Will Solana’s (SOL) Price Rise Be Halted by Profit Taking? Here’s What the Data Says!

Jakarta, Pintu News – The cryptocurrency market is always full of unexpected dynamics. One of the tokens in the spotlight is Solana (SOL), which is currently testing resistance at $180. However, the big question that arises is whether profit-taking will hamper its rise?

Solana (SOL) Total Value Locked (TVL) Recovery

Solana’s (SOL) Total Value Locked (TVL) has returned to the same level as mid-February, although the current price is still 40% lower. This suggests strong fundamentals and great potential for further Solana (SOL) price increases. Nonetheless, the high NVT value suggests that the token may be overvalued, which could be a warning signal for investors.

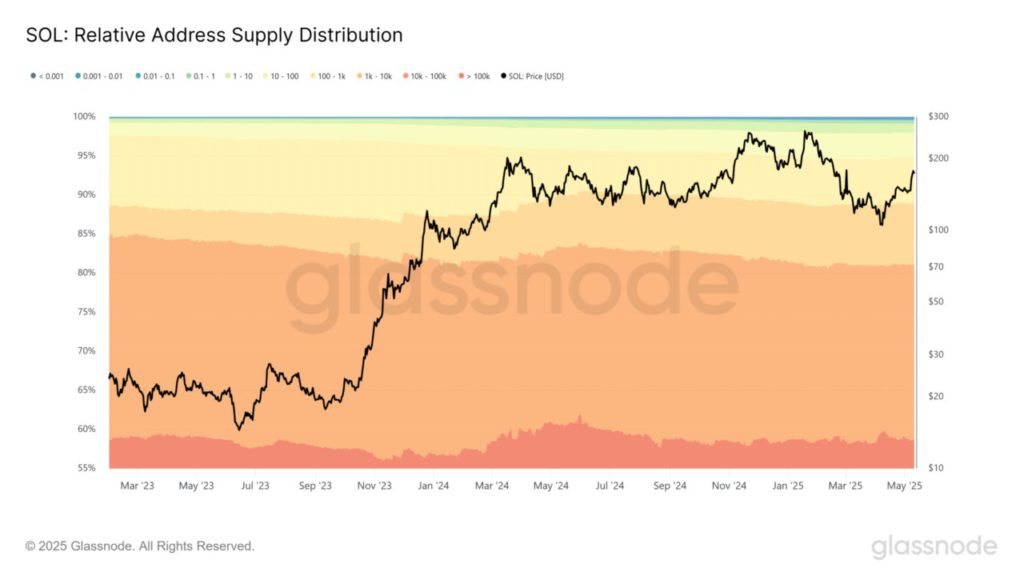

At the same time, there was no massive accumulation by whales, which can usually be an important indicator in price movements. The relative supply distribution shows that, while there was a significant increase in wallets with balances over 100,000 SOL after the big price hike, this does not necessarily indicate extensive market accumulation before the price hike.

Also Read: Potential for XRP, Kaspa, and Solana in the Next Altcoin Cycle According to Analysts!

Technical Analysis and SOPR

Solana (SOL) is currently testing resistance at $180, a zone that has been a stumbling block since mid-February. A bullish market structure is visible on the daily chart, where Solana (SOL) managed to overcome the previous low of $143, which marked a downtrend in the first quarter of 2025. This level was recently retested as support before rallying to $178.

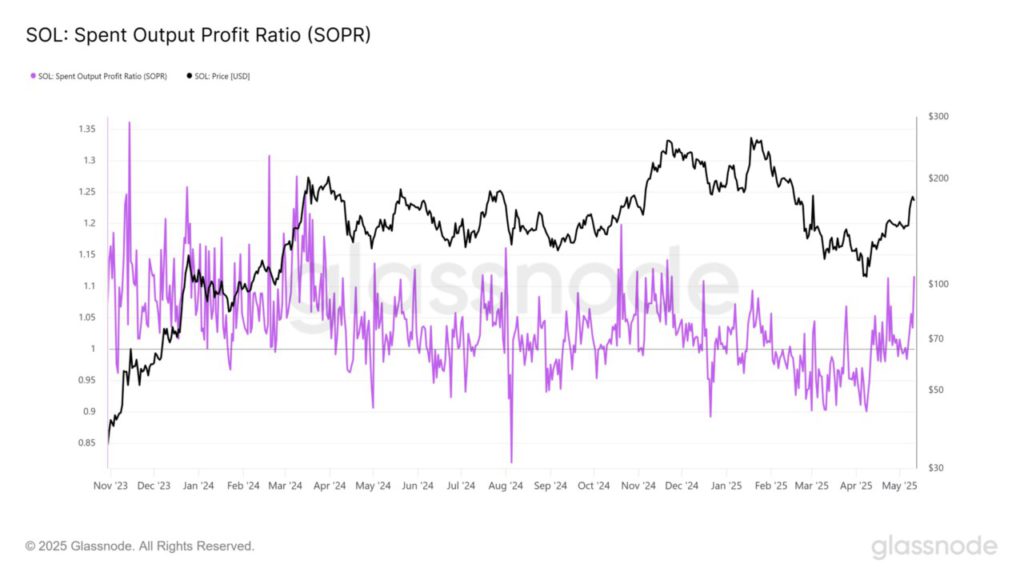

However, the Spent Output Profit Ratio (SOPR) currently at 1.16 suggests that many holders may start selling to take profits. The SOPR, which measures the ratio of selling price to buying price, has shown that whenever the value reaches 1.06-1.1, the Solana (SOL) price experiences a significant drop.

Investment Outlook and Strategy

Although there is a potential for a price drop due to profit-taking, the steady demand for Solana (SOL) indicated by the increasing On-Balance Volume (OBV) provides some optimism. Investors may want to consider waiting for a price drop to the $150-$160 range before making further purchases, provided the OBV can maintain its uptrend.

It is important to monitor these indicators and adjust investment strategies according to changing market conditions. Understanding when to enter and exit the market can go a long way in determining investment success in the long run.

Conclusion

Taking all these factors into account, Solana (SOL) investors should remain vigilant and prepared for possible volatility. Keeping a close eye on technical and fundamental indicators will help in making the right investment decision at the right time.

Also Read: New York Mayor Appoints Crypto Advisor After Corruption Case Dropped

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana bulls eye $180, but will profit-taking spoil SOL’s rally?. Accessed on May 13, 2025

- Featured Image: Crypto Rank

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.