Ethereum Holds Steady at $2,500 — Is a Major Breakout Just Around the Corner?

Jakarta, Pintu News – Ethereum (ETH) is showing signs of a major bullish breakout as macroeconomic trends and on-chain data align with historical market patterns.

Trading at $2,593.20 (26/5), Ethereum has risen by 8.16% in the past week.

Ethereum also managed to maintain a support level above $2,580. This bullish movement has attracted the attention of investors and traders to pay more attention to Ethereum’s price movements.

Then, how is Ethereum’s current price movement?

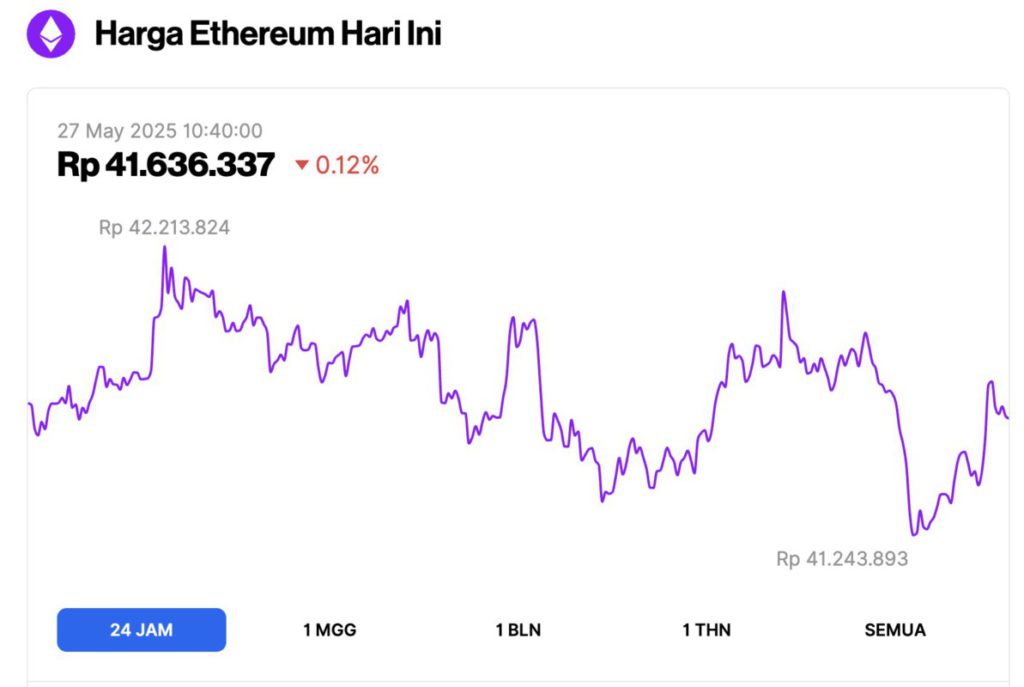

Ethereum Price Drops 0.12% in 24 Hours

As of May 27, 2025, Ethereum (ETH) was trading at approximately $2,552, or around IDR 41,636,337, after a minor 0.12% correction over the past 24 hours. Within that time frame, ETH reached a high of IDR 42,213,824 and a low of IDR 41,243,893.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $308.21 billion, with daily trading volume rising 7% to $15.05 billion in the last 24 hours.

Will the US Dollar Index (DXY) Drive ETH Price?

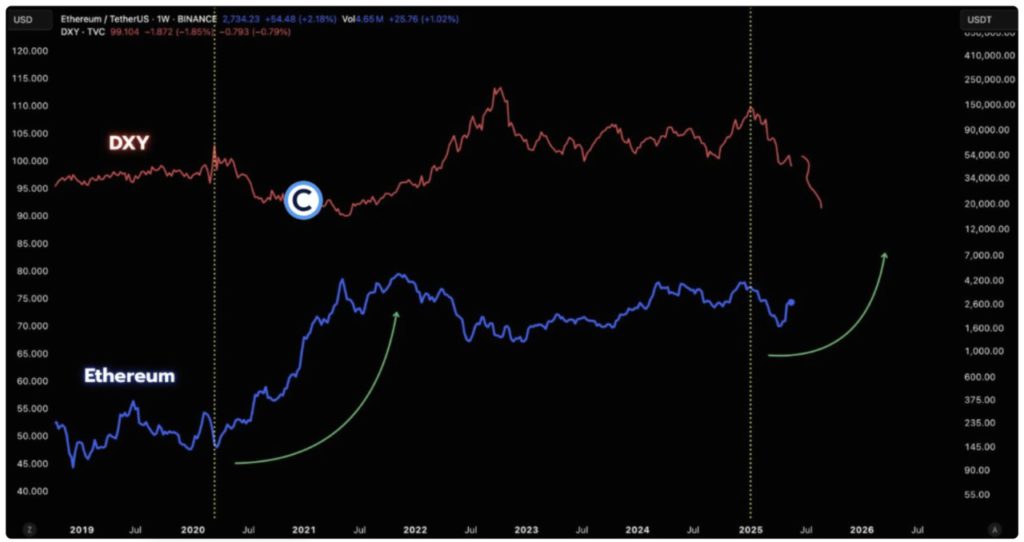

According to a post from Crypto Uncle analyst who recently shared a compelling chart-based analysis, Ethereum has the potential to experience significant upside. He highlighted that the inverse correlation between ETH and DXY still holds strong.

He also stated that we could witness parabolic movements in 2025, just as we did in 2020 and 2022.

In the comparison chart he shared, DXY peaks (red line) have historically often coincided with Ethereum lows (blue line).

With the DXY peaking at the end of 2023 and now showing sharp weakness, ETH appears to be moving up from a “higher low” – a common bullish accumulation signal.

Ethereum (ETH) Price Analysis

Based on the ETH price chart in the 4-hour timeframe (5/26), the altcoin looks to be going through a consolidation phase, with the main resistance level at $2,735.89 and psychological resistance at $3,000.

Read also: 3 Crypto that Could Hit a New All-Time High in June 2025

This bullish movement could potentially be reinforced by high daily volume, inflows from ETFs, as well as a push from large institutions such as BlackRock.

Conversely, in the event of a decline, ETH is likely to find support at $2,479.50, forming a higher low pattern which is a bullish technical signal.

While history doesn’t always repeat itself in exactly the same way, a similar pattern seems to be forming.

With Ethereum’s position in the current macro cycle, coupled with the dollar’s weakness and growing institutional interest, there is a high probability that the $3,000 level will be successfully broken in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Ethereum Price Eyes Breakout to $3k, Amid Dollar Weakness? Accessed on May 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.