Bitcoin (BTC) sets a new record, breaking $111,000! What’s the Outlook in June 2025?

Jakarta, Pintu News – On May 21, Bitcoin (BTC) reached a new high with an exchange rate of $111,381. This phenomenon was driven by a significant increase in Open Interest (OI) in the derivatives market, which recorded a new high of $74.25 billion. This increase signaled a large capital flow into the market, indicating a strong bullish signal.

Open Interest Surge and Market Potential

Since April, Open Interest for Bitcoin (BTC) has increased by more than $24 billion, signaling high interest from investors in the derivatives market. This increase not only shows investor confidence in Bitcoin (BTC), but also the potential to reach higher price points.

When the Open Interest peaked, many expected a significant price spike, and that was proven with new highs being reached. This rise in the price of Bitcoin (BTC) also brought risks for investors who opted for short positions.

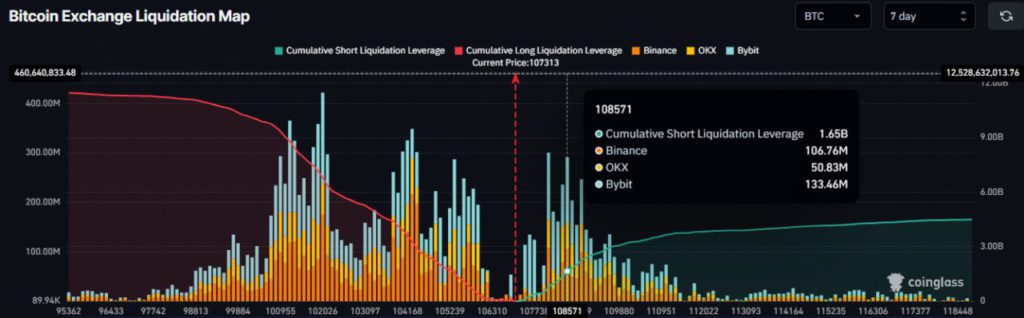

Less than 24 hours before the price peaked, there were $1.65 billion in short positions at risk of liquidation if the price continued to rise. When the price crossed $108,500, all of those short positions suffered heavy losses, indicating a high risk of liquidation for those betting on a Bitcoin (BTC) price drop.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

Market Dynamics and Funding Rates

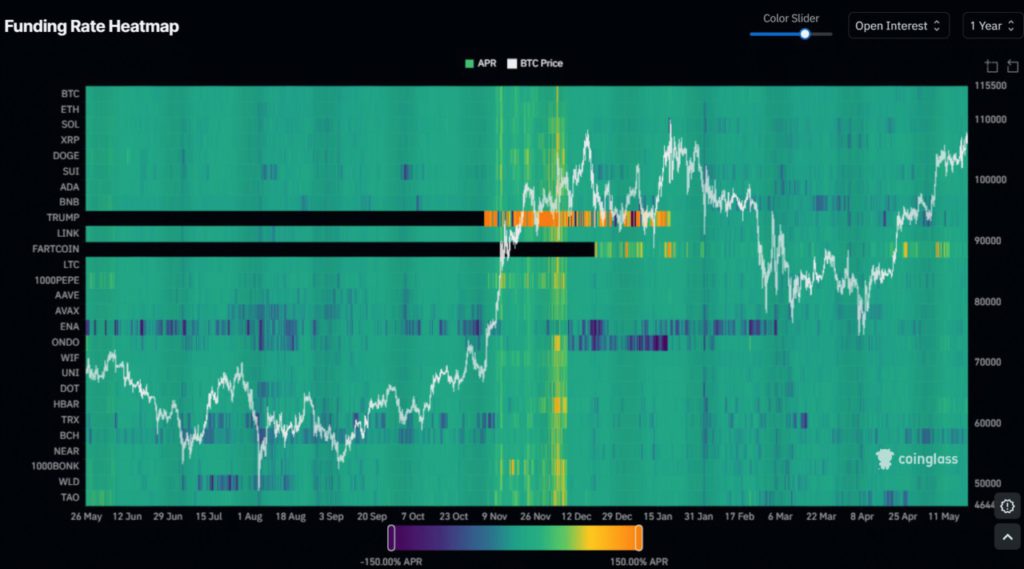

Although the derivatives market is showing high activity, the current funding rate shows that the market is not yet over-leveraged. Funding rates, which are periodic payments made by traders to maintain their positions, are currently at a healthy rate of around 3%.

This shows that market sentiment is still stable and there are no visible symptoms of overheating as in the November-December period last year, where funding rates reached 50-100%. In that period, the market experienced a pullback in early 2025 due to over-leveraging. However, with the current conditions, the Bitcoin (BTC) market is considered healthy and has the potential to reach new highs. This provides an opportunity for investors to continue to observe and possibly capitalize on the existing price volatility.

MVRV Pricing Model Analysis

Based on the MVRV price model, Bitcoin (BTC) is currently within the upper band range seen at the beginning and end of 2024. If this trend repeats, Bitcoin (BTC) price could fluctuate between $98,000 to $118,000 in the next two months. This model provides a perspective for investors to assess the price potential of Bitcoin (BTC) and make informed investment decisions based on historical trends and current market conditions.

Investors and market analysts must constantly monitor these indicators to make informed decisions in the face of fast-changing market dynamics. By understanding the various factors that influence prices, such as Open Interest and funding rates, market participants can be better prepared for the volatility that may occur.

Conclusion

By reaching new highs and favorable market dynamics, Bitcoin (BTC) is showing potential never seen before. Investors who understand the risks and opportunities can take advantage of these conditions to optimize their portfolios. However, it is important to remain vigilant against sudden changes in the market that could affect investments.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s price hits new ATH of $111,000 as open interest climbs to $72 billion. Accessed on May 22, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.