Chainlink Has the Potential to Surpass $16.5: What Barriers Are Holding It Back?

Jakarta, Pintu News – The latest data from Santiment shows that Chainlink (LINK) development activity in the past 30 days surpassed Ethereum (ETH) by 50%. Despite this, Chainlink (LINK) still faces several challenges that could affect its price movement in the future. This article will delve deeper into the dynamics affecting Chainlink (LINK)’s price and the potential obstacles that could hinder its rise.

Chainlink Network Activity Analysis

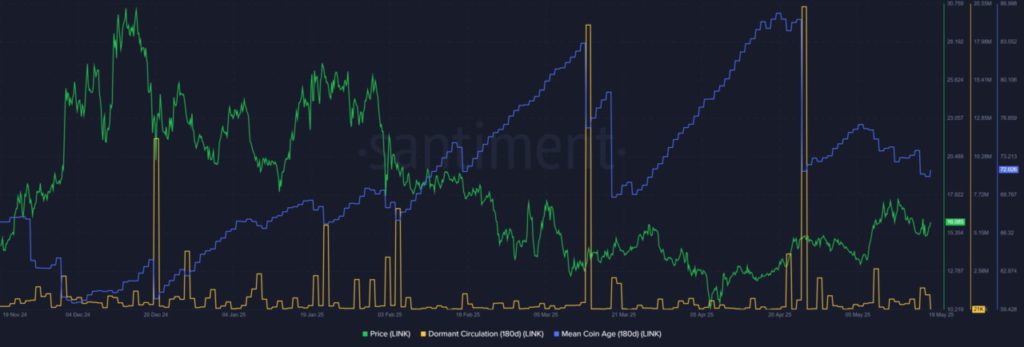

On April 25, Chainlink’s (LINK) dormant circulation chart showed a significant spike, signaling a sudden increase in network activity. This spike coincided with a drop in Mean Coin Age (MCA), indicating that many holders started selling as the Chainlink (LINK) price approached the $15.5 level. This level was previously the peak of the price range that existed at the time.

When the price of Chainlink (LINK) tried to break through the key resistance level, it was seen that there was an increasing trend of selling. This reflects a lack of conviction among holders as the price approaches that resistance level. This dynamic is important to understand as it can provide insight into investor behavior over the long term.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

Difficulties Faced by Chainlink

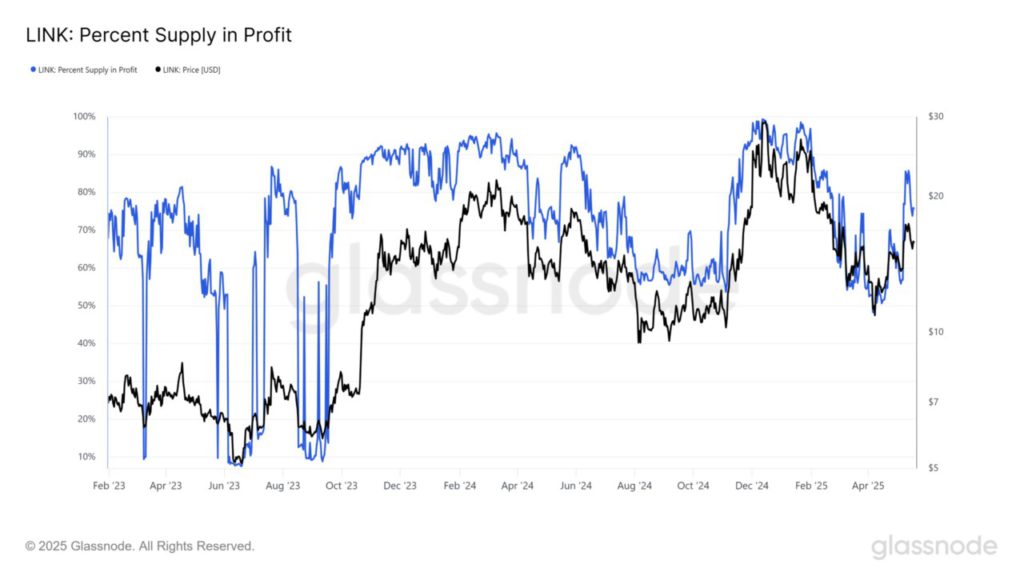

One metric that long-term investors need to pay attention to is the percentage of profitable supply. Currently, 76% of Chainlink (LINK) holders are in a profitable position. However, the previous wave of selling in March and April occurred when this figure was at 65% and 56%.

This shows that this percentage increase does not necessarily signify price stability. In addition, although Chainlink (LINK) is leading the way in development activity, selling pressure and lack of market conviction remain a concern. These factors could hamper Chainlink (LINK)’s efforts to maintain positive price momentum, especially as it tries to break and sustain higher price levels.

Chainlink’s Future Potential

In recent days, Chainlink (LINK) has retested the $15.5 level-which was previously a resistance zone-as a support zone. These efforts suggest that there is a possibility that Chainlink (LINK) could push the price higher if it can overcome the existing obstacles.

However, investors and market watchers should remain aware of indicators that may affect price movements. Understanding these dynamics will be crucial to making the right investment decisions in the face of cryptocurrency market volatility.

Conclusion

Although Chainlink (LINK) shows significant potential with impressive development activity, there are still some obstacles that need to be overcome. Investors should pay attention to various metrics and market dynamics to make informed decisions. With a deep understanding, the opportunity to capitalize on Chainlink (LINK)’s potential becomes more open.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Chainlink could rally past $16.5, but this hurdle weighs on LINK. Accessed on May 21, 2025

- Featured Image: The Block

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.