4 Bitcoin Patterns Emerge, Can the Bullish Era Continue in June 2025?

Jakarta, Pintu News – Bitcoin (BTC) has recently shown a sharp decline, from a local peak of $110,000 to $103,000, sparking speculation about a potential further drop. Crypto market analysts have been observing indicators that suggest the market may have overheated. With four consecutive sell signals appearing, many are wondering if it is the right time to sell.

Recent Market Analysis

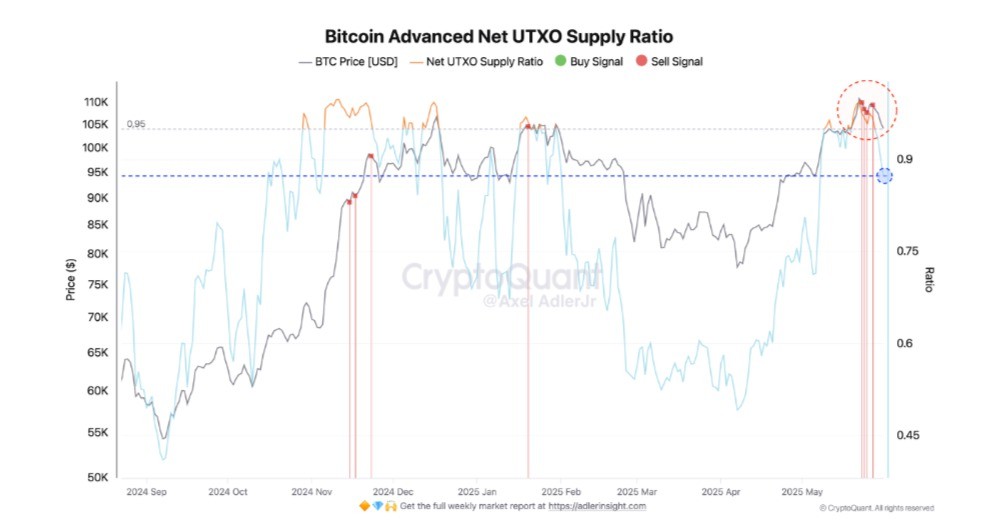

This week, Bitcoin (BTC) experienced a significant drop, from $110,000 to $103,000, marking a 3.88% decline in the last seven days. Axel Adler of CryptoQuant suggested that Bitcoin (BTC) could fall to $92,000 due to overheated market conditions. Bitcoin (BTC)’s Net UTXO Supply Ratio has shown four consecutive sell signals, an indication that the market may be entering a downward phase.

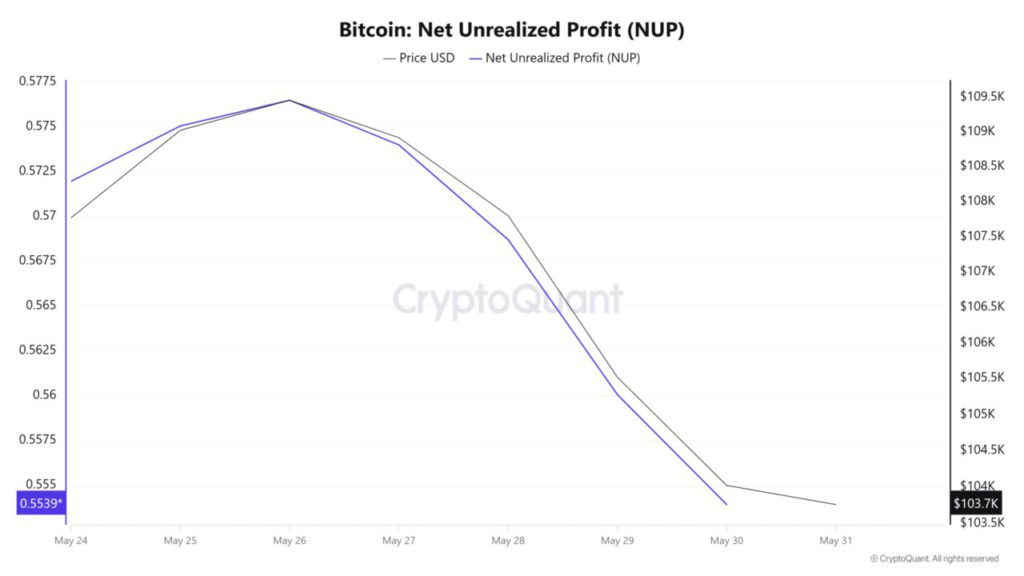

According to Adler, the drop in UTXO Ratio and increase in sell signals suggest that many coins have moved into unrealized gains, reducing the incentive to hold (HODL) and increasing the potential for profit-taking. On-chain data supports this thesis, with Bitcoin’s (BTC) Net Unrealized Gains dropping to 0.553, indicating that profit margins for current holders are lower.

