Ethereum Soars to $2,600 — Is a Surge to $4,000 Just Around the Corner?

Jakarta, Pintu News – Ethereum (ETH) surged by 43.75% for three consecutive days between May 8 and 10, 2025.

This increase pushed the price of ETH from $1,808 to $2,600, before finally experiencing a 7% correction on May 12, 2025. However, if the Ethereum price enters an accumulation phase, the pattern predicts that the next target could be $3,600.

Due to the recent surge of bullish momentum in Bitcoin (BTC) and other altcoins, expectations for future growth have increased. Therefore, the expectation that Ethereum price will reach $3,000, $3,500, or even $4,000 is not out of the question.

Then, how will Ethereum price move today?

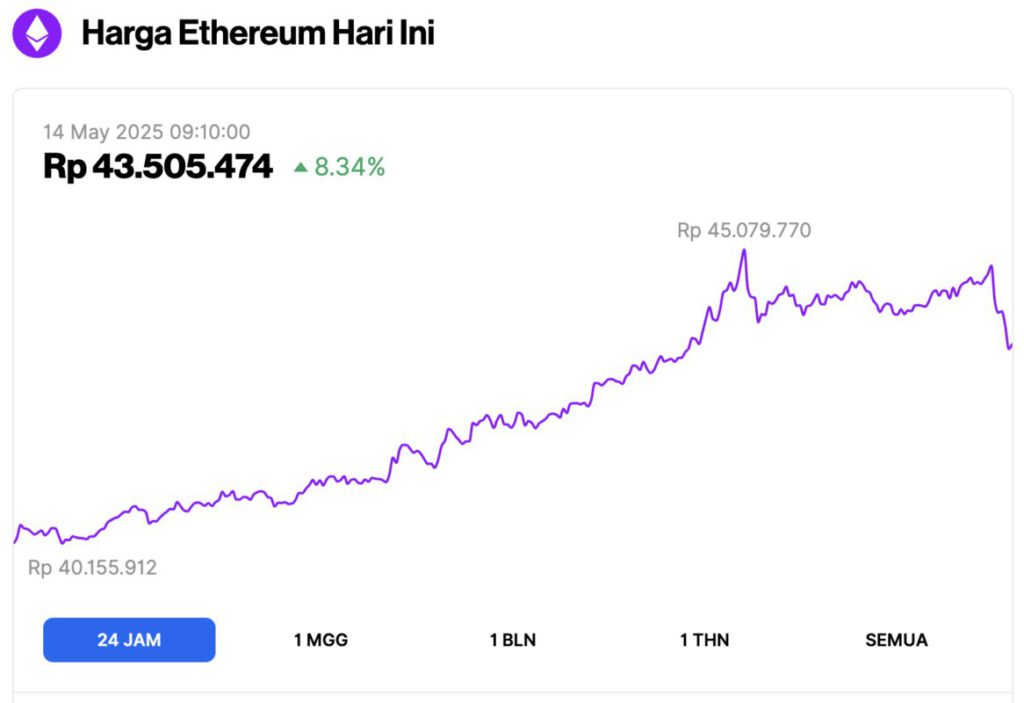

Ethereum Price Rises 8.34% in 24 Hours

As of May 14, 2025, Ethereum (ETH) was trading at approximately $2,641, or around IDR 43,505,474—marking an 8.34% increase over the past 24 hours. Within the same period, ETH saw a low of IDR 40,155,912 and peaked at IDR 45,079,770.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $319.82 billion, with daily trading volume rising 7% to $34.4 billion in the last 24 hours.

Read also: US CPI Inflation Drops to 2.3% — Is Bitcoin About to Explode to a New All-Time High?

Unconfirmed Accumulation Pattern Suggests Ethereum Could Reach $3,600

Reporting from Coingape (5/13/25), the bear market of 2025 caused the price of Ethereum to fall in a classic distribution pattern. This pattern usually marks the end of a bullish trend and reflects a reversal, characterized by a sharp decline followed by a distribution or consolidation phase.

In the case of Ethereum, there were three distribution phases and four expansion moves that together led to a 66% decline. After forming a local low at $1,385, ETH prices rebounded by 30%, indicating a potential reversal to a bullish trend and a possible end to the bear market.

After a sharp spike in buying pressure, Ethereum price entered a two-week accumulation phase. The breakout from this consolidation phase pushed ETH price up by 43.75% between May 8 and 10.

As of May 13, ETH was trading at $2,456. If the bullish trend has indeed begun – as many investors believe – then the next phase of accumulation is likely to occur.

Considering the 43.75% rally followed by consolidation, the two most likely patterns to form are a bull flag or a bullish pennant. Both are continuation patterns that are usually followed by a large price spike after the accumulation phase ends.

Read also: 5 Altcoins that Crypto Whales Are Buying After the US-China Trade Deal!

The targets of these patterns are calculated by measuring the height of the initial spike and adding it to the breakout point of the consolidation phase. In this case, investors can anticipate a price surge of 47% to reach $3,600.

In a more optimistic scenario, Ethereum price could return to the December 2024 high of $4,100, or even set a new record high above $5,000.

Why Is This Pattern Effective for Ethereum (ETH)?

As explained earlier, the rally-consolidate-rally pattern works well for Ethereum (ETH) due to the nature of the crypto market and investor psychology.

When the market enters abull run, prices tend to rise excessively, then correct or consolidate to reset technical indicators such as the RSI before continuing to rise. This pattern gives the market room to “breathe” before resuming its upward movement.

However, Ethereum’s case is slightly different. ETH wasoversold and failed to perform strongly when other altcoins surged throughout 2025. The ETH/BTC ratio has also been steadily declining since 2022, reflecting Ethereum’s relative weakness against Bitcoin (BTC).

Therefore, if Ethereum’s price bounces, it will likely be accompanied by a huge surge in buying pressure and an exponential price rally.

Technical Analysis: ETH Short-Term Outlook

Although the recent price surge has been quite impressive, Ethereum price is most likely preparing for a correction. Key support levels to watch are around $2,240 and $2,140.

However, if both levels are broken, the ideal zone for the next accumulation phase is around $1,872.

Investors should also be wary of potential whipsaws that could sweep away important swing points at $2,615, $2,340, or $2,140.

The aforementioned accumulation phase will likely see ETH prices move in a range between $2,614 and $1,140.

Read also: Ripple (XRP) Price Could Break $3 This Week? Here’s the Bullish Pattern and Whale Action!

Overall, Ethereum’s price outlook remains bullish after a 43.75% rally that pushed the price close to $2,600. This sharp rally is likely to be followed by a consolidation or accumulation phase, giving buyers a chance to take positions before the next move.

If the price manages to break $3,000 and hold above $2,600, this could be a strong signal that ETH is ready to continue its big rally in the short term.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price May Hit $3,600 Next Hints Accumulation Pattern. Accessed on May 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.