Bitcoin Falls to $108,000 on June 12, 2025 as Whale Activity Slows Near All-Time Highs

Jakarta, Pintu News – Bitcoin (BTC) is again trading near the $110,000 mark, up nearly 4.5% in the last seven days. The price has held above $105,000 for the past four days, reinforcing the optimistic sentiment in the market.

This steady performance came amid a pause in accumulation by the “whales” and support from strong technical indicators, such as bullish EMA alignment and support from the Ichimoku Cloud.

As BTC tests important resistance levels, traders are closely watching whether this momentum will continue or if it will experience a correction.

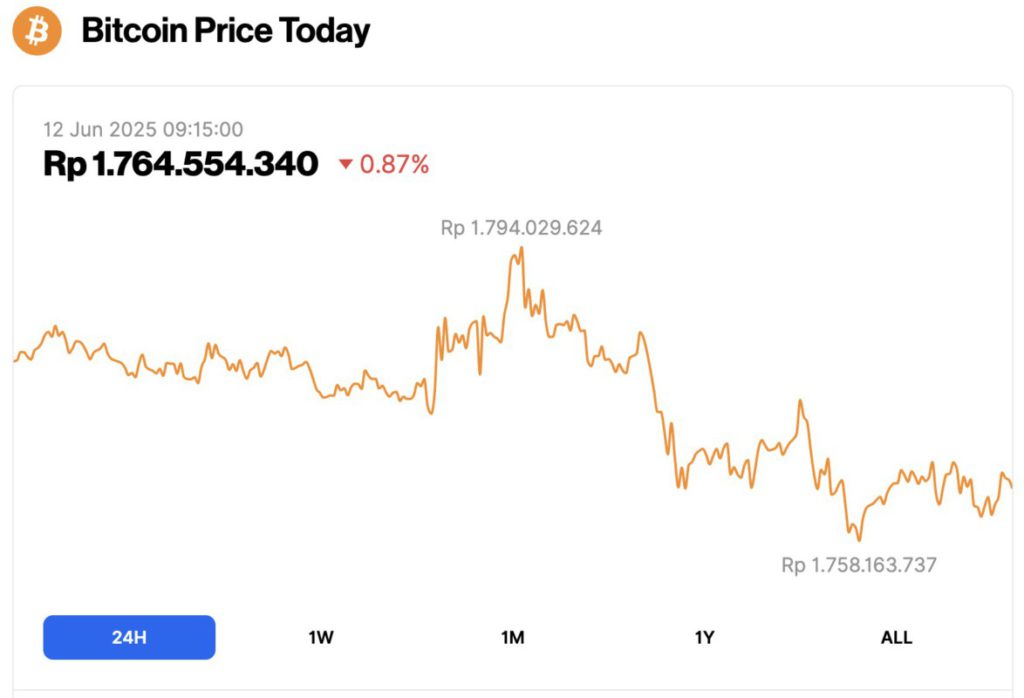

Bitcoin Price Drops 0.87% in 24 Hours

On June 12, 2025, Bitcoin’s price was recorded at $108,616 (around IDR 1.76 billion), slipping 0.87% in the past 24 hours. During the same period, BTC saw a dramatic swing—climbing as high as IDR 1.79 billion before dipping to a low of IDR 1.75 billion—hinting at growing uncertainty as the market loses some steam.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.15 trillion, with trading volume in the last 24 hours down 8% to $49.99 billion.

Read also: 6 Cryptos Ready to Explode in the Next 90 Days!

BTC Accumulation by Whale Experiences a Pause

According to BeInCrypto, between May 28 and June 4, the number of whale-owned Bitcoin wallets – those holding between 1,000 and 10,000 BTC – rose from 2,002 to 2,017.

This brief uptick indicated renewed interest from large holders, often regarded as “smart money”. Since then, however, whale counts have tended to stabilize, hovering in the range of 2,013 to 2,016 over the past week, with the latest count recorded at 2,013.

This lack of continued growth indicates that aggressive accumulation is on pause, at least for now.

Tracking whale activity is important because their movements are often an early signal of major price changes. These large holders can influence market sentiment, create waves of liquidity and signal institutional confidence or caution.

The current stagnation in whale activity likely reflects a “wait-and-see” approach amid uncertain macroeconomic or technical conditions.

While the previous uptick suggests accumulation, the subsequent stagnation suggests that whales may still be hesitant to allocate more capital at current price levels-which could potentially limit near-term price gains, unless a new catalyst emerges.

Bitcoin Remains Above Ichimoku Cloud, but Momentum Begins to Weaken

The Ichimoku Cloud chart for Bitcoin shows that the price movement is still above the green cloud, reflecting a bullish market structure.

Leading Span A (upper limit of the cloud) indicates an uptrend, and the green color of the cloud ahead indicates continued bullish momentum. This cloud also serves as a potential support zone.

The latest breakout of the red cloud confirms that buyers have taken control after the consolidation phase.

The blue line (Tenkan-sen) is still above the red line (Kijun-sen), which is another bullish signal and shows that the short-term momentum is stronger than the medium-term trend.

Read also: Whale Pi Network on the Move Ahead of June 28 Update: Can Pi Coin Surge to $1.2?

However, both lines are starting to flatten out, which could be a sign of a potential pause or mild consolidation.

Meanwhile, the lagging green line (Chikou Span) is above the price and above the clouds, which reinforces the bullish bias. However, its position starting to approach the current price suggests that a drop below the Tenkan-sen could be a warning signal.

BTC Faces Key Support Test

Bitcoin’s EMA structure still shows a strong bullish signal, with the short-term EMA consistently above the long-term EMA and a healthy inter-line spacing.

This pattern confirms the existence of solid upside momentum and suggests that the uptrend is still holding, barring a significant disruption.

As the price of BTC approaches the next resistance level, a breakout above this level could open up further upside opportunities and potentially print new highs in the short term.

However, downside risks remain. If support around $108,000 fails to hold, BTC could enter a correction phase, targeting a gradual decline to lower support levels.

A drop below the $106,700 region will open up the potential for a deeper retracement, with the $103,000 and $100,400 zones being the next targets if the downtrend strengthens.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Whales are Slowing Down Near All-Time High – What’s Next? Accessed on June 12, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.