Satoshi Nakamoto’s wealth reaches $120 billion, can he surpass Elon Musk?

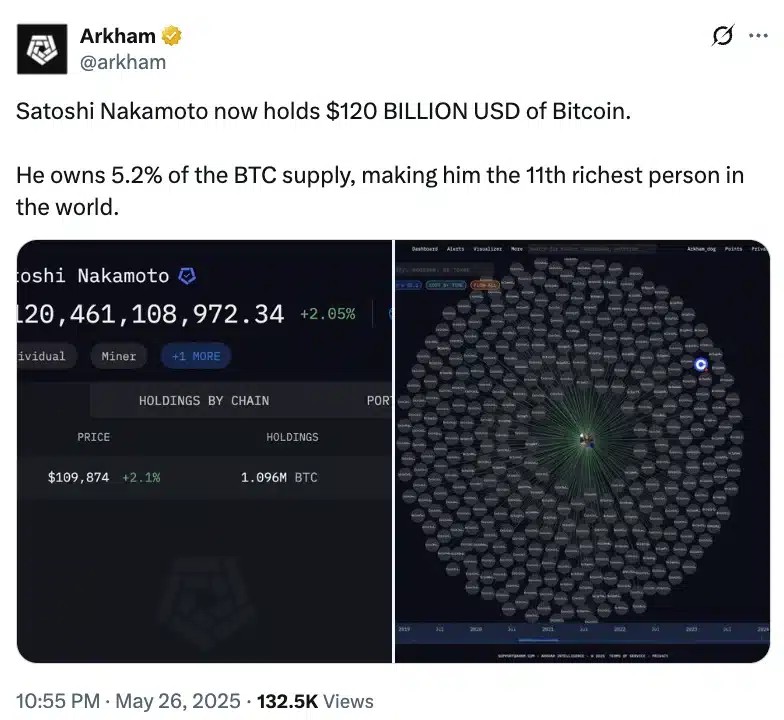

Jakarta, Pintu News – Satoshi Nakamoto, the mysterious creator of Bitcoin (BTC), is now ranked as the 11th richest person in the world with an estimated wealth of $120 billion. This comes after Bitcoin recorded an unprecedented price increase, with a new high near $112,000 before correcting and trading at $109,331.

Previous concerns regarding a spot Bitcoin ETF in the US that could surpass Nakamoto’s holdings have now subsided. According to blockchain analytics firm Arkham Intelligence, a group of dormant wallets, believed to be under Nakamoto’s control, have not been touched since he disappeared in 2011. These wallets are known to contain around 5.2% of the total Bitcoin supply, confirming Nakamoto’s ongoing influence on the crypto market despite his disappearance.

Community Reaction and Identity Speculation

News of Nakamoto’s growing wealth has sparked various reactions in the crypto community. One X user described Nakamoto as “the world’s most silent billionaire”. Meanwhile, another user speculated that Nakamoto may have died a few years ago, which means his Bitcoin (BTC) may be gone.

Speculation about Nakamoto’s true identity continues, with names like Hal Finney and Nick Szabo often mentioned. However, the mystery remains unsolved. Clearly, concerns about the impact of the Bitcoins he holds if they are one day transferred or liquidated are a frequent topic of discussion.

Also Read: Whale’s Big Sale of SAND, Will Prices Plummet as Early as June 2025?

Bitcoin Value Growth and Its Impact

Bitcoin’s rise in market value has pushed Nakamoto’s wealth beyond Bill Gates. However, in order to surpass Elon Musk who has an estimated wealth of $395.6 billion, the value of Bitcoin would need to reach around $360,000. Analysts believe that this is a stunning figure, but not impossible given the volatility of the crypto market.

On the other hand, while Bitcoin’s value is increasing, its on-chain activity is at a historical low. This indicates a fundamental shift in the way Bitcoin is perceived and used. Users are increasingly turning to centralized exchanges and more cost-efficient blockchains for everyday transactions.

Bitcoin: From Peer-to-Peer Cash System to Long-Term Store of Value

The shift in the way Bitcoin is viewed from a peer-to-peer cash system to a long-term store of value is increasingly evident. Bitcoin is increasingly seen and treated as a long-term store of value, similar to digital gold.

This evolution changed Bitcoin’s true identity, making it less about day-to-day transactions and more about long-term investments. This new perception may explain why Bitcoin’s on-chain activity is declining despite its rising price. Bitcoin seems to be losing its original identity as a cash system, but gaining a new identity as a form of digital gold.

Conclusion

With a growing fortune thanks to the rising price of Bitcoin, Satoshi Nakamoto is now one of the most influential figures in the financial world. While his identity remains a mystery, his impact on the crypto market and the digital economy as a whole cannot be ignored. The question of what will happen to his Bitcoin if it someday moves remains a hot topic among observers and investors.

Also Read: BNB Nearing $700 Again – Time to Buy or Wait?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Satoshi Nakamoto’s Bitcoin wealth hits $120B, but can he overtake Elon Musk now?. Accessed on May 28, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.