Ripple’s performance soared in Q1 2025, what was the main factor?

Jakarta, Pintu News – Ripple started 2025 with significant achievements, especially in the performance of its digital currency, Ripple (XRP). The first quarter 2025 market report showed a nearly 50% increase in the value of XRP, which caught the attention of institutional investors.

This momentum was supported by the settlement of a legal case with the US Securities and Exchange Commission (SEC), which provided further legal clarity for the digital asset industry. In addition, the acquisition of Hidden Road for $1.25 billion was a strategic move to expand institutional access to Ripple Ledger (XRPL).

Check out the full analysis below!

Trade and Investment Volume

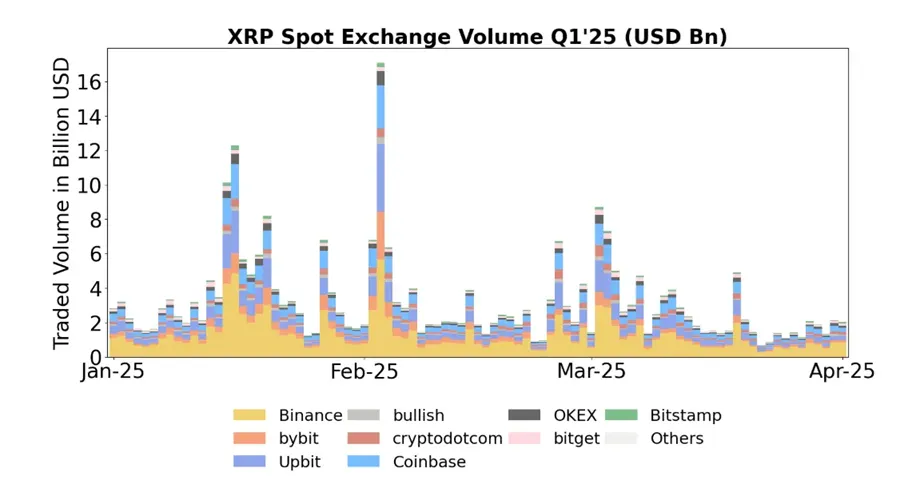

XRP spot trading volumes recorded steady numbers in the first quarter of 2025, with average daily volumes reaching $3.2 billion on major exchanges. Peak trading occurred in late January and early February, with volumes reaching over $16 billion before declining in March.

Binance dominates with around 40% of the total volume, followed by Upbit and Coinbase. The increase in trading volume through fiat pairs indicates a growing interest in fiat trading, with USD pairs and USD stablecoins increasing from 25% in the fourth quarter of 2024 to 29% in the first quarter of 2025.

Also read: 5 Major Causes Allegedly Suppressing XRP Price, Crypto Analysts Reveal This!

On-Chain and DEX Activity

In contrast, on-chain activity on XRPL saw a significant decline. The report shows a 37.06% drop in the number of transactions on XRPL, from 167.7 million in the fourth quarter of 2024 to 105.5 million in the first quarter of 2025.

New wallet creation dropped by 40.28%, and the amount of XRP burned as transaction fees also decreased by 30.89%. Although trading volume on the decentralized exchange (DEX) fell by 16.94%, the growth of the newly launched stablecoin RLUSD helped prop up DEX volume.

Also read: Top 3 Reasons Why Binance Hasn’t Listed Pi Network Until Now!

Regulations and Their Impact on the Market

The settlement of the case with the SEC is considered a significant milestone for Ripple and the digital asset industry as a whole. The deal brings more clarity and will likely set the standard for future crypto-related regulations in the United States.

Moreover, with increased regulatory clarity, Ripple hopes to create more opportunities for the crypto ecosystem. The acquisition of Hidden Road is also expected to boost XRPL’s on-chain activities by expanding infrastructure and liquidity services for large-scale clients.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ripple Q1 2025 Spot Volume Surges. Accessed on May 7, 2025

- CryptoTimes. XRP Sees 50% Growth in Ripple’s Strong Q1 2025. Accessed on May 7, 2025

- Featured Image: Bitcoin News

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.