Ethereum to Hit $10,000 in 2025? Arthur Hayes Says It’s Not Just a Dream

Jakarta, Pintu News – In the second quarter, the price of Ethereum (ETH) showed a remarkable recovery, surging from a low of around $1,400 to over $2,700. This rise was largely driven by the successful launch of the Pectra update, which significantly boosted investor confidence.

Interestingly, this launch also coincided with positive geopolitical developments. On May 8, the United States and the United Kingdom announced a historic trade deal, the first of its kind in history.

The certainty of this deal triggered a wave of optimism that spread across other major altcoins and coins.

Ethereum Ready to Play an Important Role in 2025

Arthur Hayes, in a recent interview, also stated that it is not just technical factors that are driving the rise in ETH prices, but rather market sentiment.

Read also: Ethereum Surges to $2,500 — Is a Massive Run to $4,000 Just Around the Corner?

He believes that the current Ethereum price still offers attractive investment opportunities. Hayes even set an ambitious target of $5,000 for Ethereum, stating that a price of $10,000 could be reached by the end of this year.

Despite the challenges it may face, Ethereum seems poised to play a significant role in the crypto landscape of 2025.

Continued innovation and interest from large institutions could make Ethereum a leading platform among its competitors, and an important turning point for the crypto ecosystem as a whole. Stay tuned for more information.

Arthur Hayes Predicts Ethereum Price Could Break $10,000

In a macroeconomics-themed interview on the Bankless podcast, Arthur Hayes-former CEO of BitMEX and now CIO at Maelstrom-expressed his optimistic predictions for Ethereum’s price.

Hayes stated that if the price of ETH manages to break through the $5,000 level, then it is possible that it will continue to soar to $10,000, even $15,000 before the end of this year. The prediction came at the end of the interview, when he was asked about ETH price projections for this year.

In discussing Ethereum’s rally in May, Hayes emphasized that ETH’s price rise was more influenced by market sentiment than technical factors.

According to him, the revival of the Ethereum price has been long awaited, especially after the last few years of losing prestige compared to Solana and other high-beta tokens.

Even so, Hayes also warned that Ethereum’s journey will not always be smooth. He admits that so far ETH’s performance is still lagging behind Bitcoin, but he believes Ethereum’s momentum is getting closer.

This optimism is driven by expectations of improved regulatory clarity, as well as the possibility of a revival of the decentralized finance (DeFi) sector that is capable of creating sustainable cash flows.

Hayes highlights projects like EtherFi and Pendle as examples of token ecosystems that have the potential to prove their valuation through strong fundamentals.

Towards the end of the interview, the host asked Hayes about his personal portfolio. He revealed that his crypto asset holdings consist of about 60% Bitcoin, 20% Ethereum, and the rest is spread across various other altcoins and tokens.

Outside of xrypto assets, Hayes also invests in physical gold, shares of gold mining companies, and T-bills.

Read also: BTC Strengthens, Bitcoin Price Forecasted to Reach $600,000 by October 2025

Will Ethereum Price Show Outstanding Performance?

On the daily price chart (21/5), Ethereum is currently moving volatile between major resistance and support levels, while technical indicators are giving mixed signals.

After experiencing a significant rally in May, Ethereum’s momentum now appears to be weakening. This can be seen from the Relative Strength Index (RSI) indicator which has fallen from the overbought zone, and is now at 68.70.

Currently, the ETH price stands at $2,528, with a daily trading volume of $23.47 billion.

The direction of ETH’s next price movement depends largely on its ability to break the resistance level at $2,800. If this level is successfully broken, the potential for further gains will be even stronger.

