Ethereum Smart Contracts Soar to 2021 Levels — Is a Massive Rally to $10,000 Next?

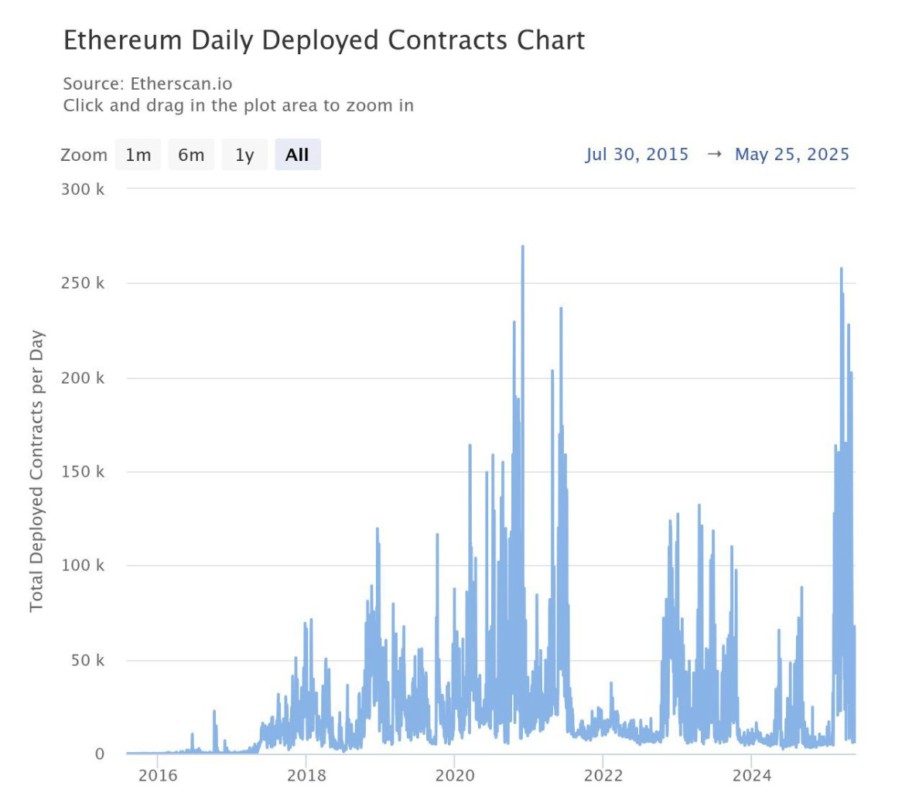

Jakarta, Pintu News – In 2025, Ethereum (ETH) experienced a significant spike in smart contract deployment activity. The number of contracts deployed daily has reached levels not seen since 2021.

This marks a strong resurgence in the Ethereum ecosystem, one of the world’s leading blockchain platforms. This increase also reinforces optimistic predictions for the ETH price, raising the question: Can Ethereum reach another record high like in 2021?

What Could Push Ethereum to $10,000?

Based on data from Etherscan, the number of smart contracts deployed daily on the Ethereum network has jumped sharply since the beginning of the year.

Read also: Ethereum Holds Steady at $2,500 — Is a Major Breakout Just Around the Corner?

The chart shows that in the first quarter of 2025, daily adoption reached its highest level since 2021 – the year ETH set its record high above $4,800.

This surge was largely fueled by expectations of an improved Pectra network. In addition, the increasing number of smart contracts reflects the growing usability of Ethereum, which in turn drives demand for ETH.

However, the price of ETH has not fully reflected this positive trend. After dropping from $3,700 to $1,400, the ETH price is slowly recovering and is at $2,500 at the time of writing.

Although the price lags behind the growth of smart contract activity, a crypto investor named Ted remains optimistic. He believes ETH could surpass its record high in 2021.

“Ethereum’s daily smart contract count is now on par with the 2021 bull run. Developer activity is increasing, which is a strong signal that on-chain momentum is returning. Price is following fundamentals. ETH to $10,000 this cycle,” Ted predicts.

