Elon Musk Hits Undo on Trump Feud — Will Dogecoin Soar or Crash?

Jakarta, Pintu News – Reporting from AMB Crypto (12/6), Dogecoin (DOGE) experienced a bounce from the $0.1727 support level and briefly traded at $0.1992, recording a daily gain of 2.97%.

This rise came after Elon Musk surprisingly apologized to Donald Trump-a political moment that caught the public’s attention on social media, although it hasn’t triggered a significant price spike.

Are Small Scale DOGE Owners Taking Part in this Rally?

DOGE’s trading volume surged 37.73% to $5.21 billion, while Open Interest rose 10.84% to $2.20 billion.

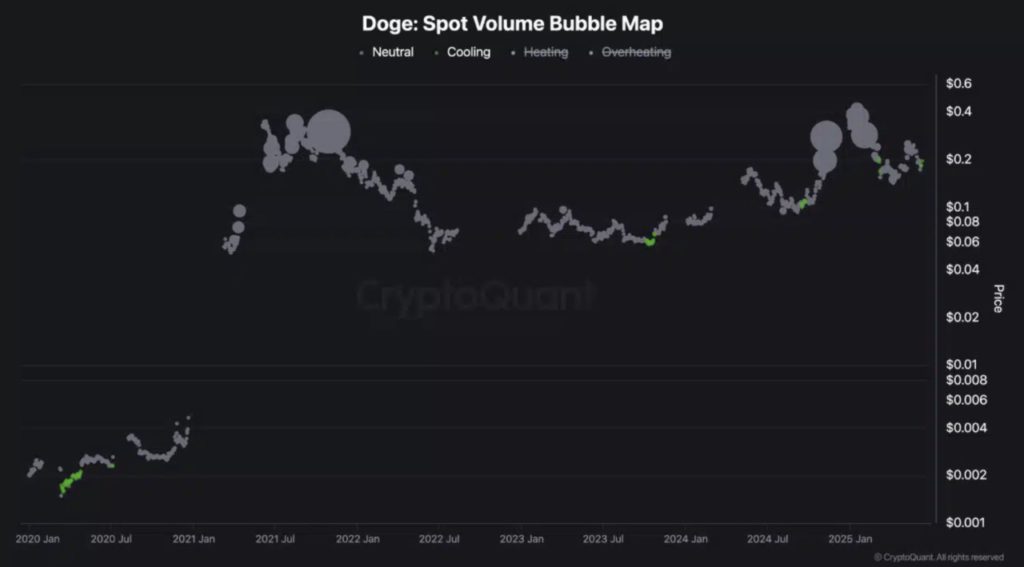

However, according to CryptoQuant’s Spot Volume Bubble map, the involvement of retail investors (small owners) appears minimal. This rally doesn’t show the bubble density that usually comes when many small investors buy in.

In fact, the bubbles near the recent price lows remain small and scattered, in stark contrast to the large clusters seen in previous price spikes.

This lack of “heating” in the spot market indicates that the current price increase has not been supported by broad buying interest.

Therefore, while there is price momentum, this movement appears to be driven only by a narrower group of market participants.

Without strong support from the investor base, Dogecoin’s price movement risks becoming just a short-term spike, rather than a sustainable trend.

Did Elon Musk’s Moment with Trump Fail to Trigger FOMO from Retail Investors?

Despite Elon Musk’s apology to Donald Trump going viral and dominating the news, retail traders have not flocked to Dogecoin.

CryptoQuant’s Retail Frequency Heatmap shows no signs of the usual retail excitement-no red clusters signaling mass buying from small investors (often called “ants”).

Historically, news involving Musk often triggers rallies driven by retail investors, but this time the market seems more cautious.

Although sentiment on social media is quite buoyant, the absence of widespread demand from retail circles limits the continuation of the price rally. If this layer of investors does not return, DOGE will likely struggle to break through important resistance levels.

Can DOGE Break Out of the Descending Channel Pattern?

Technically, DOGE is approaching the top of its descending channel pattern, with resistance levels around $0.2496.

Read also: Did Israel’s Attack on Iran Trigger Today’s Crypto Crash? Here’s What You Need to Know!

The Bollinger Bands begin to narrow-a classic signal that often precedes large bursts of volatility.

On the other hand, the MACD indicator started to flatten, which could be a sign of a possible upward crossover (bullish signal).

However, if the DOGE fails to break the resistance level convincingly, the downward pressure is likely to continue. Therefore, the current market structure demands caution.

If DOGE manages to break the downtrend line, then the market sentiment could turn bullish. However, the lack of participation from retail investors could limit the continuation of the price rise.

Are Long Positions Starting to Dominate the Market Too Early?

Dogecoin’s Long/Short account ratio on Binance remains strongly skewed towards long positions, with the figure consistently above 60% according to data from CoinGlass.

At the same time, the amount of liquidation of short positions on June 11 amounted to $2.55 million-much larger compared to only $690 thousand for the liquidation of longs.

This imbalance indicates the presence of strong directional pressure to the upside, but it also reflects market vulnerability. If the price is rejected at the resistance area, the dominance of overconfident long positions could trigger a sharp correction.

Therefore, bullish traders need to monitor market sentiment closely to avoid getting caught in a potential reversal.

Can DOGE Break Resistance Without Euphoria from Retail Investors?

DOGE’s momentum is currently increasing, driven by interest in the derivatives market and the social buzz triggered by Elon Musk’s political stunt.

Read also: As US-China Tariff Relations Improve, These 4 Crypto Are Poised to Skyrocket!

However, without the involvement of retail investors-who were the backbone of DOGE’s previous big rallies-this potential breakout risks losing steam.

Until small investors (“ants”) return to participate massively, this rally will likely face headwinds and struggle to sustain its gains.

Speculators and whales may be able to keep the market active, but sustained price increases remain dependent on widespread involvement from the crowd.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Dogecoin: Musk apologized, DOGE reacted – You’ll want to see this! Accessed on June 13, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.