Latest Analysis: Bitcoin (BTC) Could Rise to $76,000, Not the Beginning of a Bear Market!

Jakarta, Pintu News – The Bitcoin (BTC) market still seems to be in a bullish phase despite its recent correction to $76,000. A crypto analyst who successfully predicted a Bitcoin (BTC) correction in early 2024, has now revealed that the price drop is just a downside deviation that does not indicate the beginning of a bear market.

Understanding Downside Deviation

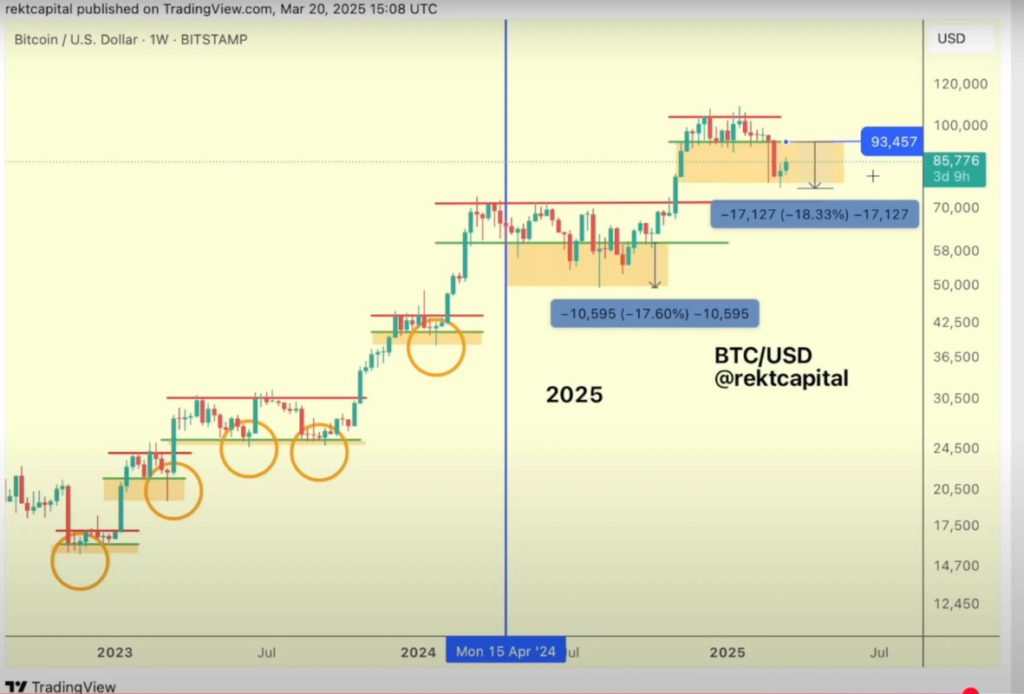

A downside deviation is a condition where an asset loses immediate support and registers a false drop before eventually recovering and rising to a higher price level. In the case of Bitcoin (BTC), Rekt Capital analysts, who have a following of 542,000 on social media platform X, assert that the recent correction to $76,000 is an example of a downside deviation.

This correction is similar to the one in 2024, where Bitcoin (BTC) experienced a 32% drop. According to Rekt Capital, it is important to maintain an objective view and not rush to declare that the market has entered a bear market phase. Historical analysis shows that periods of downside deviation are often followed by significant price recovery.

Also Read: Will Ripple (XRP) Surge? Latest Analysis and Predictions for April 2025

Bitcoin (BTC) Bull Market Analysis

Rekt Capital also told its 107,000 YouTube subscribers that the current Bitcoin (BTC) bull market cycle has not yet reached its peak. He estimates that the Bitcoin (BTC) bull market’s progress is currently at 82.5%. This progress is expected to accelerate during periods of parabolic rise and slow down during deeper retracements.

The price correction to $76,000 should not be seen as the beginning of a bear market, but rather as part of normal fluctuations within a larger bullish trend. Analysts emphasize the importance of looking at data and charts in an unbiased way to understand the true dynamics of the market.

Market Outlook and Investor Reaction

Bitcoin (BTC) is currently trading at $88,028, having risen 3.4% in the last 24 hours. The market’s reaction to this analysis could be an important indicator for investors about Bitcoin’s (BTC) potential to reach higher price levels.

Investors are advised to ‘zoom out’ or look at the bigger picture when in doubt about current market conditions. Understanding that price corrections are part of market dynamics can help in making more informed investment decisions and avoid unnecessary panic.

Conclusion

With analysis and historical data in mind, Bitcoin (BTC) investors would do well to remain calm and objective. Understanding that downside deviations are part of a larger market cycle can help in navigating through market volatility and capitalizing on opportunities that arise.

Also Read: Will Cardano (ADA) Surge? Check out the latest prediction in April 2025!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Daily Hodl. Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why. Accessed on March 27, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.