PEPE Coin Set to Soar? Fresh Analysis Sparks New Hope for Investors

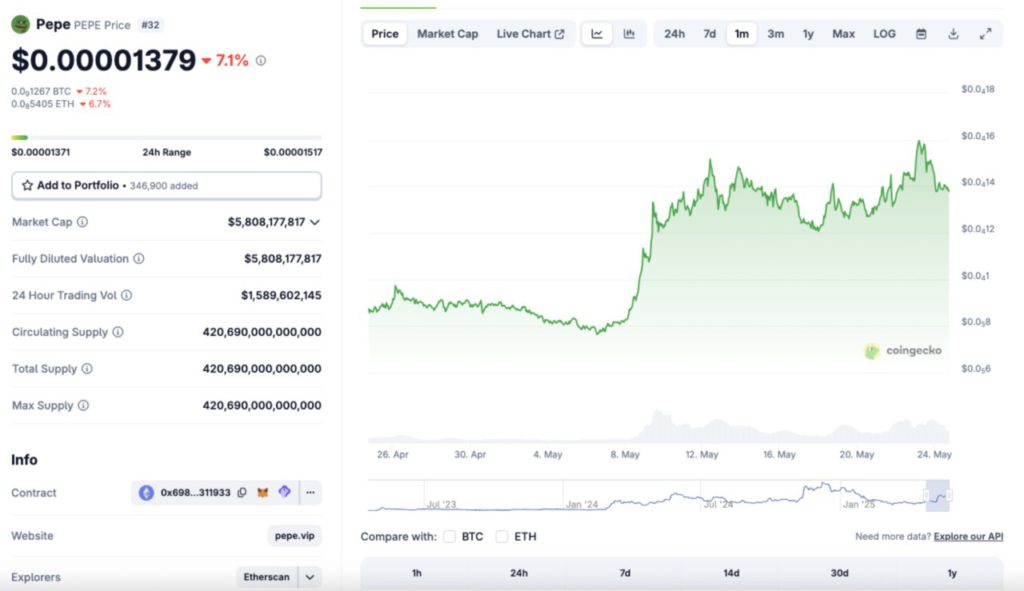

Jakarta, Pintu News – According to Coingape, the price of Pepe coin (PEPE) fell by 7% on Saturday, May 24, 2025, to $0.000012. This drop caused the market capitalization of the second-largest memecoin on the Ethereum network to lose around $620 million.

Despite the sudden drop, on-chain data shows that the majority of long-term holders are holding on, with over 114,000 wallet addresses still holding PEPE despite the loss.

PEPE Coin Plummets After Trump Dinner Triggers Memecoin Market Volatility

The price of PEPE Coin (PEPE) experienced massive selling pressure as the general memecoin market struggled to keep up with the crypto rally that occurred on Friday. This decline came after a controversial dinner event involving the President of the United States, Donald Trump, on the same day.

Read also: Trump’s New EU Tariffs Just Dropped — These 3 American Cryptos Could Skyrocket Next!

The event was met with sudden protests that sparked volatility in the top-tierecoin market.

The price of the Official Trump token fell 4.3% in the 24 hours following the event, and the sell-off spread to other majorecoins.

PEPE was dragged along for the ride, registering sharp declines of 7.2% against BTC and 6.7% against ETH, suggesting that the price drops were not part of profit-taking in the crypto market in general, but rather a direct response to the increased political risk perceived byecoin investors.

As of May 24, 2025, the price of PEPE is trading in the range of $0.00001379, with a daily price range between $0.00001371 to $0.00001517. With a 7.2% drop in the last 24 hours, PEPE was listed as the worst-performing asset among the top 40 cryptos on Saturday.

Why has the price of Pepe Coin fallen?

Based on data from CoinGecko, PEPE has actually still recorded gains of 10.5% in the past 7 days, 7.1% in 14 days, and an impressive surge of 59% in the past month. This means that the sell-off in the last 24 hours was most likely triggered by a new market catalyst.

