Bitcoin’s Big Move: What Are Long-Term Holders Trying to Show?

Jakarta, Pintu News – The transfer of Bitcoin (BTC) by long-term holders signals a potential change in the market as Bitcoin prices increase.

Bitcoin Displacement by Long-Term Holders

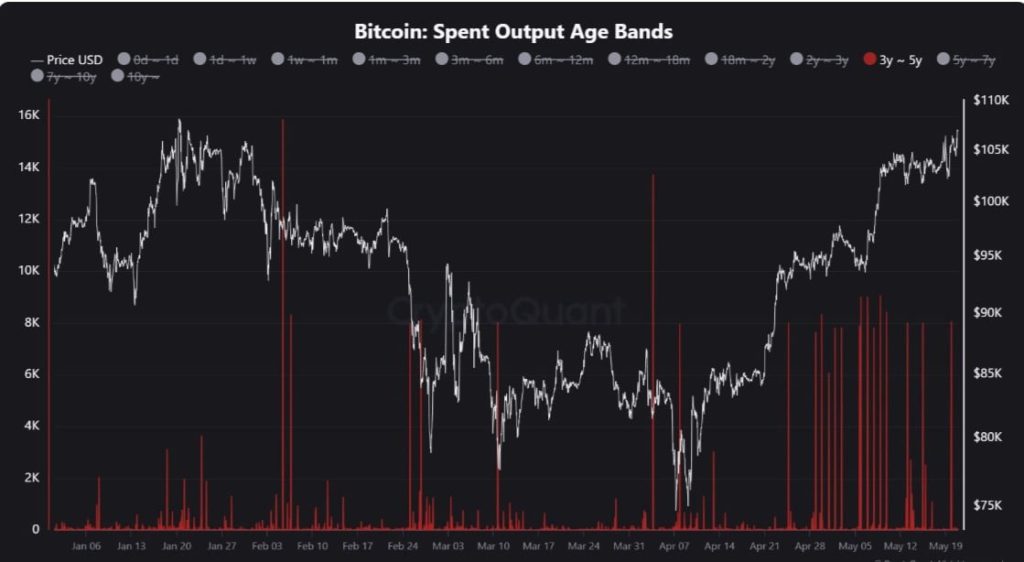

According to CryptQuant analyst Maartunn, a total of 8,511 BTC from the 3-5 years age group has been moved within the network over the last day. This is the 22nd time this year that more than 5,000 BTC from this group has been reactivated.

This increase in activity suggests that as Bitcoin (BTC) prices rise, old coins are being redistributed, possibly reaching new market participants. On the same day, 90-day Coin Days Destroyed (CDD) saw a spike from 5 million to 29 million, signaling new demand. In addition, the average dormancy dropped from 42 to 33, indicating that new buyers are actively entering the market.

Also Read: PEPE Coin (PEPE) Shows Bullish Signal, What’s the Secret?

Bitcoin Transfer by Grayscale

The latest Bitcoin (BTC) move appears to have originated from Grayscale, which transferred BTC to a newly created address. While it remains unclear whether this volume reflects an actual change in ownership or just an internal adjustment, historical Grayscale ETF flows have been negative at times, and these movements may be related to upcoming or recent outflows.

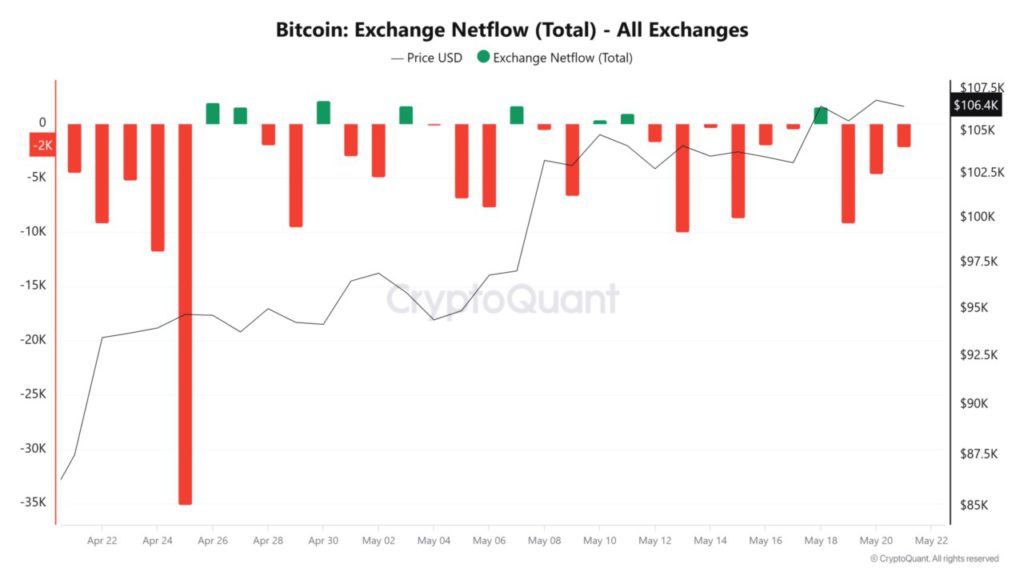

The Exchange’s Netflow data suggests that this transfer is likely an internal reset, meaning the reactivated BTC has not yet been deposited into the exchange. Bitcoin (BTC) has recorded three consecutive days with negative netflow values, a signal that is usually bullish.

Impact on Bitcoin Price

While the movement of old coins can cause concern, these latest transfers are not directly deposited on exchanges. Reactivated Bitcoin (BTC) remains in private wallets, which means it does not negatively affect price action. The market is still dominated by accumulators, reinforcing the bullish view.

However, if Grayscale decides to sell these coins, it could trigger outflows and push Bitcoin (BTC) price down to $104,000. On the other hand, if current conditions hold, Bitcoin (BTC)’s uptrend is likely to continue, potentially surpassing $107,000 and reaching $108,000.

Conclusion

These significant moves by long-term holders of Bitcoin (BTC) provide important insights into current market dynamics. By monitoring indicators such as CDD and Exchange Netflow, investors can gain a better understanding of how changes in ownership may affect the price of Bitcoin (BTC) in the future.

Also Read: Will Pi Token (PI) Surge Beyond $0.9? Check out the Analysis!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin: 8511 BTC moved on-chain, what LTHs are trying to show us. Accessed on May 22, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.