Dogecoin Surges Today (June 3) — But a Major Whale Just Started Sellin, is a Crash Coming?

Jakarta, Pintu News – The Dogecoin (DOGE) price has fallen by 26% from its May high of $0.1900.

Technical analysis suggests that this decline could continue due to the formation of a double top pattern. In addition, the action of whales selling their tokens also increases the likelihood of this downward trend.

So, how is the Dogecoin price moving today?

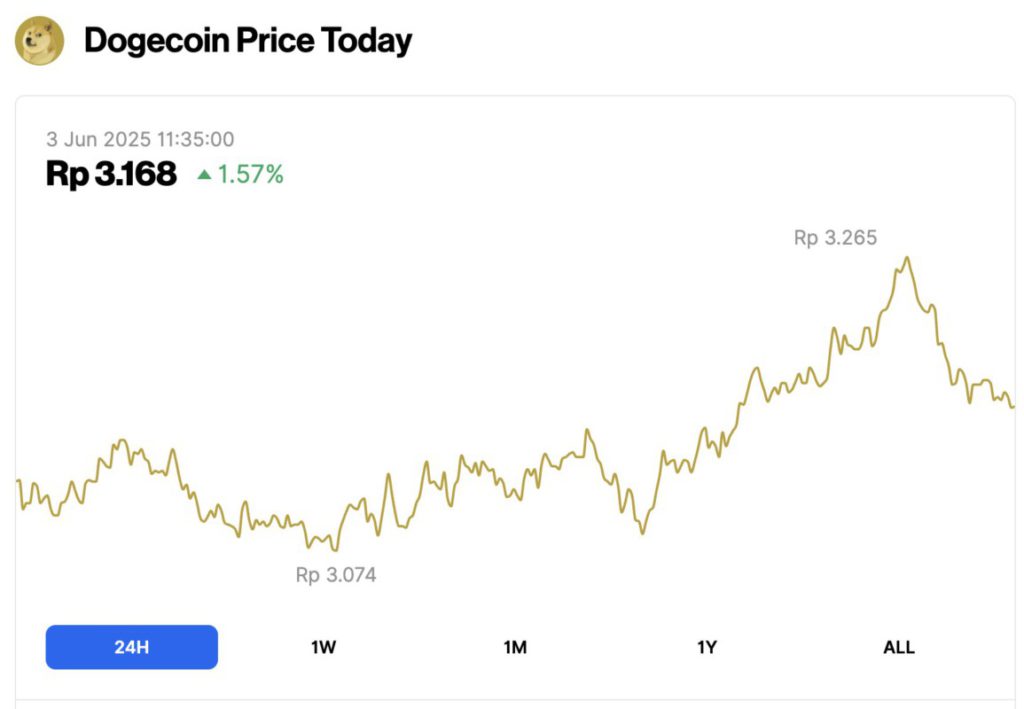

Dogecoin Price Rises 1.57% in 24 hours

On June 3, 2025, Dogecoin saw a modest 1.57% gain over the past 24 hours, trading at $0.1950, or around IDR 3,168. During the day, DOGE fluctuated between a low of IDR 3,074 and a high of IDR 3,265.

At the time of writing, Dogecoin’s market cap stands at around $29.12 billion, with trading volume rising 22% to $1.15 billion within 24 hours.

Read also: Bitcoin Holds Strong at $105K — Is a Major Reversal Just Around the Corner?

Dogecoin Price Analysis Shows Double Top Pattern

Reporting from Coingape (2/6/25), technically, the price of DOGE still has the potential to fall further this month. Currently, a double top pattern has formed at the level of $0.2528, with a neckline at $0.2113.

A double top pattern is a common bearish signal, signaling that bulls (buyers) are reluctant to buy above that level.

Dogecoin price has plummeted below the $0.2113 neckline, which was also the lowest level on May 17. Additionally, DOGE is also losing support from its 50-day and 100-day exponential moving averages (EMAs).

DOGE also formed a small bearish flag pattern, which could be a sign of further selling in the next few days.

If this pattern is confirmed, the next price target is expected to be around $0.1300 – the April low, or about 31% lower than the current price.

If DOGE falls below $0.1300, the situation could become even riskier as the only major support level after that is at $0.08057 – the lowest level in August last year – which would mean a drop of about 57% from the current price position.

Dogecoin whales start selling holdings, downside risk increases

The risk of a Dogecoin (DOGE) price drop of at least 30% is increasing, with the potential to move towards its lowest level this year. One of the main triggers of this selling pressure is the action of whales who have started to offload their DOGE holdings.

Read also: Top 3 Potential Altcoins of the Week

Data from Santiment shows that DOGE holders with amounts between 100,000 and 1 million coins have reduced their holdings in recent months.

This group now holds around 8.93 billion DOGE, down from 9.2 billion in March. The same is true for holders of between 100 million and 1 billion coins, who now hold only 26 billion DOGE, down from a peak of 26.45 billion last month.

The entry and exit of whales is usually a bearish signal, as the volume of coins they own is very large. Some whales are also considered “smart money investors” – experienced investors who are often more discerning than retail traders.

One of the main reasons for this sell-off is that June is historically a bad period for crypto markets. Data from CoinGlass shows that Bitcoin and Ethereum prices often experience corrections in June, partly because many investors take summer vacations.

In addition, there is another more subtle but impactful factor: Elon Musk, Dogecoin’s biggest promoter, has left his role at the White House as head of the Department of Government Efficiency (DOGE).

However, the bearish scenario due to the double top pattern and whale selling could be invalidated if the DOGE price is able to break and turn the resistance level at $0.2113 into support. This would signal a reversal of the market structure in favor of a bullish movement.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Double Top Pattern Predicts Dogecoin Price May Crash 30%. Accessed on June 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.