Bitcoin (BTC) Market Outlook in June 2025 According to Analysts, Are There Big Opportunities Awaiting?

Jakarta, Pintu News – Bitcoin’s (BTC) volatility is often regarded as a double-edged sword; on one hand it provides huge profits, on the other hand it holds equally huge risks. Although Bitcoin (BTC) has not touched the $110,000 price since the last 120 days, there is an interesting market dynamic going on. Investors are now starting to lock in their profits to avoid a deeper drop, but this is not entirely a negative impact.

Long-Term Holder Distribution and Volatility Signals

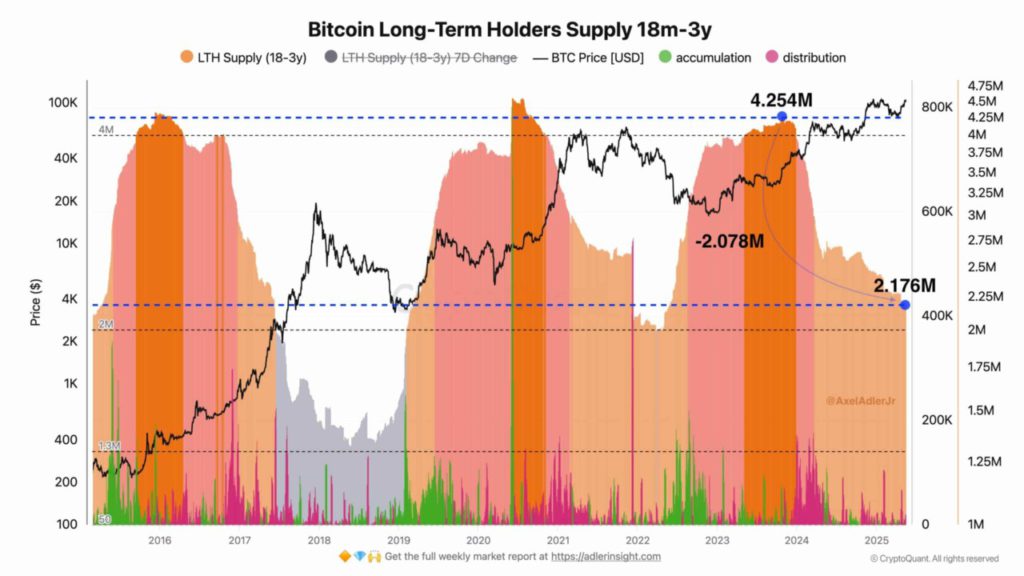

Since November 2023, Long-Term Holders (LTHs) who have owned Bitcoin (BTC) between 18 months and 3 years have sold more than 2 million coins, with total realized gains reaching around $138 billion. The drop in supply from a peak of 4.254 million to just 2.176 million Bitcoin (BTC) signals a clear distribution phase, similar to what happened in previous bear markets.

In 2022, a similar pattern occurred and was followed by a 63% annual decline from Bitcoin’s (BTC) opening price of $46,017. However, what sets the current cycle apart is the outcome. Despite similar levels of distribution and profit-taking, the price of Bitcoin (BTC) continues to show a positive trend, with a rise of almost 200% during the same phase. This suggests that there is a change in the way the market responds to selling and volatility.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

Upcoming Bitcoin (BTC) Market Projections

Analysis from data-driven experts suggests that up to 500,000 Bitcoin (BTC) may enter the market towards the end of this year. This signals a significant liquidity outflow wave that is forming beneath the surface. According to AMBCrypto, this release will put Bitcoin (BTC) volatility under renewed pressure, testing the market’s ability to absorb large-scale distributions without disrupting the broader uptrend.

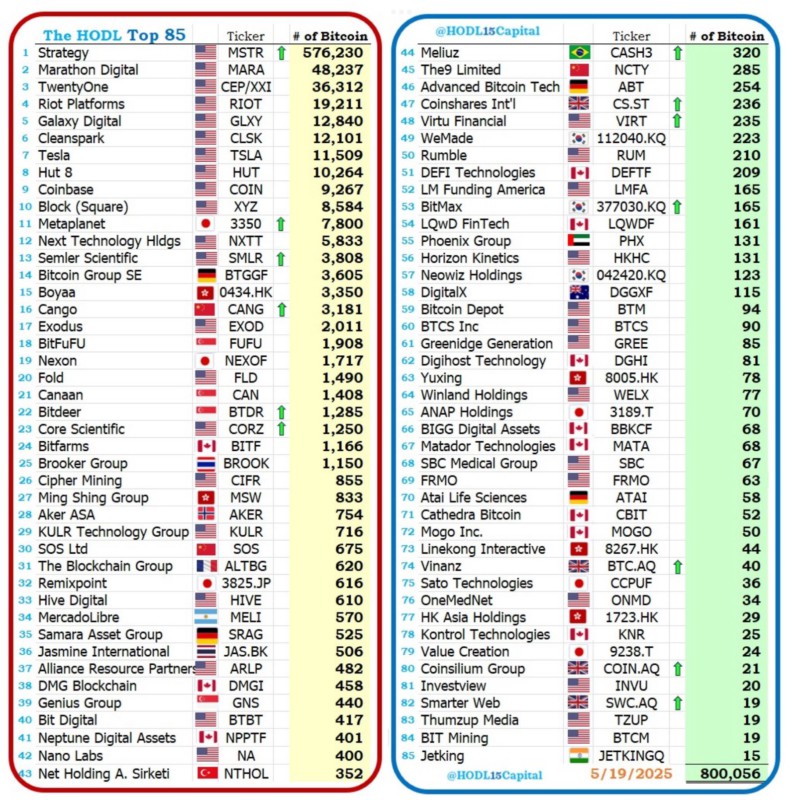

However, with institutional and corporate interest in Bitcoin (BTC) now surpassing the levels seen in the 2023-2024 cycle, this volatility may no longer be seen as a threat. Instead, it could be another opportunity. If history is any guide, Bitcoin (BTC) may once again show its resilience, providing a strategic opportunity for investors to step in and set the stage for further price discovery.

Conclusion

By monitoring this group of long-term holders, investors can gain important insights into the future direction of the Bitcoin (BTC) market. While the potential for massive selling could create volatility, current market conditions and growing interest from institutional and corporate parties could help stabilize and even push the price of Bitcoin (BTC) to higher levels.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. A 500k BTC dump coming, Bitcoin’s volatility faces a new test. Accessed on May 21, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.