Bitcoin Surges Past $110,500 Today (May 22, 2025) — Jim Cramer Now Calls It a Safe-Haven Asset!

Jakarta, Pintu News – On May 22, 2025, the price of Bitcoin (BTC) set a new All-Time High record at $110,000. However, investor concerns have risen again after Moody’s downgraded the US government’s debt rating.

However, CNBC’s Jim Cramer suggests a different response. He advised investors to control their emotions and not panic. According to him, digital assets such as Bitcoin can be a choice of protection in the midst of uncertainty.

Then, how is the current Bitcoin price movement?

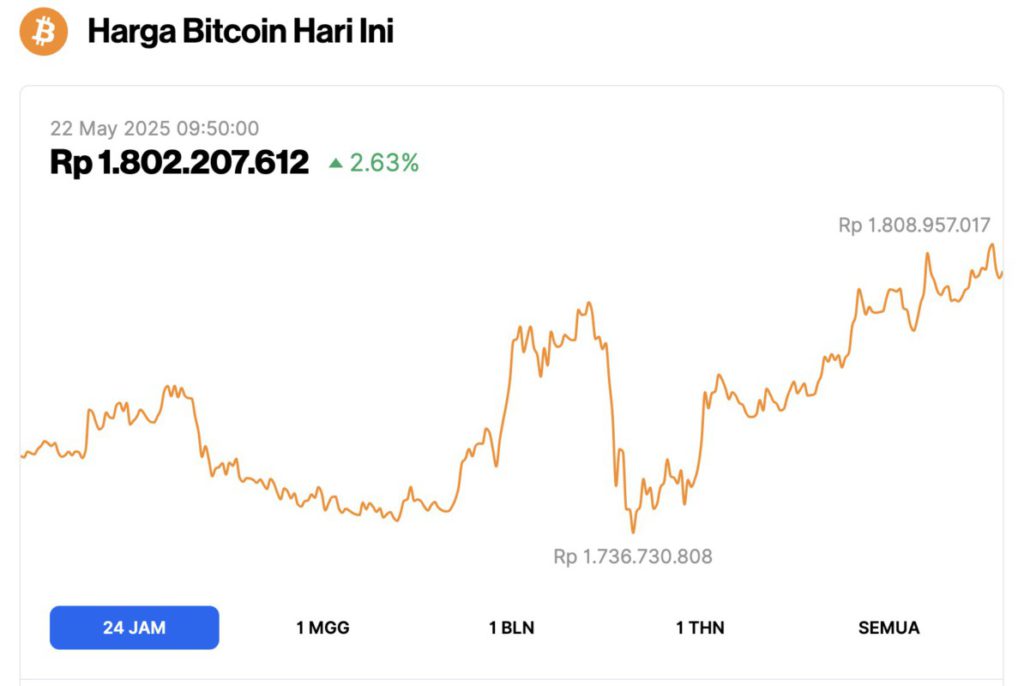

Bitcoin Price Up 2.63% in 24 Hours

On May 22, 2025, Bitcoin was trading at $110,545, equivalent to approximately IDR 1,802,207,612, marking a 2.63% increase over the past 24 hours. Throughout the day, BTC saw a low of IDR 1,736,730,808 and climbed to a peak of IDR 1,808,957,017.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.19 trillion, with trading volume in the last 24 hours rising 72% to $86.65 billion.

Read also: Bitcoin Smashes $109,400 Barrier to Hit New All-Time High — Is a Massive Surge to $150K Next?

Jim Cramer warns against selling stocks out of fear

Jim Cramer, host of Mad Money on CNBC, delivered his message to investors on Monday after Moody’s downgraded the United States’ debt rating.

The announcement, made after market close on Friday, triggered a tumultuous start to the week. Markets opened lower, with the Dow Jones index down 300 points and the S&P 500 down 1% in early trading.

Despite a dip at the start of the session, the market managed to recover. The Dow closed up 0.32%, the Nasdaq edged up 0.02%, and the S&P 500 gained 0.09%.

Jim Cramer urged investors not to lose themselves in fear, calling this a recurring pattern every time there is a downgrade, as was the case with the downgrade by S&P in 2011 and Fitch in 2023.

“This is a wake-up call for you to start investing more-not aggressively, but from funds that you can spare,” says Jim Cramer.

He added that selling assets after a downgrade is not a strategy that has proven effective in the past.

