Will FARTCOIN jump 21% and escape the bearish pressure? Here’s what the analysts have to say!

Jakarta, Pintu News – FARTCOIN is currently showing bullish signals on the charts, but there is still mixed sentiment among market participants. An in-depth analysis of FARTCOIN’s potential price increase will be outlined through several market and technical indicators.

Early Symptoms of FARTCOIN Movement

On the 4-hour chart, FARTCOIN looks to be in a symmetrical triangle pattern, which is often an early indicator of a major rally. This pattern is characterized by converging support and resistance lines, which the price consolidates within. Currently, FARTCOIN is trading in the support zone, which is usually the starting point for a large rally. If this pattern continues, there is a high probability that FARTCOIN will experience a price surge.

According to recent data, FARTCOIN is strategically positioned to begin its rise. This provides an opportunity for investors to consider FARTCOIN as a short- or medium-term investment asset. However, it is important to continuously monitor price movements and trading volumes to confirm this bullish trend.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

Market Sentiment Dynamics

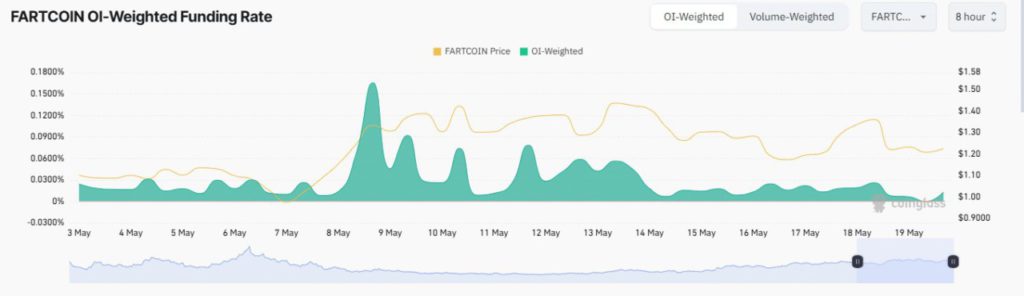

An analysis of the Market Funding Rate, which is used to determine the dominance of long-term traders, shows that traders on Binance and OKX are very bullish on FARTCOIN. They expect a rally and are willing to pay a premium to maintain their positions, with the Funding Rate reaching 5.1% on both platforms. This indicates a positive expectation of FARTCOIN’s future performance.

In contrast, derivatives traders on ByBit tend to be bearish, with a majority of short positions. Although the Funding Rate on ByBit is negative, this is not necessarily a negative signal as the Open Interest (OI) suggests that sellers on ByBit may have an edge over traders on other platforms. However, the overall Open Interest Weighted Funding Rate shows that long positions still dominate.

Technical Indicators Provide Certainty

Technical indicators confirm that the bulls are still in control of the market. The Accumulation/Distribution (A/D) metric shows that the market is gradually accumulating assets. Although it is still in the negative zone, it indicates that FARTCOIN is still in the recovery phase. This indicator is important to monitor as it can provide early signals of a trend change.

The Money Flow Index (MFI), which tracks the inflow and outflow of liquidity, shows that additional liquidity is being added and traders are buying, as the indicator remains in positive territory. This suggests there is strong support from buyers which could push the price of FARTCOIN even higher in the future.

Conclusion

In conclusion, despite some bearish sentiments among traders on some platforms, technical indicators and overall market dynamics still point to bullish potential for FARTCOIN. Investors and traders are advised to monitor these indicators regularly to make informed investment decisions. Under the right circumstances, FARTCOIN has the potential to surge up to 21% from its current position.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Assessing if Fartcoin can break free from bearish pressure, rally 21%. Accessed on May 21, 2025

- Featured Image: The Crypto Times

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.