The timing coincided with the fallout from Donald Trump’s dinner on Friday, which sparked a new debate over the legality and ethics of crypto projects affiliated with political figures.

It was reported that US lawmakers rejected the Genius Act bill, a bill aimed at regulating USD-backed stablecoins. This rejection was triggered by Trump’s alleged direct financial interest in the crypto sector, following the launch of a USD1 stablecoin by the Trump-backed WLFI project.

The controversy comes shortly after Argentina’s President Javier Milei was criticized for his involvement with the Solana-based Libraecoin, which even sparked impeachment threats earlier this year.

A market capitalization loss of $620 million in just one day suggests that this negative context likely led large holders to choose to reduce risk from top-tier memecoins like PEPE in the past 24 hours.

114,000 Address Pepe Coin Still Keeps in Loss Position, a Sign of Investor Resilience

Despite the sharp 7.2% drop in PEPE price, on-chain data shows that most PEPE holders remain reluctant to sell their assets.

Read also: Dogecoin Holds Steady at $0.2254 — Is the Road to $1 Finally in Sight?

According to IntoTheBlock’s Global In/Out of the Money indicator, 113,590 addresses-about 25.71% of all current holders-are underwater.

This means that more than a quarter of the PEPE community still chooses to hold their coins despite the unrealized losses.

Historically, when a large number of investors are reluctant to exit during a sharp market decline, this is often considered a positive signal by strategic traders, for two main reasons:

Firstly, it shows that a large group of active investors see PEPE not as a short-term speculativeecoin, but as a long-term asset. Secondly, it reflects the widespread confidence of holders in the early recovery potential of PEPE prices.

More importantly, with the price of PEPE currently trading near the weekly support level of $0.000012, and the majority of holders still recording weekly gains of 7%, the likelihood of a capitulation is low.

If the selling pressure triggered by the Trump dinner controversy subsides, these two key factors could encourage an influx of new investors looking to buy PEPE at low prices.

Pepe Coin Price Prediction: Elliott Wave Pattern Suggests Recovery Toward $0.000016 As Resilient Holders Hold On

The current price movement of PEPE shows the potential for a fifth wave (Wave 5) breakout rally towards $0.00001632, which could even continue to $0.00001845, based on the Elliott Wave structure formed on the daily chart.

Wave (Wave 4) was previously seen forming a bottom above an important support level around $0.000010, and the price is now thought to have entered the initial phase of Wave (Wave 5) formation.

With prices now stabilizing around $0.00001395, the market is showing a pattern of moving within a low volatility zone – a condition that is often the start of a bullish impulse.

Trading volumes have also started to increase, supporting the scenario of an uptrend continuation. Although the RSI divergence indicator (5,14) is still negative at -6.90-which generally signals caution-in some cases, such conditions actually precede breakouts when prices fail to break lower.

Read also: These 4 Memecoins Could Outrun Bitcoin’s Bull Run – Don’t Miss the Next Crypto Explosion!

Data from IntoTheBlock reveals that a total of 66,590 wallet addresses have accumulated approximately 58.5 trillion PEPE in the $0.00011 price range, forming a strong support base of large investors just below the current price.

More importantly, a total of 113,590 addresses (25.71% of all PEPE holders) are still in a loss position, but have shown no signs of exiting the market-indicating strong long-term confidence in PEPE.

PEPE could also potentially get a boost from its historical correlation with Ethereum. If the price of Ethereum continues to rise and breaks $2,600, PEPE could potentially bounce quickly towards $0.000016 in the next few days.

From a technical perspective, as long as PEPE is able to stay above the $0.000013 support level and successfully break through the recent local resistance, the recovery target towards $0.00001632 (Fibonacci extension 1.087) is still considered realistic.

However, if it fails to maintain support at $0.000013, this bullish Elliott Wave pattern could be invalidated, and PEPE prices risk dropping back down to the $0.000010 area.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Pepe Price Analysis: Elliott Wave Flashes Rebound Signals as 114,000 Pepe Holders Resist $620M Outflows. Accessed on May 26, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.