Metaplanet Goes All In: Snaps Up 1,088 More Bitcoin as Holdings Soar to $829.7 Million!

Jakarta, Pintu News – Japanese investment firm Metaplanet has made a large purchase of Bitcoin (BTC), with total holdings reaching 8,888 BTC.

This purchase marks a major step for Metaplanet in achieving its acquisition target of 10,000 BTC by 2025. With an aggressive strategy, Metaplanet is now the 10th largest Bitcoin holder among publicly traded companies globally.

These latest purchases were made at an average price of $107,771 per BTC, totaling nearly $117.3 million in investment.

Buying Strategies and Their Impact on Stocks

Metaplanet has announced the purchase of an additional 1,088 BTC increasing their total holdings to 8,888 BTC. These purchases were made at an average cost of $93,354 per BTC, totaling the overall investment to approximately $829.7 million.

Read also: Bitcoin Holds Strong at $105K — Is a Major Reversal Just Around the Corner?

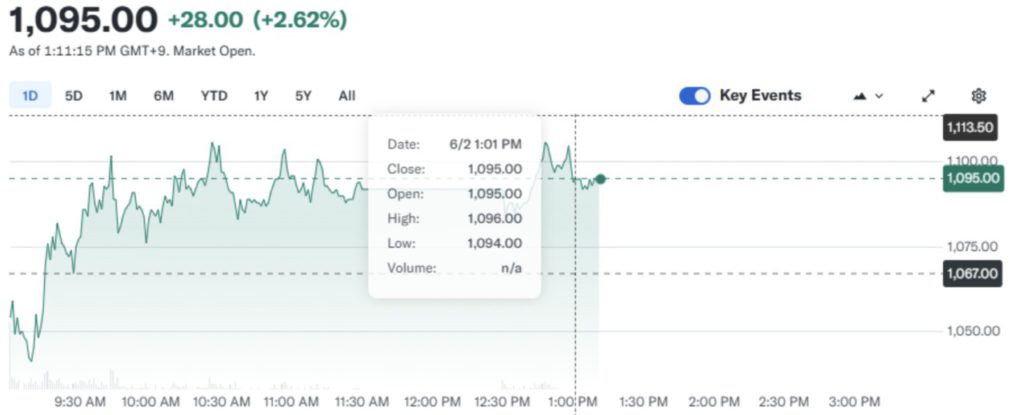

The increase in Metaplanet Inc.’s (3350.T) share price reflected the market’s positive response, with the share price jumping 2.34% to 1,092 yen per share. This increase shows investors’ confidence in Metaplanet’s Bitcoin acquisition strategy.

With the total value of Bitcoin held now reaching around $932.2 million, Metaplanet enjoyed unrealized gains of around $102.5 million. This performance caught the attention of the market and analysts, considering that Metaplanet started their Bitcoin acquisitions well after many other big players.

However, with an aggressive strategy in place, they managed to outperform many companies that have long been involved in Bitcoin investment.

Market Reaction and Future Projections

The market reacted positively to Metaplanet’s aggressive strategy in Bitcoin acquisition. Metaplanet shares have surged over 155% in one month and almost 214% since the beginning of the year. This rise suggests that investors are optimistic about Metaplanet’s long-term prospects in the cryptocurrency ecosystem.

Metaplanet CEO Simon Gerovich revealed that Bitcoin’s volatility is not a problem, but rather a signal that drives their acquisition strategy. In addition, Metaplanet has also announced plans to issue its 16th and 17th series bonds with a total value of $71 million to fund further Bitcoin purchases.

Read also: Top 5 AI Crypto Set to Soar 100x by Mid-2025 – Are You In?

This move demonstrates Metaplanet’s strong commitment to continue expanding their Bitcoin portfolio, while strengthening their position as a leader in cryptocurrency investment in Asia.

Overall, Metaplanet has established themselves as a key player in the cryptocurrency market with their bold and well-planned Bitcoin acquisition strategy. By achieving almost 90% of their acquisition targets, Metaplanet has not only increased the value of their portfolio but also set a new standard in the management of digital assets by public companies.

Going forward, Metaplanet is expected to continue to play an important role in shaping the direction of the global Bitcoin market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Metaplanet: Top 10 Bitcoin Holders. Accessed on June 2, 2025

- CoinGape. MicroStrategy of Japan: Metaplanet Buys Another 1088 Bitcoin, Stock Price Surges. Accessed on June 3, 2025

- Crypto Times. Metaplanet Buys 1088 Bitcoin, Holding Reaches 8888 BTC. Accessed on June 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.