Bitcoin and Gold Recommended as Safety Nets

Jim Cramer suggests that those who are concerned about the rising national debt should consider assets outside of traditional markets. He specifically mentions gold and Bitcoin as viable alternatives amid fiscal uncertainty.

Read also: Bitcoin on Fire: Price Could Skyrocket to $600,000 by October 2025, Experts Say

“Fear is something that must be controlled if you want to be a good investor,” Cramer explains, emphasizing that panic often leads to bad decisions.

Bitcoin, in particular, has shown resilience in recent days. After the announcement of the downgrade, Bitcoin’s price did fluctuate, but remained above key support levels.

Cramer noted that digital assets such as Bitcoin could be a buffer for those who are worried about government profligacy in debt.

He also mentioned that fear narratives are often driven by parties with certain financial interests.

“The people who are spreading these rumors are either ignorant fools who don’t know anything, or they are very cunning short sellers who need to spread fear to benefit their business,” said Jim Cramer.

Bitcoin Open Interest Surges, Price Hits $107,000

Bitcoin’s open interest (OI) in the futures market reached $74 billion, according to data from Coinglass. This is one of the highest levels in recent weeks and indicates increased trader activity.

Currently, Bitcoin price is trading around $105,000 after briefly touching $107,000. However, the price was rejected twice at that level in the last few sessions, signaling strong resistance.

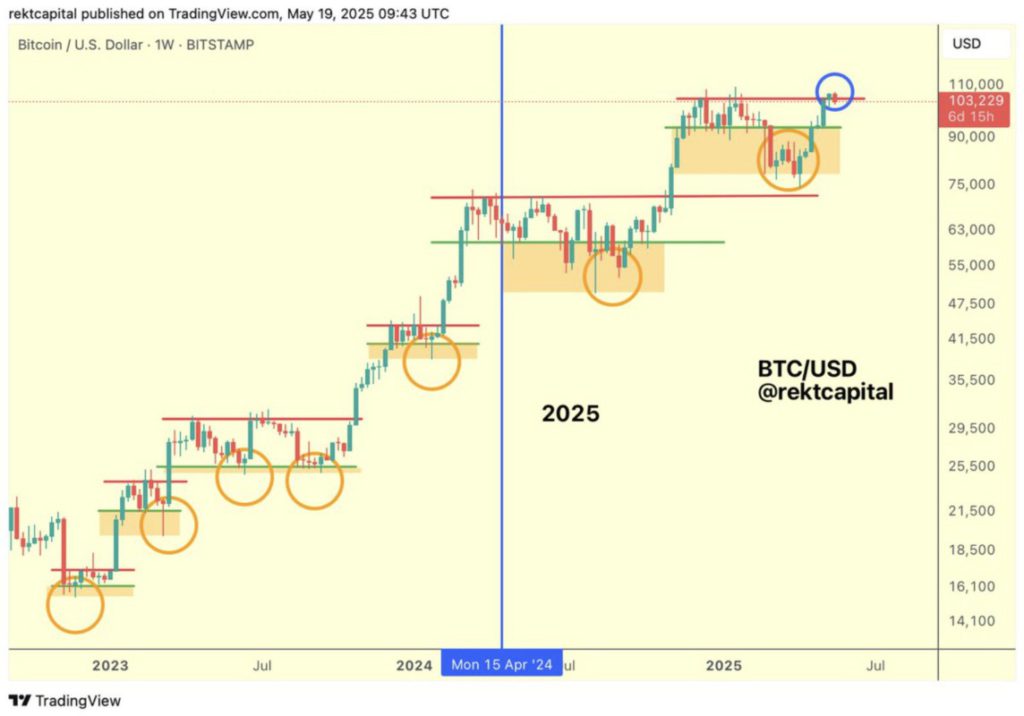

Despite the fluctuations, crypto expert Rekt Capital mentioned that the previous weekly candle close was above $103,000, which was previously an important resistance point.

Analysts think this surge in activity is fueled by expectations that interest rates will fall and inflation will subside-two factors that favor assets like Bitcoin.

In addition, the increasing exposure of large financial firms to crypto, such as that of the Michael Saylor-led Strategy, is also cited as one of the reasons behind Bitcoin’s recent price stability.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Jim Cramer Calls Bitcoin a Safe Haven Amid Growing US Debt Concerns. Accessed on May 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.