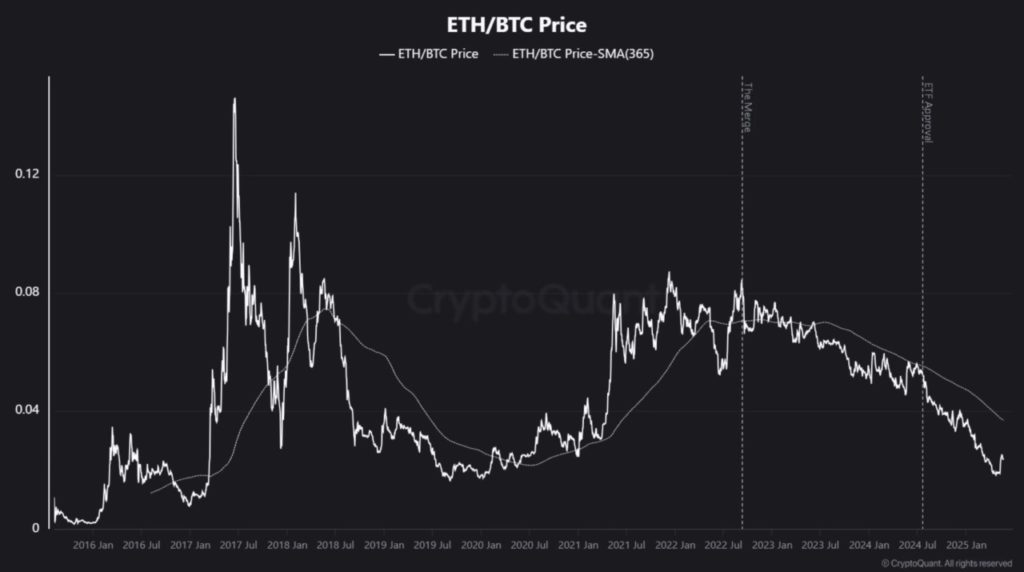

ETH/BTC Ratio Hits the Lowest Point

Positive signals also came from on-chain data, as revealed in CryptoQuant’s weekly report.

The price ratio of ETH to Bitcoin (BTC) (ETH/BTC) seems to have bottomed out, which could be a sign of the beginning of the so-called “altcoin season”.

In the past week, the ETH/BTC price ratio jumped by 38% after hitting its lowest point since January 2020.

Historically, this has often signaled that Ethereum is bottoming relative to Bitcoin – and is usually followed by a period where altcoins as a whole outperform BTC.

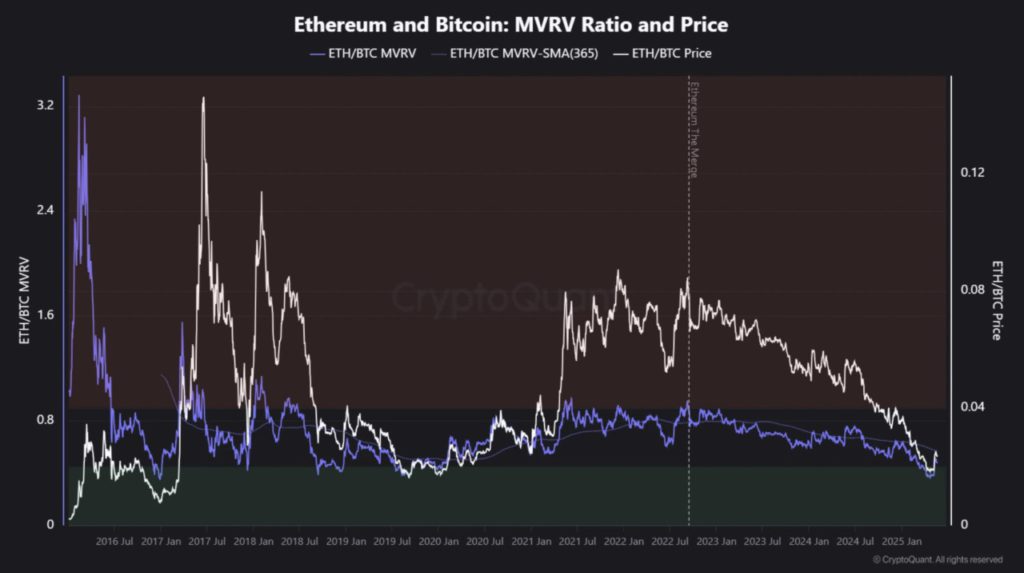

Furthermore, Ethereum is now also in the extreme undervaluation zone compared to Bitcoin, based on the Market Value to Realized Value (MVRV) metric for the ETH/BTC pair. This is the first occurrence since 2019.

In the past-in 2017, 2018, and 2019-a similar situation triggered a surge in Ethereum’s performance relative to Bitcoin, reinforcing the potential for mean reversion in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Ethereum Price Could Hit $10,000 in 2025, Says Arthur Hayes. Accessed on May 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.