Bitcoin Crashes — But Experts Predict a Shocking Surge to $365,000!

Jakarta, Pintu News – CryptoElites utilizes Bitcoin’s uptrend line and historical price movements to predict when BTC will hit an all-time high in this cycle.

Specifically, between June 6 and 8, Bitcoin (BTC) experienced a sharp spike and managed to break the $105,000 mark on June 9. The next day, the first cryptocurrency briefly peaked above $110,000 before consolidating slightly.

This latest price action has increased optimism, with one analyst recently predicting that BTC could reach its cyclical peak of $365,000 by December.

Key Patterns that Show ATH’s Future Potential

According to a report from CryptoElites analysts on platform X, there is a recurring pattern in Bitcoin’s price movement that could signal a new all-time high (ATH).

Read also: Bitcoin Price Crashes to $103K — Is This the Bull Trap Everyone Feared?

The analyst highlighted previous ATH levels to indicate a long-term upward trend.

The first significant ATH occurred in December 2017 at $19,600, which was followed by a sharp drop to below $3,000.

After that, in October 2020, the Bitcoin price started to rise again and peaked above $64,000 in April 2021, before finally touching a cyclical peak at $69,000 in November 2021. It then corrected to around $15,000 before starting to rise again.

These recurring patterns are important as they indicate a long-term uptrend, characterized by an ever-increasing ATH as well as a decline towards the accumulation zone.

With Bitcoin’s current price at $107,879, this is within the historical pattern that has formed, and suggests that the next ATH will likely surpass the previous record.

Ascending Triangle Pattern

Another positive development identified by CryptoElites is the ascending triangle pattern, which is a bullish continuation pattern. This pattern is characterized by an upward sloping lower trendline and a horizontal upper trendline as resistance levels.

An ascending triangle pattern usually indicates a potential breakout in the direction of the ongoing trend-in Bitcoin’s case, an uptrend.

This means that if Bitcoin manages to break through the current resistance level, the price could experience a significant increase.

This ascending triangle pattern began to form after Bitcoin’s ATH in 2021 and continued with the next highest price reached at $69,000 on November 1, 2021.

After that, the price corrected to touch the lower trend line around $15,500 and stayed there.

Recently, Bitcoin reached a new ATH above $112,000, but has yet to break the upper resistance line.

If Bitcoin manages to break through that resistance and move towards the historical ATH uptrend line, analysts project a potential new record high.

Read also: Top 9 Altcoins to Buy Before Bitcoin Price Hits Record Highs!

This movement could push the price of Bitcoin to $365,000 by the end of 2025, which would mean an increase of about 238% from the current price of $107,902.

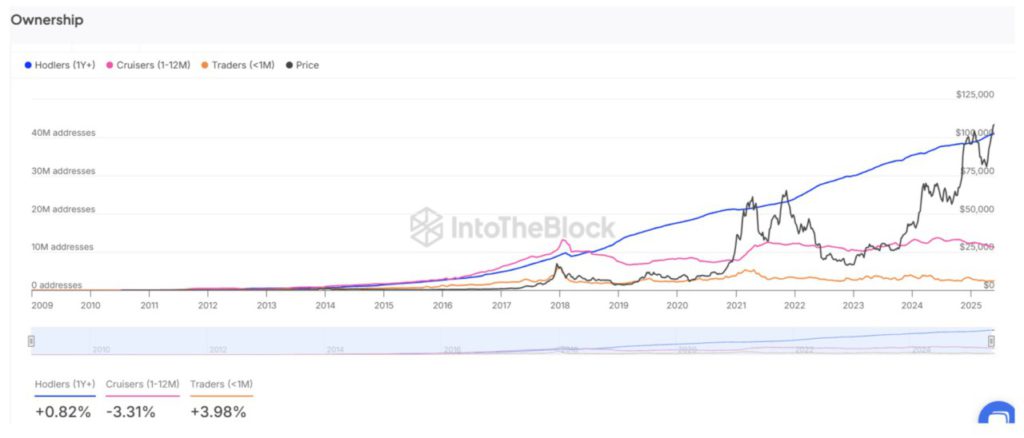

Changes in Bitcoin Holder Categories

In addition to price movements, recent data on the categories of Bitcoin holders provides additional insight into current market dynamics.

Bitcoin addresses that have held their assets for more than a year (known as Hodlers) saw a slight increase of 0.82%. This indicates a growth in the number of long-term investors, reflecting confidence in Bitcoin’s future potential.

Meanwhile, addresses holding Bitcoin for 1 to 12 months (Cruisers) decreased by 3.31%.

On the other hand, addresses that have held Bitcoin for less than one month (Traders) increased sharply by 3.98%, reflecting a surge in short-term market activity.

Currently (13/6/25), the Bitcoin price stands at $103,955, down 3.65% in the last 24 hours.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Analyst Predicts Timeline for Bitcoin to Hit Its Peak of $365k for This Cycle. Accessed on June 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.