Hyperliquid & JELLY Crypto Chaos Explodes! HYPE Plummets 16%, Community Calls “FTX 2.0”

Jakarta, Pintu News – Crypto trading platform Hyperliquid (HYPE) is facing a reputation storm after the JellyJelly (JELLY) crypto-related scandal rocked the community.

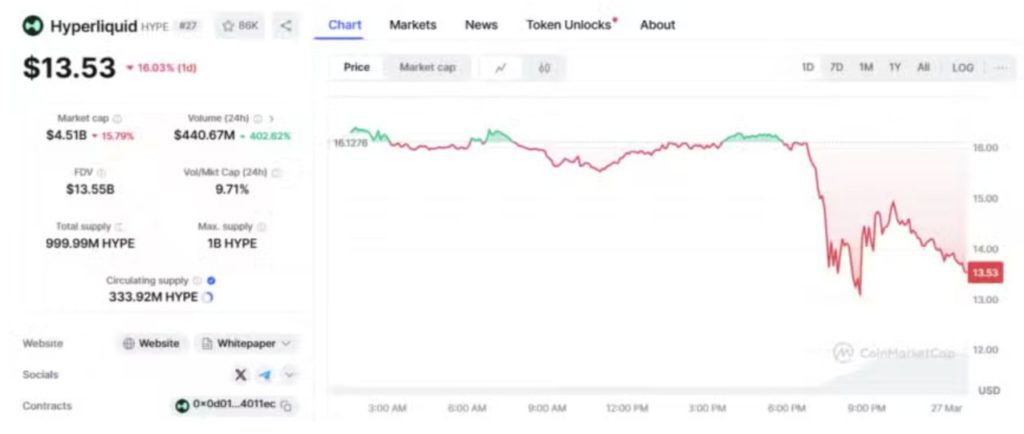

In less than 24 hours, the price of its native token, HYPE, plummeted by more than 16%, extending the decline from the all-time high peak (ATH) reached in December 2024.

The incident triggered a mass user exit and raised serious questions about the credibility of the decentralized exchange (DEX) platform.

The chaos began when a trader made a structured trading action by opening a $6 million short position on the JELLY token, and then self-liquidating the position, triggering a sudden price spike that left Hyperliquid with huge losses.

In response, Hyperliquid immediately removed JELLY crypto from the platform-a decision that sparked strong criticism from the DeFi community.

Traders lose big, HYPE loses 61% to ATH

According to data from CoinMarketCap (27/3), the HYPE token is now trading at $13.53 (Rp224,325), down 61% from its highest price of $35.02 (Rp580,384).

Read also: Solana Price Set to Soar to $300, What’s Driving the Increase?

This drop not only reflects the market reaction to the JELLY crypto incident, but also reflects the crisis of confidence in Hyperliquid as a decentralized financial service provider.

HYPE had previously skyrocketed more than 900% in just a month post-launch, attracting the interest of retail and whale investors. However, this latest incident has left deep scars – with more than USD $12 billion in funds leaving the platform in a short period of time, according to a report from TheCryptoTimes.

Bitget Says Hyperliquid Has the Potential to Become FTX 2.0

Bitget crypto exchange CEO Gracy Chen stated that the JellyJelly incident exposed many of Hyperliquid’s structural flaws, calling the platform “unethical, unprofessional, and prone to manipulation,” even likening it to “FTX 2.0.”

Chen highlighted Hyperliquid’s operational structure, which resembles an offshore centralized exchange, with no KYC/AML, and the use of “mixed vaults” that open up systemic risks.

In addition, the absence of trading position limits exacerbates the potential for price exploitation and manipulation by bad actors. He added that unilateral decisions such as JELLY’s delisting undermine the principle of openness that is the foundation of DeFi.

Binance “Declares War”? JELLY Crypto Perpetual Listing Considered an Attack

Read also: Beincom Airdrop Ready to Launch, How Much Will BIC Token Cost at Launch?

Amidst controversy, Binance surprised the community by announcing that it will list JELLY crypto in the form of perpetual futures contracts. Many see this move as a direct response to Hyperliquid’s position and possibly a “business offensive” to gain market share in altcoin derivatives.

As a result, JELLY crypto has actually risen 62% in the last 24 hours (3/27), inversely proportional to HYPE’s tragic fate. This move by Binance is considered a major blow to Hyperliquid, who must now prove that they are still worthy of the trust of the DeFi trader community.

All in all, the controversy between Hyperliquid and JellyJelly has turned into a major crisis for one of the DEXs that was previously considered the most innovative. From falling HYPE prices, billions of dollars in losses, to scathing criticism from industry figures, Hyperliquid’s reputation is now on the line.

At a time when the crypto ecosystem is looking for transparency and accountability, this case is a reminder that even in the DeFi world, trust is still the main currency.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Hyperliquid JELLY ‘exploiter’ could be down $1M, says Arkham. Accessed March 27, 2025.

- CryptoBriefing. Hyperliquid Faces Criticism Amid Jelly Incident. Accessed March 27, 2025.

- TheCryptoTimes. Hyperliquid’s HYPE Token Price Drops 16% After JellyJelly Fiasco. Accessed March 27, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.