Bitcoin MicroStrategy: Financial Innovation or Speculative Risk?

Jakarta, Pintu News – American technology company MicroStrategy has caught the attention of the financial world with its transformation into an entity focused on Bitcoin (BTC) investments. The move has sparked debate about the sustainability of the strategy and its impact on the cryptocurrency market as a whole.

MicroStrategy’s Transformation: From Tech Company to Largest Bitcoin Holder

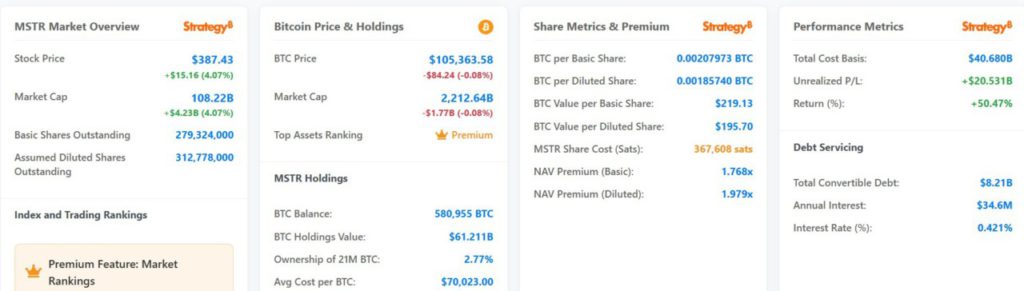

Since 2020, MicroStrategy has changed its business direction by accumulating Bitcoin as the main asset on its balance sheet. The company now holds around 580,955 BTC, with a market value of more than $61 billion or around Rp995 trillion (at an exchange rate of 1 USD = Rp16,293). This move makes MicroStrategy the largest corporate Bitcoin holder in the world.

This strategy is driven by the belief that Bitcoin can serve as a hedge against inflation and declines in the value of fiat currencies. However, this approach also carries significant risks, mainly related to Bitcoin’s price volatility and the potential for large losses in the event of a sharp price drop.

Also Read: Shocking Prediction of Long-Term Analysis by Javon Marks: XRP Price Could Hit $21?

Premium NAV and MicroStrategy Financial Strategy

MicroStrategy shares trade at a significant premium to the company’s net asset value (NAV), which reflects the market value of the Bitcoin it holds. In October 2024, the NAV premium reached approximately 2.7 times the value of Bitcoin held, the highest since February 2021.

Companies capitalize on this premium by issuing new shares and debt instruments to raise funds, which are then used to buy more Bitcoin. This strategy creates a multiplier effect, where each new share issue can increase the amount of Bitcoin per share, although it also increases the risk if the Bitcoin price declines.

Risks and Challenges of a Bitcoin Investment Strategy

While the MicroStrategy strategy has generated significant profits during the bull market, this approach also carries high risks. The reliance on the constantly rising price of Bitcoin makes the company vulnerable to market corrections. If the price of Bitcoin drops drastically, the value of MicroStrategy’s shares may be depressed, and the company may face difficulties in meeting its debt obligations.

In addition, some analysts are concerned that this strategy resembles a Ponzi scheme, where sustainability depends on an influx of new investors and rising asset prices. Critics also highlight that the company does not generate stable cash flows from its core business operations, making it dependent on capital markets for funding.

Impact on Cryptocurrency Market and Corporate Investments

MicroStrategy’s move has influenced the way other companies look at investing in cryptocurrencies. Several publicly traded companies, such as GameStop and Trump Media, have begun to consider or have made investments in Bitcoin as part of their financial strategies.

However, this approach has also sparked discussions about the need for stricter regulation and transparency in financial reporting related to digital assets. Investors and regulators are now more wary of the risks associated with the integration of cryptocurrencies in corporate balance sheets.

Conclusion

MicroStrategy’s aggressive Bitcoin investment strategy reflects innovation in corporate financial management, but also carries significant risks. The success of this approach depends largely on the future performance of the Bitcoin price and the company’s ability to manage debt and market volatility.

Investors and other stakeholders need to carefully consider the risks and potential returns before following MicroStrategy’s lead in integrating cryptocurrencies into their financial strategies.

Also Read: Is Dogecoin (DOGE) Due for a Decline? Descending Triangle Pattern Indicates This

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Here’s What Would Happen if MicroStrategy’s Bitcoin (BTC) Holdings Fell Below NAV. Accessed June 5, 2025.

- Featured Image: Bitcoinist

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.