Can Ethereum (ETH) Break $1,810 Next? Check out these Key Levels!

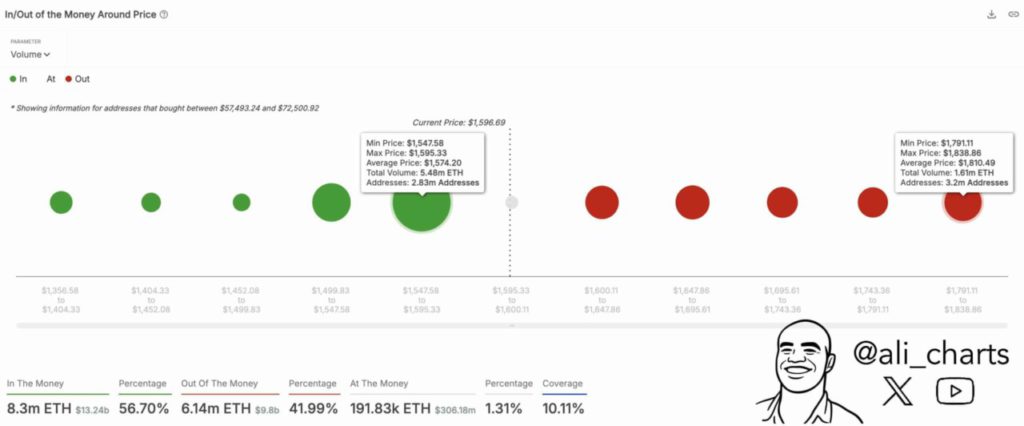

Jakarta, Pintu News – Ethereum (ETH) recently managed to reclaim the key support level of $1,574, signaling a potential rise towards $1,810 as demand increases.

Market Recovery and Ethereum’s (ETH) Upside Potential

After the market recovered from the tariff-induced fall, Ethereum (ETH) showed a rising trading pattern. Currently, Ethereum (ETH) is trading at $1,610, registering a gain of 2.36% on the daily chart.

Prior to this rise, the cryptocurrency was on the decline, with a 10.99% drop in the weekly chart and 14.79% in the monthly chart. This latest rise has led stakeholders to expect a more sustained uptrend. Renowned crypto analyst Ali Martinez has suggested a potential rally towards $1,810.

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

Demand and Support Analysis

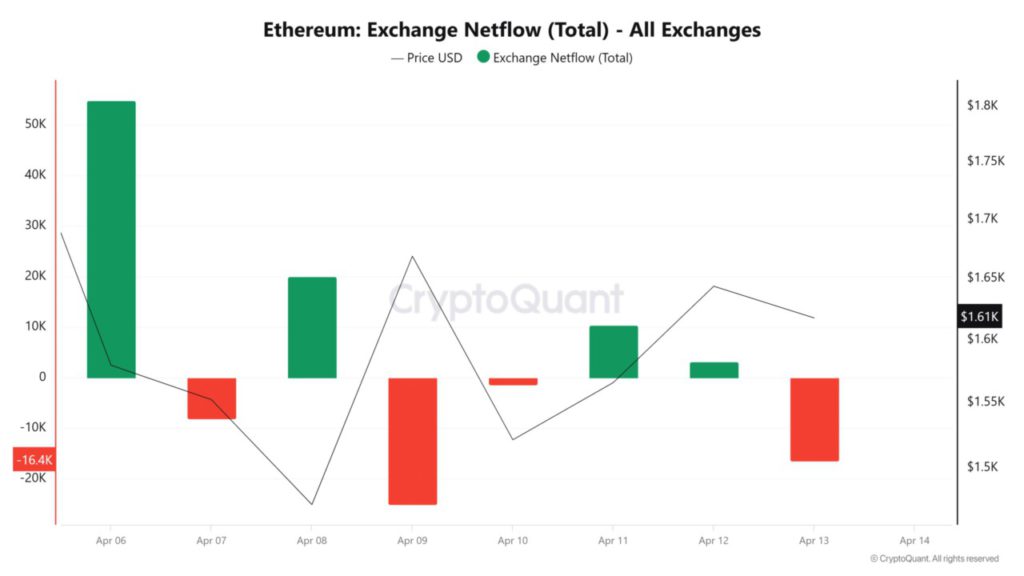

According to analysis from AMBCrypto, Ethereum (ETH) is experiencing a recovery on the demand side. First, the Ethereum (ETH) Exchange Netflow has turned negative after two consecutive days of positive flow. The change to negative indicates that investors are starting to accumulate Ethereum (ETH), with more outflows from the exchange than inflows, reflecting increased demand.

Positive order imbalance further validates this aspect. In the presence of a positive order imbalance, it indicates that there are more buy orders being executed than sold. This suggests that buyers are active in the market, resulting in more outflows from the exchange.

Role of Big Holders in Market Trends

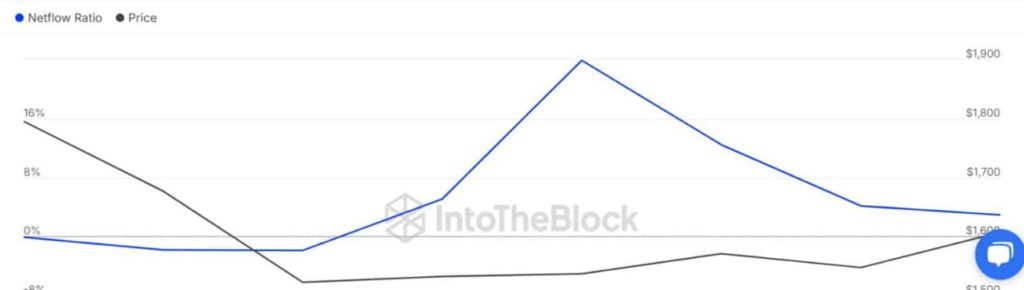

This increased demand is even more pronounced among large holders. Ethereum (ETH) large holders are making fewer transfers to exchanges. Looking at the ratio of large holder net flows to exchange net flows, the ratio of flows to exchanges from whales has dropped from 23.9% to 2.92%. This decrease indicates that whales are buying more than selling.

With whales and retailers buying, they seem to be buying these cryptocurrencies and taking long positions. This can be seen from the Ethereum (ETH) Aggregate Funding Rate which has turned positive, reflecting higher demand for long positions. As such, most investors expect the price to continue rising.

Conclusion: Ethereum (ETH) Outlook Towards $1,810

Overall, Ethereum (ETH) is experiencing a surge in demand. Historically, higher demand results in higher prices. With Ethereum (ETH) getting more buyers than sellers, the cryptocurrency could reach $1,758 again. If it rises to this level, we could see a move towards $1,800. Conversely, if the attempt by the bulls fails, we could see a correction with Ethereum (ETH) returning to $1,465.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Can Ethereum target $1810 next? This level holds the key. Accessed on April 14, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.