SUI Jumps 26% To $2.80, Memecoins Like LOFI, BLUB Trigger Network Frenzy

Jakarta, Pintu News – Memecoins like LOFI and BLUB have sparked a frenzy on the network resulting in a surge in the price of the SUI cryptocurrency. In this article, we will dig deeper into how this phenomenon happened and what might happen next.

DEX Sui Volume Surge

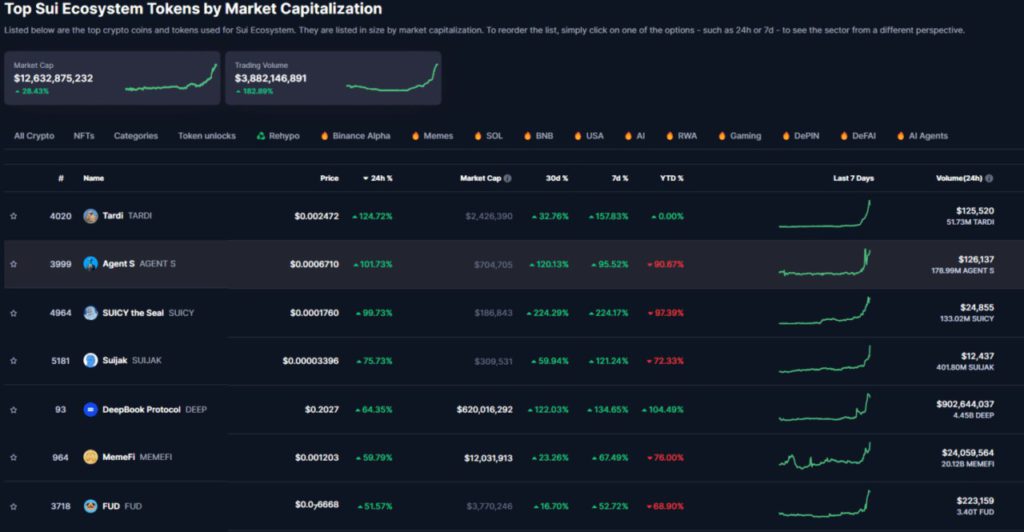

In the past 24 hours, trading volume on Sui’s decentralized exchange (DEX) has surged by 30% to $549 million, according to data from DeFiLlama. On Monday, the DEX volume reached $327 million and increased to $549 million at the peak of Tuesday’s rally. On Wednesday, this volume even reached $772 million, confirming the high speculation in the network.

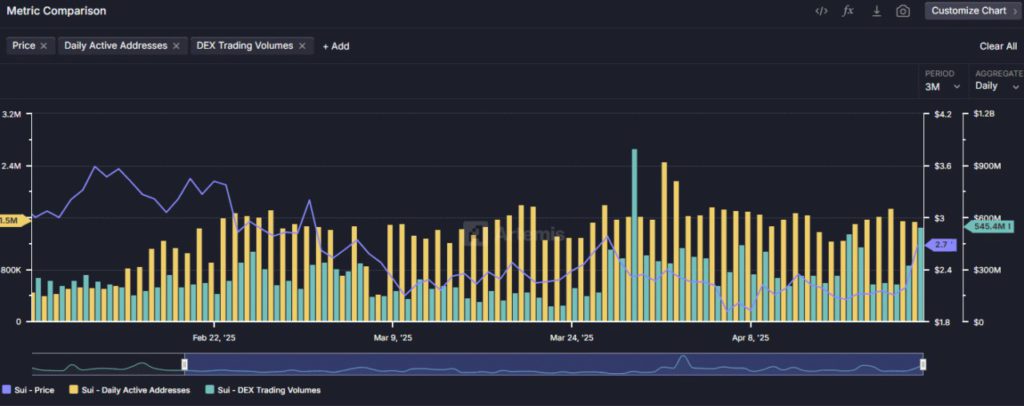

Overall, the Sui network has seen $2.5 billion worth of token trades in the last seven days. Data from Artemis shows that SUI’s price increase from $2.1 since mid-April correlates with a significant increase in daily active addresses and DEX trading volume. Although active addresses peaked at 1.7 million on April 20, the subsequent increase in DEX volume pushed the SUI price even higher to $2.7 on April 22.

Also Read: 7 Ways to Save Dollars (USD) for Maximum and Effective Use

Technical Analysis and Obstacles Faced

On the daily price chart, SUI has increased by 26% in the last 24 hours and looks set to reach the $3.5 level. However, there are some obstacles to overcome, including the moving averages at $3 and $3.1. In addition, the daily Relative Strength Index (RSI) is approaching the overbought zone, which suggests that this rally may cool down a bit before resuming gains or experiencing declines. V

olume that increased on Wednesday to $777 million, coinciding with the rally that continued to $2.9. Therefore, high DEX volumes, especially from memecoins, have contributed greatly to this rally.

SUI’s Future Prospects

Considering the current trend and available data, it is likely that SUI will continue to experience high volatility. Increased speculative interest and high trading activity on DEX suggests that there is still a lot of interest in buying and selling SUI. However, it is important to note that crypto markets are highly unpredictable and external factors can dramatically affect prices.

Market watchers should continue to monitor trading volume and address activity to gain insight into SUI’s possible future price movements. If trading volumes remain high, this could be an indicator that SUI might reach higher price levels.

Conclusion

In conclusion, SUI’s significant price spike was driven by the memecoin craze and high trading activity on DEX. Although there are some technical obstacles that need to be overcome, the short-term outlook for SUI appears to be positive. However, investors and market watchers should remain wary of potential volatility and sudden changes in market conditions.

Also Read: 7 Ways to Get Passive Income from Crypto 2025, Simple!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. SUI skyrockets 26% to $2.80 as memecoins like LOFI, BLUB ignite network frenzy. Accessed on April 24, 2025

- Featured Image: Crypto Rank

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.