Will Bitcoin (BTC) Reach $150K? Qubetics 2025 Predictions and Innovations

Jakarta, Pintu News – As the price of Bitcoin (BTC) recently surged past $110,000, analysts and investors are beginning to wonder, will Bitcoin (BTC) reach $150,000? A 40% increase in trading volume and a general rise in crypto benchmarks of around 3% suggests strong momentum.

The Fear & Greed index which was at neutral (55) is now starting to lean towards “greed”, signaling increased bullish conviction. This situation opens up opportunities for more ambitious price targets.

Bitcoin (BTC) Technical Strengths Point to Bullish Trajectory

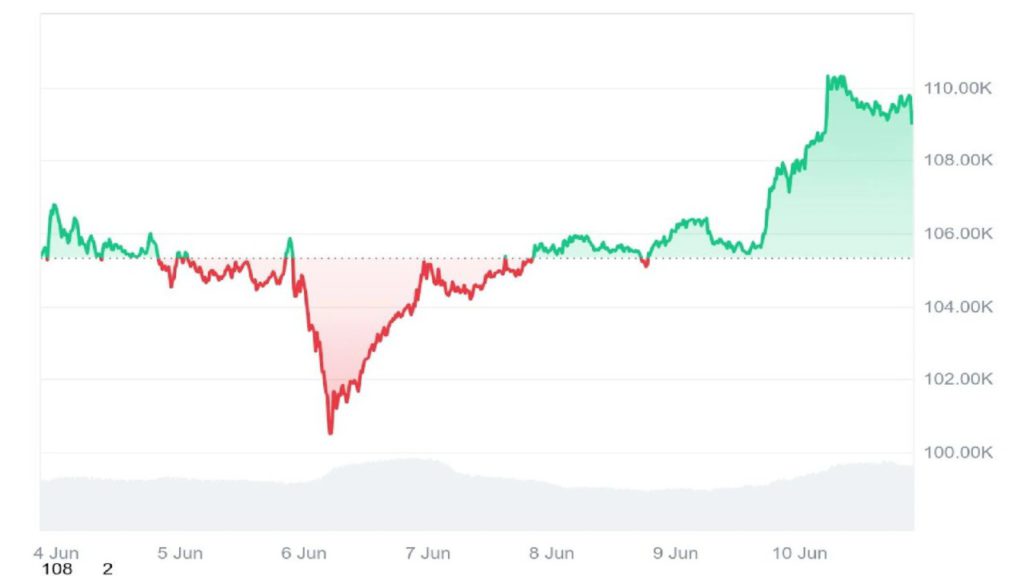

Bitcoin’s (BTC) price increase above $110,000 was a technically important milestone. The 3.4% price increase on the day, along with a 40% jump in trading volume, confirmed strong sentiment from institutions and retail.

Analysts are now setting their sights on the next key level of $120,000, which could be a stepping stone to $150,000 if the momentum continues. The quick recovery from the drop below $101,000, which was triggered by news-based volatility, reinforced the depth and resilience of the market.

Also Read: Circulating! Critic Michael Saylor’s Equal-Sized Critique of Bitcoin Strategy

Institutional and Corporate Signals Support $150K Target

The current price rise is driven not only by technical factors, but also by strategic adoption from institutions. There are rumors that asset managers associated with Trump have applied for a Bitcoin (BTC) ETF, while global asset manager Fidelity is reportedly pushing publicly traded companies to add Bitcoin (BTC) to their coffers. These developments mark an implicit shift from speculative assets to macro portfolio allocations.

Qubetics Value Proposition: Real Assets in the Chain

While Bitcoin (BTC) evolves as a digital store of value, Qubetics is building a complementary infrastructure through their Real Asset Tokenization Marketplace. This allows illiquid assets such as real estate, fine art, and structured finance products to be fractionalized and incorporated into a chain-based ecosystem. For companies, this represents a pathway to global capital without relying on traditional banking or custody entities.

Conclusion: Dual Narratives for Bitcoin (BTC) and Qubetics in 2025

The perception of Bitcoin (BTC) as a macro asset continues to grow. Strength above $110K, combined with increased volume and institutional activity, sets a credible path towards $150K. The technical breakout is gaining structure, and the shift in market sentiment suggests continued upside potential.

Meanwhile, platforms like Qubetics offer a roadmap for the evolution of digital assets beyond the speculative domain-opening a path for the tokenization of real-world assets. As participants assess Bitcoin (BTC) 2025 price predictions, many may find value in blending macro exposure with infrastructure innovation.

Overall, the likelihood of Bitcoin (BTC) reaching $150K depends on continued momentum and institutional validation, while Qubetics provides a utility-oriented path that seeks to incorporate traditional real assets into the decentralized economy. Together, they may define the emerging contours of the 2025 crypto landscape.

Also Read: MicroStrategy Stock Strategies Beat Bitcoin and Tech Giants Over the Year

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Blockchain Reporter. Will BTC Hit $150k? Bitcoin Price Prediction 2025 and How Qubetics Builds Real-World Value. Accessed on June 12, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.