Also Read: MicroStrategy Up 2,930%! Michael Saylor’s Crazy Strategy in Crypto Turns out to be Fruitful

Short-term Outlook for Bitcoin

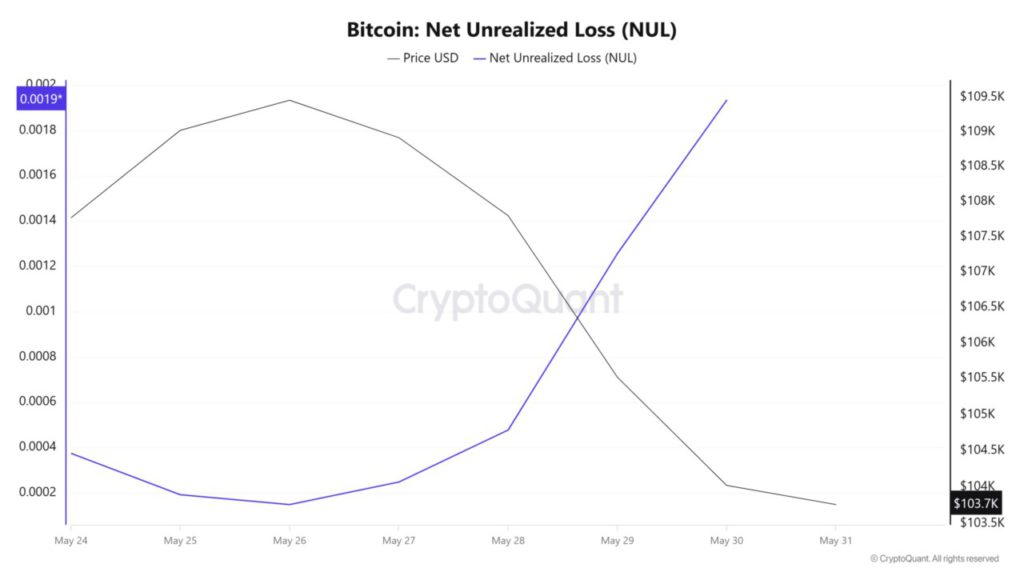

Investors who bought Bitcoin (BTC) between $104,000 and $112,000 are currently in a losing position, which increases the risk of market capitulation. Panic selling could occur if these conditions continue, pushing the price of Bitcoin (BTC) even lower. Adler predicts that the market may need a serious reset to stabilize again.

The market reset in question will have an impact on the future price movement of Bitcoin (BTC). Current conditions may cause Bitcoin (BTC) to trade sideways between $95,000 and $105,000 until the Net UTXO Supply Ratio stabilizes around 0.85 to 0.9. Alternatively, a sharper pullback to $92,000 might occur first, easing the currently overheated market structure.

Sales Theory and Price Support

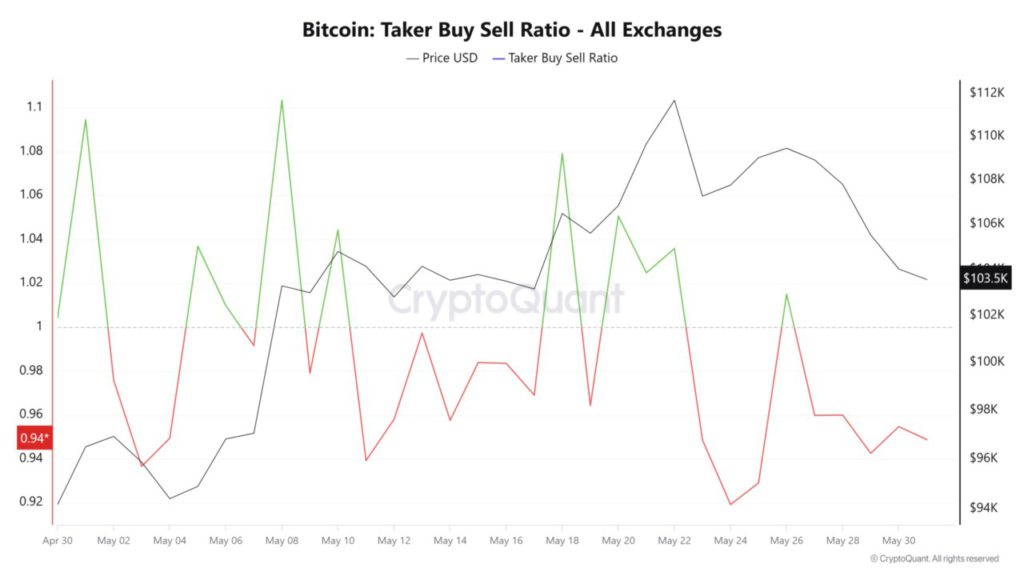

In addition to weak profit metrics, the Taker Buy-Sell Ratio has remained negative for four consecutive days, signaling high selling activity in the market. If this selling pressure continues, Bitcoin (BTC) price could drop to $101,488.

If this support does not hold, a drop below $100,000 becomes inevitable, with the next support around $98,890. This situation suggests that the market may not be ready for a sustained recovery. Investors and traders should pay attention to these indicators to make informed decisions in managing their portfolios.

Conclusion

With various indicators pointing to a potential further decline, the Bitcoin (BTC) market is currently under close scrutiny. This analysis shows the importance of understanding market signals and being prepared for possible significant price changes. Investors are expected to remain vigilant and make decisions based on current data and in-depth analysis.

Also Read: Bitcoin in danger of weakening again? Bollinger Bands indicator gives this sign!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. 4 Sell Signals Flash on Bitcoin, Are BTC Bulls Finally Running Out of Gas?. Accessed on June 2, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.