Cronos (CRO) Surges 18%, Trump Media and Crypto.com Partnership a Trigger?

Jakarta, Pintu News – A strategic partnership between Trump Media and Crypto.com has announced plans to launch a new ETF based on Cronos, Bitcoin (BTC), and other assets.

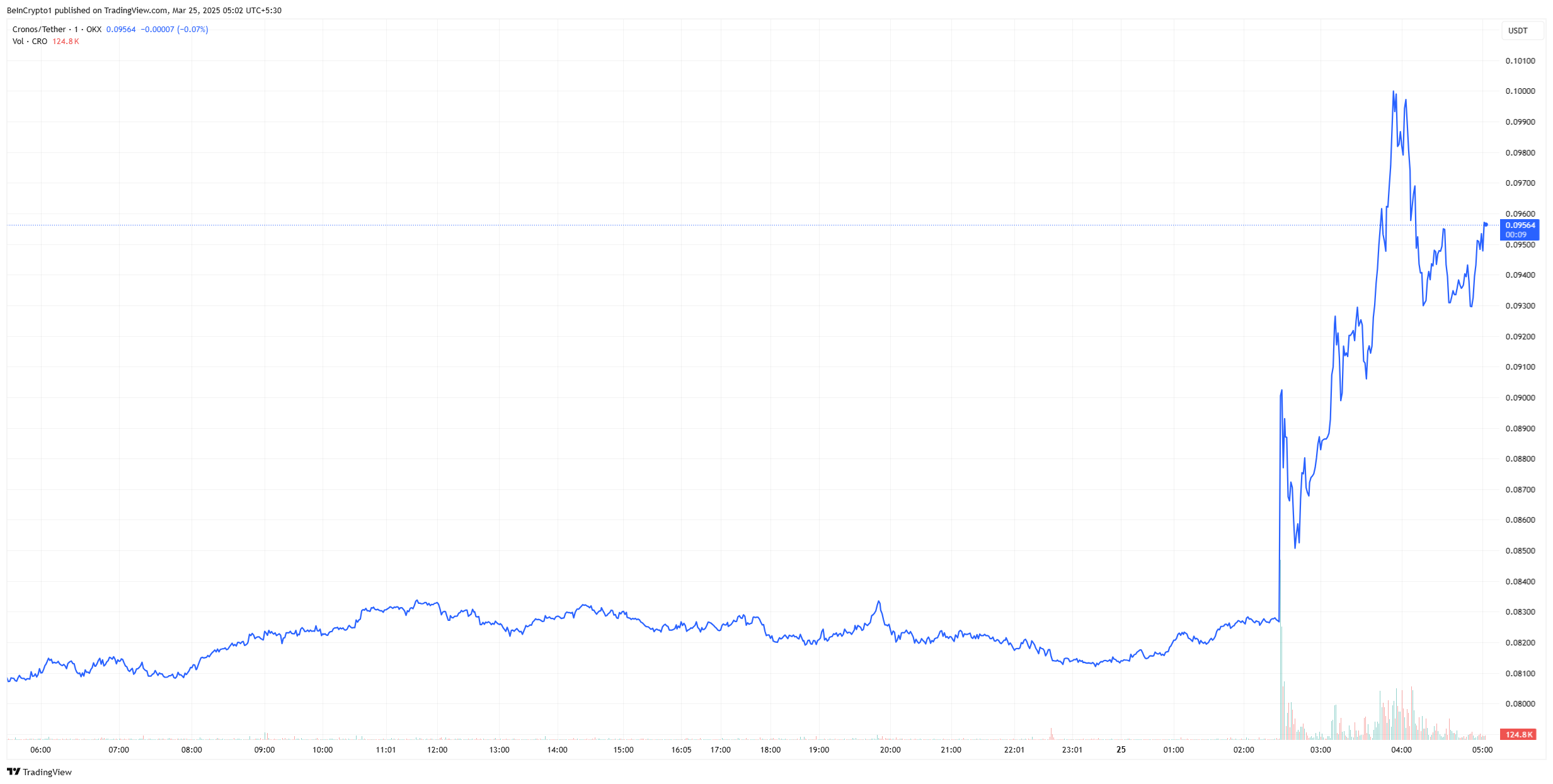

Although it still requires approval from the SEC, this news has caused a significant spike in Cronos’s value. This partnership marks a major step for Trump Media in exploring the potential of the crypto industry.

Market-Shaking Partnerships

The partnership was announced as a non-binding cooperation that aims to launch a series of ETFs and ETPs covering digital assets and securities with a “Made in America” focus. The plan covers diverse industries ranging from energy to cryptocurrencies such as Bitcoin (BTC) and Cronos.

While this is a promising first step, both parties have yet to reach a definitive agreement on an ETF that will include Cronos. Regulatory Obstacles and Approvals Despite market enthusiasm, Cronos-based ETFs still need the green light from the SEC.

This process could take months, and no ETF application has been filed for this altcoin. Moreover, Trump’s direct involvement in the business could be politically scandalous, given the precedent set with the TRUMP token.

Also read: 4 Crypto to Watch After US Stock Market Adds $1.5 Trillion!

Impact on Crypto.com and the US Market

This partnership can also potentially increase Crypto.com’s market share in the United States, which is their primary target market despite their headquarters being in Singapore. This could be a strategic move to challenge Coinbase’s dominance in the US market.

The partnership with Trump Media could give Crypto.com a significant competitive advantage. Market Reaction and Future Outlook Following the partnership announcement, Cronos reached its annual high in December, but has declined by 30% since then.

This latest news has brought new liquidity into the altcoin, showing potential for further recovery and growth. The market will continue to monitor these developments closely, especially the SEC’s reaction to the ETF proposal.

Read also: Shiba Inu Whale Surge: A Sign of an Imminent SHIB Price Rally in April 2025?

Challenges and Opportunities

While there are many challenges, including regulatory approval and potential conflicts of interest, this partnership opens up new opportunities in the crypto industry. ETFs involving Cronos and other digital assets could diversify financial products and attract new investors to the crypto market.

Political and Regulatory Considerations The “Made in America” aspect of the proposed ETF is appealing, but Crypto.com’s location in Singapore could be an obstacle.

In addition, the direct involvement of a former president in a business that has the potential to generate personal benefits could raise serious questions about the SEC’s legitimacy and independence.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Trump Media & Crypto.com Partnership: Cronos Surges. Accessed on March 26, 2025

- Decrypt. Crypto Token Cronos Spikes Following Trump Media & Crypto.com Tie-Up. Accessed on March 26, 2025

- Featured Image:

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.