Bitcoin’s long-holder movement triggers fears of market correction in April 2025

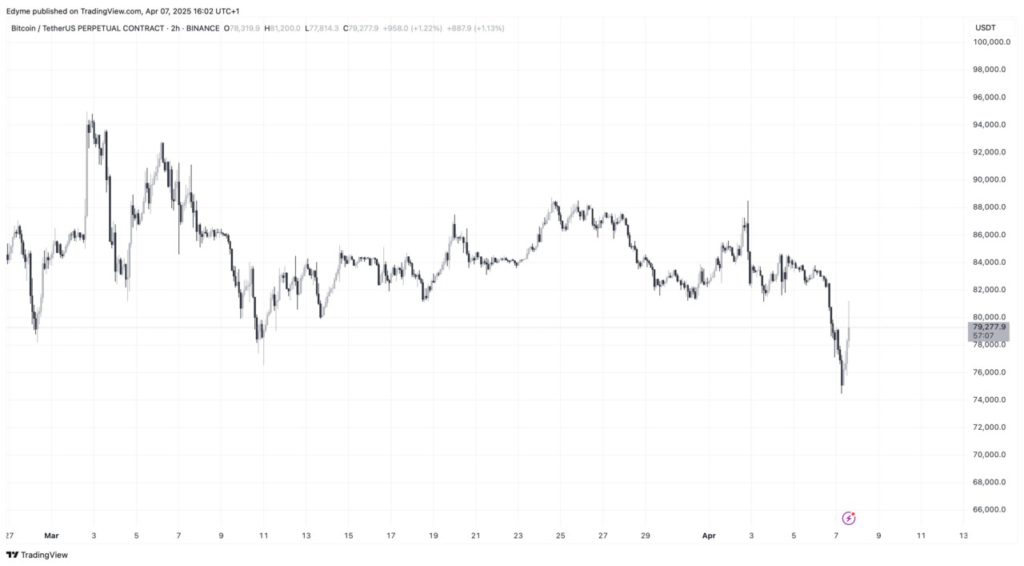

Jakarta, Pintu News – The price of Bitcoin (BTC) experienced significant selling pressure, touching a low of around $74,604 or around Rp1,246,035,648 before finally recovering slightly and perched above $79,000 (Rp1,320,248,000). Despite the small recovery, overall Bitcoin still recorded a daily decline of 3.1% and about 30% from its January peak of over $109,000 (Rp1,821,008,000).

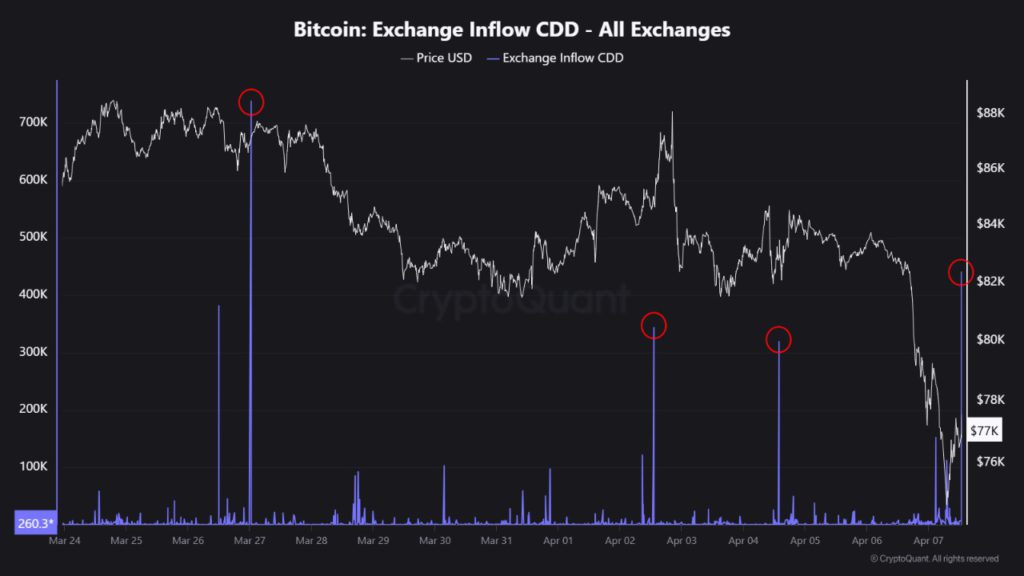

According to analysis from CryptoQuant contributor IT Tech, there has been a significant shift in long-term holder behavior. This is reflected in a spike in the Exchange Inflow Coin Days Destroyed (CDD) metric, which measures the number of days a coin does not change hands before it is eventually transferred to an exchange.

Old Coin Activity Increases, a Potential Signal for a Price Drop

A rise in CDD Exchange Inflow indicates that coins that have been sitting idle for a long time are now starting to move onto exchanges. In the crypto context, this is often a sign that long-time holders are preparing to sell their assets. This phenomenon coincides with Bitcoin’s price drop from $82,000 (Rp1,370,184,000) to $76,000 (Rp1,270,512,000), strengthening the suspicion of liquidation by existing investors.

Historically, spikes in this metric often precede major price corrections. The movement of long coins to exchanges adds to the selling pressure in the market, especially in already volatile market conditions. This could be an inflection point in market trends, as long-term holders look to secure profits amid global economic uncertainty.

Also Read: XRP Price Prediction: Between Deep Correction and Hopes of Rebound in Crypto Market (8/4/25)

Short-term holder data signals market cooling

In addition to legacy coin movements, another analysis from CryptoQuant by BilalHuseynov highlights short-term holder behavior. He uses a realized price metric based on UTXO (Unspent Transaction Output) age, specifically in the one-week to three-month range, to gauge market pressure.

The realized price in this age group reflects whether the new investor is experiencing profits or losses. On a bullish trend, realized prices tend to rise, signaling accumulation. However, as the market approaches its peak, the realized price lines begin to flatten or even decrease, signaling asset distribution by short-term investors.

Huseynov noted that currently realized prices for the one to three month age group are starting to curve downward. This pattern is similar to that of the price peaks in April and November 2021, as well as March 2025. If this trend continues, it is possible that new investors will incur losses and sell their holdings, potentially accelerating the price decline.

Contrasting Signals Amid Cryptocurrency Market Uncertainty

On the one hand, the movement of long coins signals that long-time investors are starting to take a cautious attitude towards the direction of the crypto market. On the other hand, the pressure on short-term holders creates the potential for additional pressure if they decide to sell assets at a loss. This combination could trigger a further wave of correction in the cryptocurrency market in the near future.

However, it should be noted that in previous market cycles, similar moves have also marked the formation of price bottom zones. In other words, this decline could also be an opportunity for accumulation for some market participants who are more optimistic about the long-term prospects of cryptos like Bitcoin (BTC).

Conclusion

The surge in activity from long-term Bitcoin holders and distribution signals from short-term holders highlight the complex dynamics in the crypto market today. Against the backdrop of global economic uncertainty, on-chain data such as Exchange Inflow CDD and UTXO Age Bands are becoming important tools in understanding market movements. Investors are advised to watch these trends carefully and make investment decisions based on thorough analysis, rather than solely on short-term fluctuations.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Long-Term Bitcoin Holders Are Moving Coins, Further Sell-Off Incoming?. Accessed April 8, 2025.

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.