Will Cardano (ADA) Spike Due to Whale Accumulation?

Jakarta, Pintu News – Last week, Cardano (ADA) managed to break out of a short-term downward channel. This was driven by the liquidation of $880,000 worth of short positions in less than 24 hours, which triggered a significant price spike. Recent reports suggest that accumulation by whales is increasing, especially at the $0.75 support level, which adds to the potential for future ADA price gains.

Tissue Activity Observations

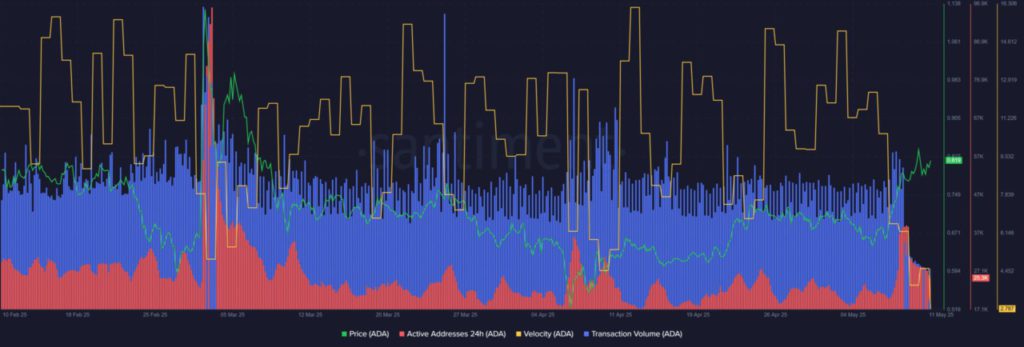

On Friday, May 9, there was a sharp drop in daily active addresses and transaction volume on the Cardano network. This activity decreased over the weekend, which is not uncommon for transaction volume, but is often seen in daily active addresses. Despite this, the current number of daily active addresses is still higher compared to most days in April.

The drop in token velocity has also coincided with a decrease in transaction volume over the past few days. This has coincided with an increase in price, indicating reduced selling pressure and minimal profit-taking activity, which is indicative of accumulation activity. In the past month, the group of 10 million to 100 million ADA holders has added 1% to Cardano’s total circulating supply, which is worth around $296 million.

Also Read: Potential for XRP, Kaspa, and Solana in the Next Altcoin Cycle According to Analysts!

Accumulation by Whale

It is true that accumulation occurred only in certain groups. The 100 million to 1 billion ADA holder group also added to their holdings in the last three days. However, other groups seem to be selling their assets, with only the retail group showing consistent buying since February.

This shows the mixed dynamics in investor behavior in Cardano. Despite selling from some groups, significant accumulation by whales could provide strong support to the price, and the potential to push the price higher if this trend continues.

Technical Analysis and Price Projections

On the daily price chart, Cardano briefly fell below the $0.68 low in late March, but managed to recover. This level was tested again as support on May 8. Currently, the $0.8 support zone is successfully defended by the bulls.

The 20 and 50 period moving averages show the dominance of bullish momentum. The next price target is the mid-range resistance at $0.91. The increasing Balance On-Chain Volume (OBV) indicates steady buying pressure, which could help ADA prices rally even higher.

Conclusion

With significant accumulation by whales and favorable technical indicators, Cardano (ADA) has the potential to experience a price surge. Investors and market watchers should continue to monitor this dynamic, as it could provide interesting opportunities in the cryptocurrency market.

Also Read: New York Mayor Appoints Crypto Advisor After Corruption Case Dropped

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Cardano as Whale Accumulation Rises, Will ADA See a Potential Surge?. Accessed on May 13, 2025

- Featured Image: Analytics Insight

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.