Ethereum Stalls at $2.500 — Is Rising Selling Pressure a Warning Sign for ETH Investors?

Jakarta, Pintu News – Ethereum (ETH) has rallied over the past week, pushing its price close to the psychological $3,000 level.

However, this surge began to be restrained due to sell-offs from large investors, which put pressure on the continuation of the crypto asset’s uptrend. Then, how will Ethereum price move today?

Ethereum Price Drops 1.49% in 24 Hours

As of May 16, 2025, the price of Ethereum (ETH) was recorded at around $2,571 or equivalent to IDR 42,427,756, experiencing a 1.49% correction in the last 24 hours. During this period, ETH had touched its highest level at IDR 43,138,809, and its lowest level at IDR 41,195,882.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $311.36 billion, with daily trading volume rising 1% to $25.75 billion in the last 24 hours.

Read also: Dogecoin Dips 4% on May 16 — But Network Activity Skyrockets Nearly 990%! What’s Going On?

Selling Pressure from Ethereum Investors Increases

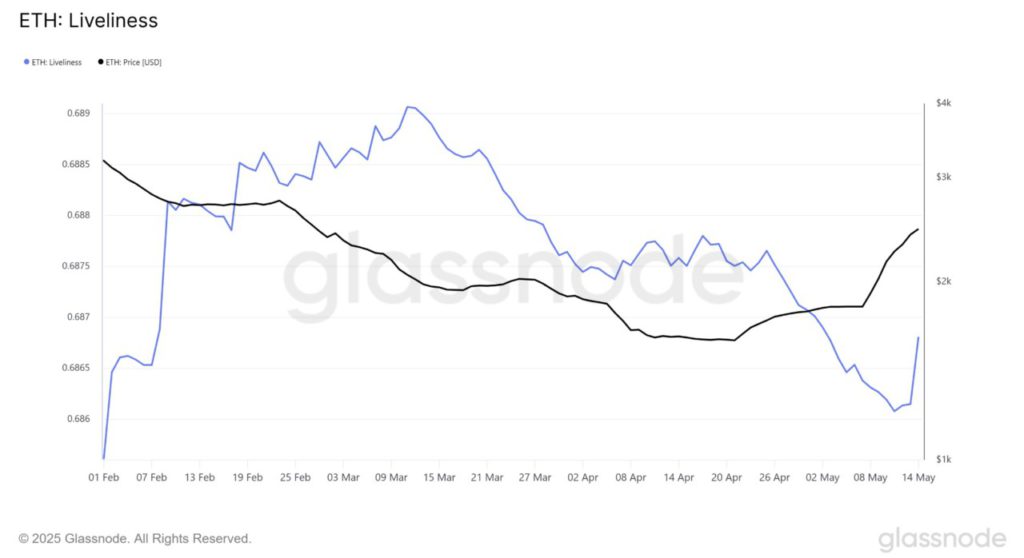

The Liveliness metric for Ethereum showed a sharp spike, signaling increased selling activity fromlong-term holders ( LTH). This is the first significant increase in the last three months, indicating that major investors are starting to realize profits at current price levels.

Given that LTH is often considered the backbone of an asset, a sell-off from this group could potentially push Ethereum’s price down.

This selling behavior from long-term holders usually reflects doubts about the potential for further price increases in the near future. This cautious attitude could be aheadwind for Ethereum’s movement, which could limit its ability to sustain its rally and break through the next resistance level.

However, Ethereum’ s In/Out of the Money Around Price (IOMAP) analysis identified an important support zone in the range of $2,345 to $2,421. In this price area, more than 64 million ETH tokens – worth about $164 billion – have been bought.

The concentration of owners in this price range is not expected to sell at a loss, creating strong price support.

This support level is crucial as it can help prevent a sharp drop, despite the increase in short-term selling pressure.

Investors who buy within that range have little incentive to offload their assets, which in turn helps stabilize prices and limit potential downside.

Read also: Bitcoin Hits $104K — Arthur Hayes Predicts It’s on the Path to $1 Million!

ETH price needs to find strong support

Ethereum price has surged by 42% in the last seven days and is currently trading at $2,577. By successfully holding above the $2,500 support level, Ethereum is now aiming to break the resistance at $2,654 to continue its upward momentum.

As of May 15, ETH is only about 16% away from the psychological target of $3,000. Although it is still facing pressure from long-term holders (LTH) selling, the strong support zone mentioned earlier is expected to keep the price from falling too deeply.

If the selling pressure subsides, ETH has a chance to resume its uptrend, especially if it manages to make the $2,814 level the new support.

However, if overall market conditions deteriorate, Ethereum could face additional selling pressure as investors tend to reduce risk.

A price drop below $2,344 could be an early signal for a deeper correction towards $2,141 – a scenario that could disrupt the bullish outlook and halt the ongoing rally.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price’s Rise to $3,000 Could Be Impeded By These ETH Holders. Accessed on May 16, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.