Number of ETH in Accumulation Wallet Reaches Record High

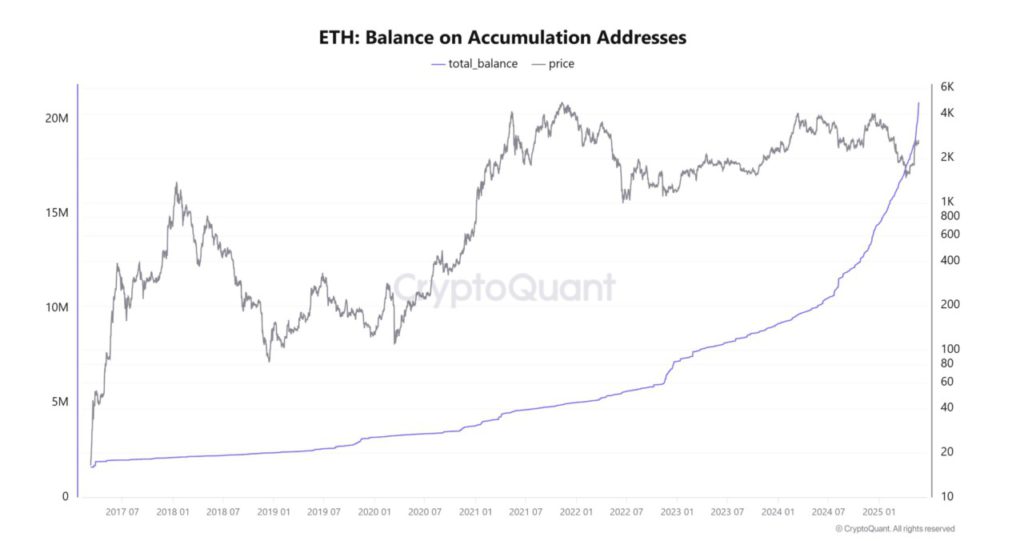

At the same time, data from CryptoQuant added to the optimistic sentiment. The amount of ETH flowing into accumulated wallets has just hit an all-time record high.

This type of wallet is usually owned by large investors, otherwise known as “whales.” This surge in inflows indicates a strong long-term belief in ETH’s potential.

As a result, the ETH balance in accumulated wallets reached a new high-nearly 21 million ETH, or about 17.5% of the total circulating supply. This upward trend throughout 2025 shows a very high demand for ETH.

Record highs in smart contract deployments and ETH accumulation reinforce the view that Ethereum remains attractive to developers and investors, despite crypto market volatility.

Read also: Shiba Inu Investors Stay Hopeful as Bearish June Forecast Looms for SHIB

Previous Price Performance Hints at Potential Short-Term Rise to $4,000

A number of analysts also gave optimistic predictions for ETH prices based on historical chart patterns.

Analyst Cas Abbe uses the 2-week Gaussian Channel indicator to analyze Ethereum’s price trend. By comparing past price movements, Abbe estimates that ETH could reach $4,000 by the third quarter of 2025.

“ETH is trying to return to the 2-weekly Gaussian Channel. Since 2020, ETH has only managed to break back through this channel twice. Both were followed by sharp price spikes. In 2020, ETH rose from $300 to $4,000. In 2024, it went from $2,400 to $4,100. If ETH breaks this level again, I believe it will reach $4,000 in Q3 2025,” Abbe said.

Another important factor is the performance of ETH compared to Bitcoin (BTC) during 2025. Data from CoinGlass shows that ETH outperformed BTC in the second quarter. Currently, ETH’s return in Q2 stands at +40%, while BTC’s is only +33%.

CoinGlass’ historical data also shows that ETH typically outperforms BTC in the second quarter. The average return for ETH in Q2 was 64.22%, compared to 27.30% for BTC.

However, the latest on-chain analysis from BeInCrypto shows an increase in caution among investors. Many investors began to realize profits after ETH recovered more than 80% since the beginning of last month.

This selling pressure could be an obstacle in ETH’s attempt to reach higher price levels.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Smart Contract Deployments Surge. Accessed on May 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.