Bitcoin Surges to $109,000, Financial Markets Excited After Trump’s Decision!

Jakarta, Pintu News – Bitcoin (BTC) has risen 1.4% in the past day, reaching an exchange rate of $109,637 in early Asian hours on May 26.

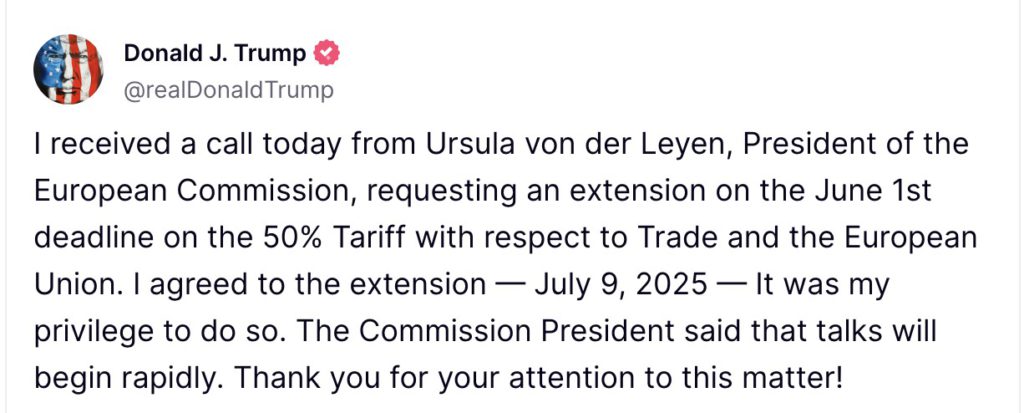

The increase comes after US President Donald Trump decided to delay the implementation of 50% tariffs on EU goods until July 9, 2025, giving both sides a chance to resume trade talks. This decision has lifted market sentiment that was previously plagued by uncertainty.

Check out the full information here!

Bitcoin Market Dynamics

In a volatile week, Bitcoin (BTC) briefly reached a new peak of $111,814 on May 22, before dropping to around $107,500. Despite the decline, the digital currency still recorded a 15% gain in the last 30 days. Activity in the Bitcoin derivatives market has also increased, signaling restored confidence among traders.

Data from Coinglass shows that open interest in the last 24 hours increased by 2.59% to $76.66 billion, while trading volume rose by 10.85% to $89.91 billion. An increase in volume and open interest usually indicates that traders are building positions, often anticipating volatility or upward price movement.

Read also: Will Ethereum (ETH) Experience Selling Pressure at the $2,800 Level?

Tariff Policy and Its Impact on Global Markets

Trump’s announcement of the tariff delay came after a brief period of tension during which he threatened to implement 50% tariffs on May 23 if negotiations failed. The decision to delay the tariffs provided temporary relief to unsettled global markets. US stock markets responded positively with gains in index futures; S&P 500 futures rose 0.9%, Dow futures increased 0.8%, and Nasdaq-100 futures rose 1%.

On the other hand, gold prices fell 0.3% to $3,346.59 per ounce, indicating a shift from safe-haven assets to riskier assets such as Bitcoin (BTC). This change in risk appetite suggests that investors are starting to look for investment alternatives that may provide higher returns amid more stable market conditions.

Also read: Pakistan Launches Digital Initiative with 2,000 MW for Bitcoin Mining!

Future Market Outlook

Despite the tariff delay, Trump’s trade policy still leaves uncertainty in the international market.

Market participants, both in the crypto sector and traditional markets, will continue to monitor developments in the negotiations between the US and the EU. Both sides are expected to reach an agreement that avoids the imposition of tariffs that could hurt both economies.

Meanwhile, traders of Bitcoin (BTC) and other cryptocurrencies may see this period as an opportunity to adjust their investment strategies. With the new deadline set for July 9, 2025, the market may experience a period of high volatility, which could be an opportunity for careful traders.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Bitcoin Reclaims $109k as Trump Extends EU Tariffs Deadline to Allow for Talks. Accessed on May 27, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.