Cardano Whale Activity Surges – 80 Million ADA Bought in 48 Hours!

Jakarta, Pintu News – The Cardano (ADA) market is experiencing a critical moment as market participants attempt to hold the support zone at $0.74 and build momentum to reach the $0.90 level. Having risen more than 68% since its April low, ADA is showing strong signs of recovery. However, to confirm the continuation of this positive trend, ADA will need to maintain its current levels.

Cardano Whales in Action: Large Accumulation Strong Indication

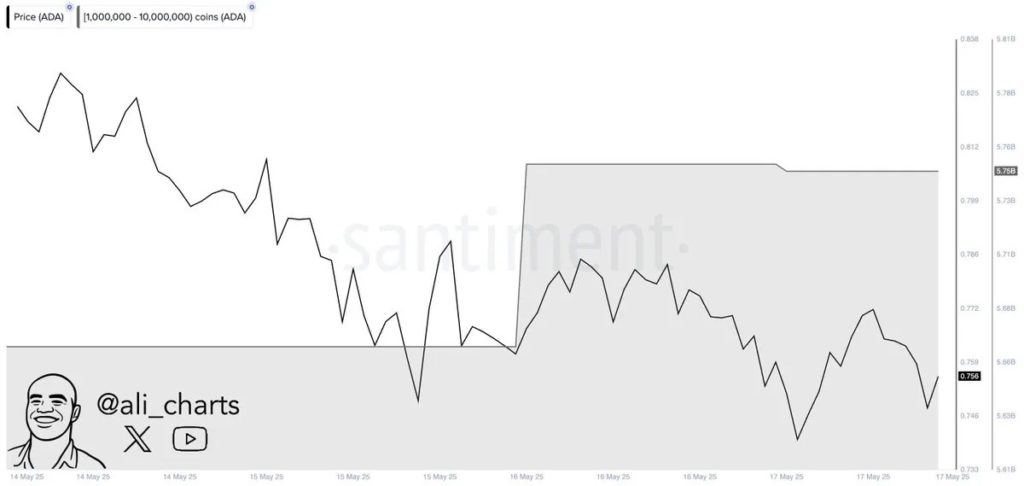

On-chain data from Santiment shows that whale has accumulated over 80 million ADA in the last 48 hours. This signals increased confidence among big players, which may set the stage for a breakout. Whale activity often precedes big market moves, and their renewed interest in Cardano could be an early signal of a sustained rally.

However, the $0.90 level is currently acting as a short-term resistance. Reclaiming this level will be crucial to unlock higher targets. The coming days will be crucial for ADA’s price structure. If market participants manage to reverse this level, the next step could be to bring Cardano back into the spotlight-perhaps also rekindling enthusiasm for altcoins more broadly.

Also Read: Bitcoin Approaches Golden Cross: Bullish Signal Amid US Debt Concerns

Cardano Position Strengthening: Consolidation Ahead of Breakout

Despite the impressive rebound, ADA is still 43% below its December 2024 peak of around $1.32. This highlights the cautious optimism that dominates the altcoin landscape. Although market participants are gradually taking control, macroeconomic uncertainty and overall market fears continue to put pressure on altcoins, many of which are still struggling to break key resistance levels.

ADA is currently consolidating just above the $0.74 level, forming a base that could precede a breakout. The market structure is tightening, and the next move-up or down-is likely to be sharp. A decisive push above $0.90 would confirm a breakout and possibly trigger renewed interest from retail and institutional investors.

Cardano Maintains Critical Support: Bulls Seek Recovery

Cardano is currently trading around $0.74, testing a key support zone after failing to hold above the $0.80 mark. The chart shows a strong spike in early May that took ADA to a local peak near $0.90, but since then the price has pulled back and is now consolidating just above its 200-day EMA (around $0.71). This level acts as dynamic support and could be critical for the next move.

The price structure suggests that ADA is in a critical phase. A drop below the EMA and horizontal support around $0.72 could expose the token to a deeper retracement towards the previous consolidation zone. On the other hand, reclaiming $0.80 would negate the bearish scenario and signal a potential push towards $0.90 and eventually $1.00-areas that mark strong historical resistance.

Conclusion

If market participants can sustain current levels and generate renewed buying momentum, ADA could resume its uptrend and break the current range, setting the stage for a retest of key resistance levels in the coming weeks. Increased whale activity and adequate market structure promise significant potential for Cardano in the face of current market dynamics.

Also Read: XRP Strengthens After V-Shaped Recovery, Next Price Target IDR56,000?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Cardano Whale Activity Spikes, 80 Million ADA Added in 48 Hours. Accessed on May 19, 2025

- Featured Image: Bitcoinsensus

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.