Impact of US-China Tariff Deal on Bitcoin Price

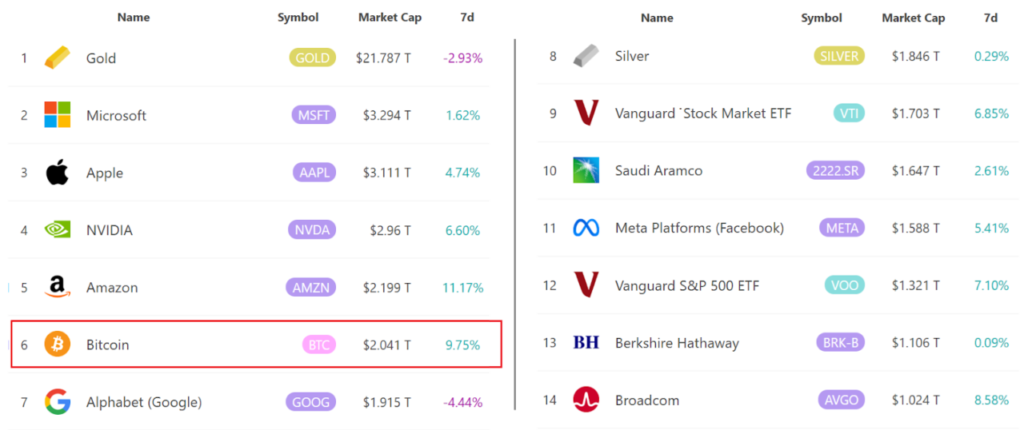

Jakarta, Pintu News – On May 12, 2025, Bitcoin (BTC) reached a three-month high of $105,720 (approximately Rp1.74 billion), but soon fell to $102,000 (approximately Rp1.68 billion).

This decline came after the announcement of a temporary agreement between the United States and China to suspend import tariffs for 90 days. While this deal was considered positive for the stock market, the price of Bitcoin experienced a correction.

High Correlation with Stock Market

Over the past 30 days, Bitcoin recorded a gain of 24%, while the S&P 500 index rose 7% and gold prices remained stable. The correlation between Bitcoin and the stock market stands at 83%, indicating that BTC price movements are increasingly influenced by traditional market sentiment.

Investors tend to shift funds to stocks that benefit directly from tariff reductions, such as technology and manufacturing companies. This causes demand for hedge assets such as Bitcoin and gold to decline.

Also Read: Bitcoin Approaches Rp1.74 Billion: Trend Analysis and Challenges May 2025

The Effect of Macroeconomics and Liquidity

The strengthening of the US dollar index (DXY) to a 30-day high reflects investors’ growing confidence in the US economy. Although the US Gross Domestic Product (GDP) declined 0.3% in the first quarter, a 6.1% surge in home sales pointed to an economic recovery. This reduced the appeal of assets such as Bitcoin that are often considered a hedge against economic uncertainty.

The Role of Institutional Investors

Companies such as Strategy and BlackRock have accumulated around 1.19 million BTC, equivalent to 6% of the total circulating supply. While this accumulation shows long-term confidence in Bitcoin, some analysts are concerned that this concentration of ownership could affect market liquidity. However, Strategy’s move to increase the capital limit by $21 billion in stock and debt shows their commitment to long-term investment in Bitcoin.

Future Prospects of Bitcoin Price

Despite the price correction, inflows of $2 billion into spot Bitcoin ETFs in the US between May 1 and 9 indicate strong institutional interest. As long as Bitcoin price remains above the psychological support level of $100,000, the medium-term outlook remains positive. However, investors are advised to pay close attention to macroeconomic data, such as the consumer price index (CPI) to be released on May 13, which could affect market sentiment.

Also Read: 3 Altcoins that Catch Analysts’ Attention Amid Positive Market Sentiment: Significant Growth!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Marcel Pechman / Cointelegraph. Bitcoin price sells off after Trump’s US-China tariff deal – Here is why. Accessed May 13, 2025.

- Featured Image: Asia Times

Latest News

Gadjah Gold Price Today March 9, 2026

Gadjah Gold Price Today March 9, 2026

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.