Breaking: SEC Hits Pause on XRP and DOGE ETFs—Market Reacts Swiftly!

Jakarta, Pintu News – Grayscale Investments’ Dogecoin (DOGE) ETF application is still under review by the US Securities and Exchange Commission (SEC).

More than 70 other altcoin ETFs, including DOGE, XRP (XRP), Solana (SOL), Litecoin (LTC), and others, are also pending with the SEC. This event is considered significant and is in the spotlight of global investors, especially after the impressive performance of the spot Bitcoin (BTC) and Ethereum (ETH) ETFs launched last year, which recorded millions of dollars in net fund inflows every day.

Spot XRP and Dogecoin ETFs Delayed

The US Securities and Exchange Commission (SEC) needed additional time to evaluate these exchange-traded funds (ETFs), which led to delays in the DOGE and XRP ETFs.

Read also: XRP Price Prediction: Ripple Potentially Rise to $4?

Grayscale filed for a Spot Dogecoin ETF in March 2025, having previously launched the Dogecoin Trust in January. However, as of now, despite months, the SEC has yet to comment and the process is still under review.

While the delay was frustrating for investors, this step was necessary to ensure compliance with Section 6(b)(5) of the Exchange Act. A similar process happened with the Bitcoin ETF, which although took some time before launching, eventually brought positive results with billions of dollars in fund inflows and a surge in Bitcoin price.

The next decision date is scheduled for June. If the outcome is positive, then approval can be granted.

“The Commission initiated this proceeding to allow for additional analysis to determine whether ETFs comply with rules designed to prevent fraudulent and manipulative acts and practices, and to protect investors,” reads the SEC document.

When will the SEC approve the Dogecoin ETF?

Although the SEC has delayed their decision until June, this does not mean that they will give their approval at that time.

In its official document, the SEC clearly states that this delay is to allow for additional analysis.

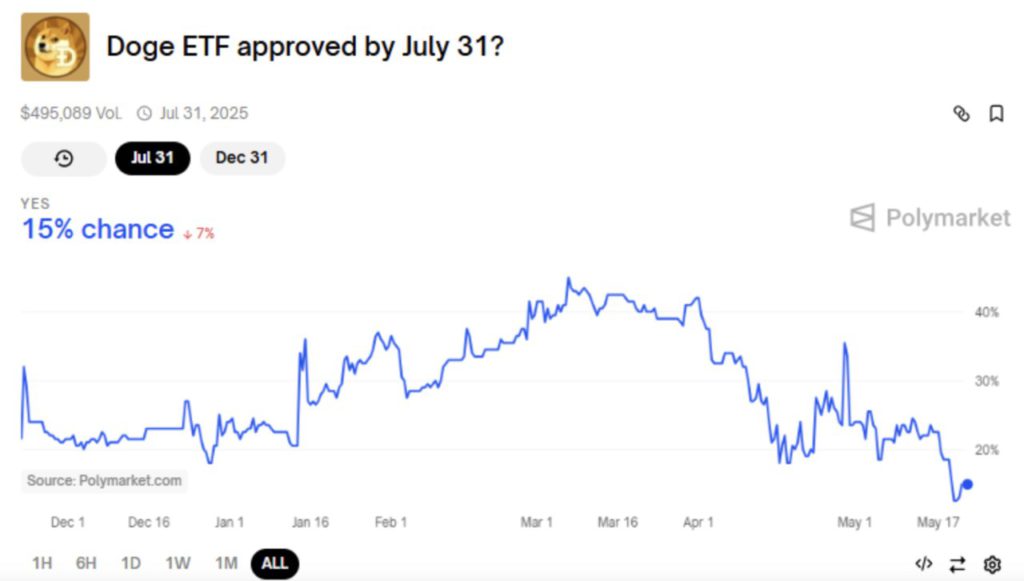

Currently, the chances of the DOGE ETF being approved before the end of July on Polymarket’s prediction platform are only 15%, down 7% in the last 24 hours.

Read also: Dogecoin Price Up 3% Today (5/22/25): DOGE Potential to Surge to $6?

However, the chance of approval in 2025 was recorded at 63%, indicating that investor confidence is higher in the likelihood of approval in the final months of 2025.

Analysts from Bloomberg also shared similar predictions. In his latest post on X, James Seyffart emphasized that there is no conspiracy theory behind the delay-it’s all part of the standard process conducted by the SEC.

He explained that the SEC does take time to respond to form 19b-4 filings, and most of these ETF filings have a final deadline in October.

Therefore, an early decision would be unusual, regardless of how “crypto-friendly” the SEC is. “There is no conspiracy here,” he said.

Many others have noticed the same, given the repeated delays in decisions on Dogecoin ETF filings. Recently, the SEC also delayed its decision on Solana ETF proposals from various issuers.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Dogecoin ETF Delayed Again: When Will SEC Say Yes?. Accessed on May 22, 2025

- Coinpedia. When Will SEC Approve an XRP ETF? Latest Delay Explained. Accessed on May 22, 2025

- Cointelegraph. SEC Delays Ether Staking, XRP ETFs Expected: Analyst. Accessed on May 22, 2025

- Crypto Times. SEC Delays XRP and Dogecoin ETF Decisions to June. Accessed on May 22, 2025

*Featured Image: Coinpedia

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.