barriers and Supports March 2025

Crypto Market Stability Maintained

Data from BeInCrypto shows that the overall crypto market remains stable despite the activity from this large Bitcoin (BTC) wallet. Bitcoin (BTC) and other major crypto assets showed little price volatility in response. This suggests that the market may have matured and is more resistant to the influence of large moves by large holders. Additionally, this transfer is not an isolated case.

Over the past year, several wallets that have long been dormant have shown signs of activity. This suggests that early holders may be reassessing their positions, especially when Bitcoin (BTC) is trading close to its historical highs.

Read More: Solana (SOL) Price Movement Faces Important Barriers and Supports March 2025

Bitcoin as a Long-Term Store of Value

This case reinforces Bitcoin’s (BTC) reputation as a long-term store of value. The owner’s decision to hold the asset for almost a decade shows how it has surpassed traditional stores of wealth such as gold and the US dollar.

The integration of Bitcoin (BTC) into traditional finance, reinforced by the launch of a spot Bitcoin ETF and plans for a US Strategic Bitcoin Reserve, only strengthens this narrative. In addition, some analysts believe that investors may be preparing for more complex strategies, involving futures or options. This indicates a growing level of sophistication and adaptation among long-term Bitcoin (BTC) investors.

Conclusion

This latest activity from a Bitcoin (BTC) wallet provides important insights into the current market dynamics and long-term potential of Bitcoin (BTC) as an asset. Although the motives behind these transfers remain unclear, their impact on the market demonstrates the growing confidence in Bitcoin (BTC) as a stable and profitable investment.

Read More: Chainlink (LINK) Tests Critical Support, Potential Price Recovery on Investors’ Eyes

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Whale Resurfaces After 8 Years. Accessed on March 24, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.