Astonishing Prediction: Bitcoin (BTC) to $160,000!

Jakarta, Pintu News – Bitcoin (BTC) is currently still in the $103,000 price range, although the upward momentum that started in May has shown a slowdown in the past seven days. Although short-term volatility is occurring, the long-term outlook is without a doubt still bullish.

Gold Ratio Multiplier: A Proven Predictive Tool

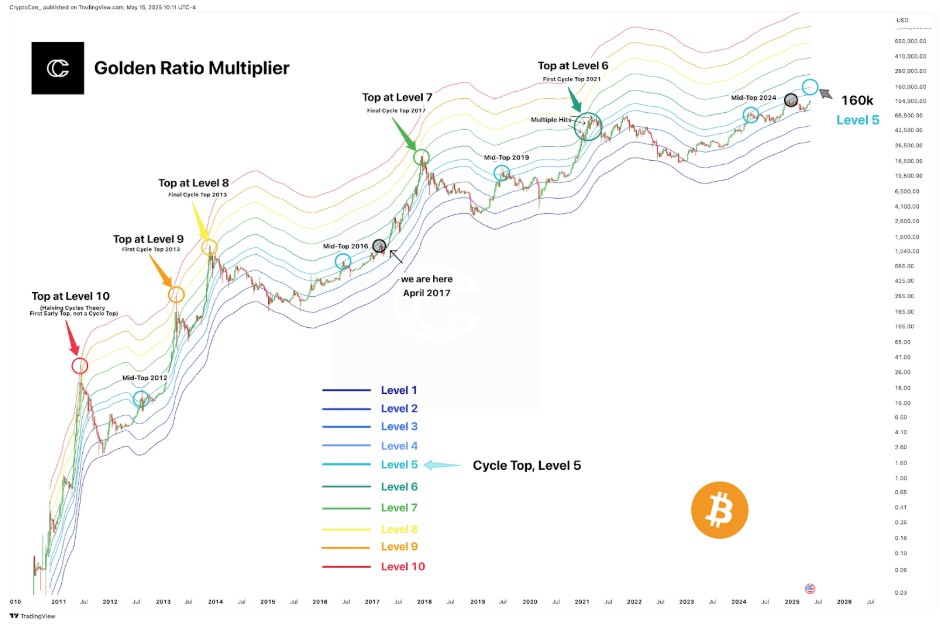

In a post on social media platform X, renowned crypto analyst CryptoCon highlighted the reliability of the Golden Ratio Multiplier in predicting Bitcoin (BTC) price peaks in each cycle. The Golden Ratio Multiplier is a logarithmic model that incorporates multipliers derived from Fibonacci to anticipate Bitcoin (BTC) macro trends. The model successfully predicted the April 2021 cycle peak in real time, just like the 2017 and 2013 price peaks.

This cycle, the model has marked a significant peak in March 2024, although the analyst interprets it not as a final peak but as a mid-peak. CryptoCon explained that Bitcoin (BTC) price action has reached Level 4 of the multiplier chart this cycle, but this is not the final peak. “We’ve already reached the peak level of our cycle once, but that was for the mid-cycle peak in March 2024, which means we’ll definitely do it again,” he wrote.

Also Read: Bitcoin Approaches Golden Cross: Bullish Signal Amid US Debt Concerns

Parallel Current Cycle with 2015-2017

Based on comparisons with previous cycles, the current market phase is seen as equivalent to April 2017, just before Bitcoin (BTC) rallied in the following months. The Level 5 band is currently at around $160,000 and continues to trend upwards. Drawing parallels with the 2015 to 2017 cycle, when Bitcoin (BTC) experienced a gradual buildup followed by an explosive burst.

The current cycle structure shows strong similarities to that period, signaling that we may be on the verge of a significant price increase. If the market continues to respect this structure, Bitcoin (BTC) could be set to rally towards the Level 5 mark of $160,000 at a later date, which could mark the final peak of this cycle.

Market Outlook and Future Price Predictions

If the market continues to follow this structure, Bitcoin (BTC) may be preparing to rally towards the Level 5 mark of $160,000, which could be the final peak of this cycle. The current range of around $103,000 may be the calm before the final breakthrough.

“Slower development, then all at once,” the analyst said. At the time of writing, Bitcoin (BTC) was trading at $102,971. Considering the current trends and analysis, investors and market watchers may see this as an opportunity to assess their positions before a possible significant price spike.

Conclusion

By utilizing predictive tools such as the Golden Ratio Multiplier, market participants can gain deeper insight into the potential future price movements of Bitcoin (BTC). While there is inherent uncertainty in every investment, tools like these provide a framework for making more informed decisions.

Also Read: XRP Strengthens After V-Shaped Recovery, Next Price Target IDR56,000?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Golden Ratio Multiplier Called Bitcoin Top in 2021, Here’s What It’s Saying Now. Accessed on May 19, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.