TRON Surge: Market Bubble or Investment Opportunity?

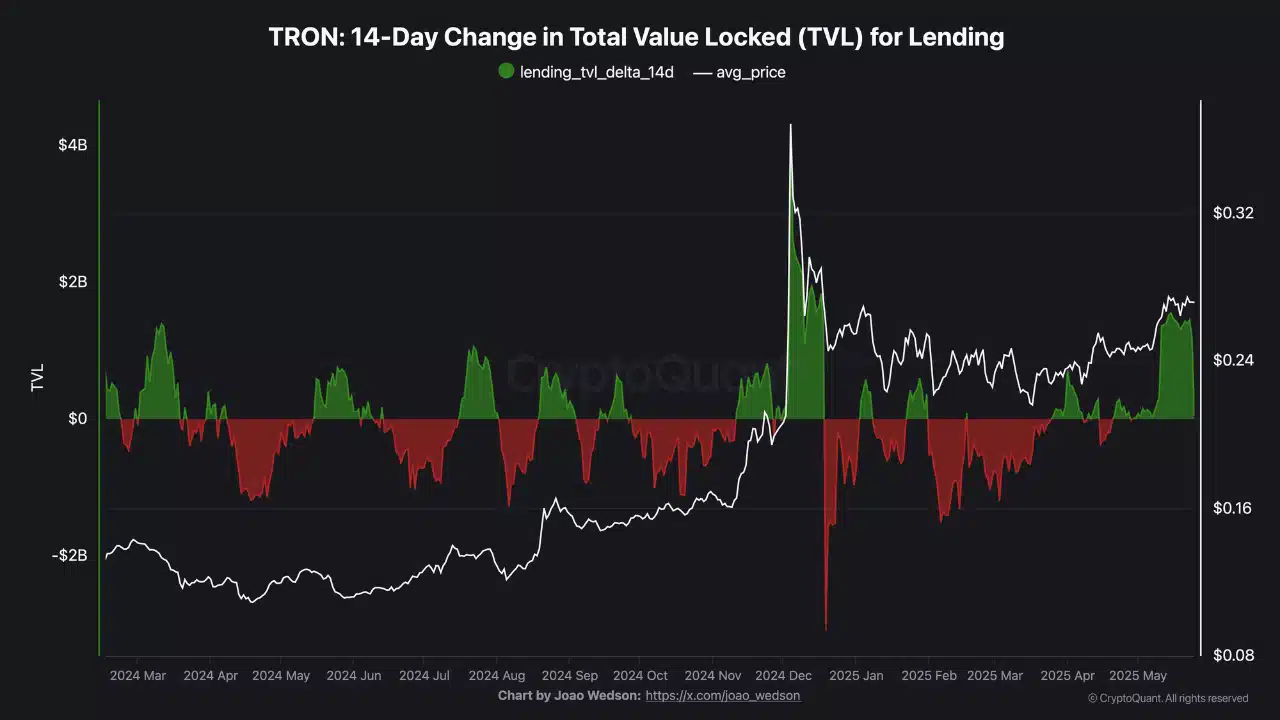

Jakarta, Pintu News – The cryptocurrency market is always full of interesting dynamics, and the recent rise of TRON (TRX) is no exception. Although TRON’s Total Value Locked (TVL) is showing significant growth, activity from large holders or “whales” does not seem to be keeping pace. This raises important questions about the sustainability of this rally.

Whale’s Absence: A Warning Signal?

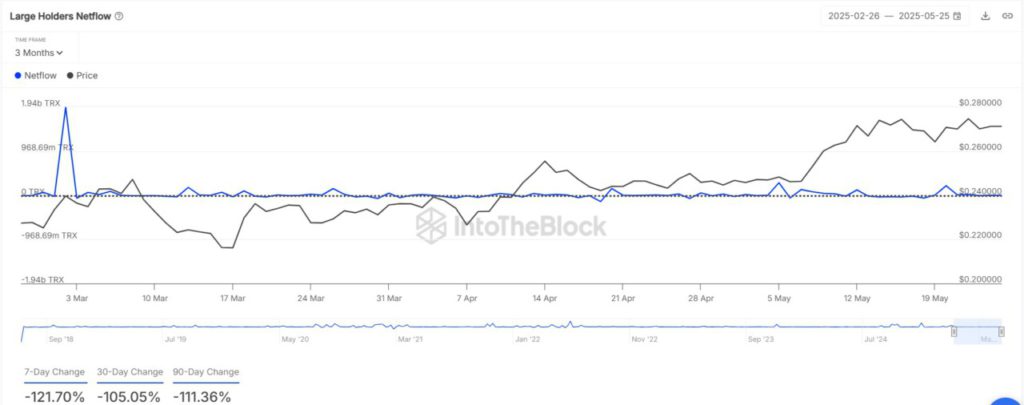

Although TRON’s TVL shows an increase, the whale net flow data paints a different picture. In the past 90 days, whale net flows decreased by 111.36%, and in the past 7 days, the decline was even sharper, reaching 121.7%.

This shows that despite the increase in value in the TRON ecosystem, large holders do not seem to be very active in capitalizing on this situation. This absence of whale activity could be because they think that the current market is too volatile or perhaps they are waiting for more stable conditions. This lack of participation from large investors could be an indicator that they lack confidence in the sustainability of this positive trend.

Also Read: Whale’s Big Sale of SAND, Will Prices Plummet as Early as June 2025?

TRX Trader’s Over-optimism?

TRON’s Long/Short ratio on Binance currently stands at 1.86, with 65.07% of accounts going long. This indicates a strong bullish sentiment among traders, which may be triggered by the increase in TVL and positive price momentum. However, this overconfidence can be a double-edged sword.

Overly optimistic traders may ignore warning signs that may emerge from the market. If too many traders go long without considering the potential downside, this could trigger a price correction if the market suddenly reverses. This overconfidence may result in sharp and unexpected adjustments.

Transaction Activity and Liquidation Risk

The latest transaction data shows a surge in activity with small volumes, particularly transactions in the $0-$1 range, which increased by 9.73%. This shows that there is increased participation from retail investors, who may not have as much clout as institutional investors, but they are still re-energizing the market.

On May 26, liquidation data showed moderate volumes, with short liquidations of $10,000 and longs of $6,790. While this indicates low volatility at the moment, the imbalance still leaning bullish could be an indicator of risk building. If this trend continues, the market may experience a correction.

Conclusion: Is the TRON Rally Sustainable?

Although increased TVL and bullish positioning from traders have supported TRON’s recent price gains, the underlying metrics suggest that the current market structure may not be as strong as it appears at first glance. Investors should be wary of a potential correction if factors such as whale absence and trader over-optimism do not change.

Also Read: BNB Nearing $700 Again – Time to Buy or Wait?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Tron Investors Alert: Why TRX’s Surge May Not Be What It Seems. Accessed on May 28, 2025

- Featured Image: AInvest

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.