Ethereum Hits $2,500 as Whale Snaps Up 1.29M ETH – Is a Surge to $4,000 Coming?

Jakarta, Pintu News – As reported by Coingape, Ethereum (ETH) may be approaching a state of scarce supply, as reserves on exchanges are dwindling amid massive accumulation by “whales” and growing demand from institutions.

ETH supply on exchanges is currently at an all-time low, while whales have bought 1.29 million tokens in just one month. At the same time, the amount of ETH staked has also reached a record high.

With this surge in demand, what does the impending supply squeeze mean for the Ethereum price? Will this be the trigger that pushes ETH through the $4,000 mark?

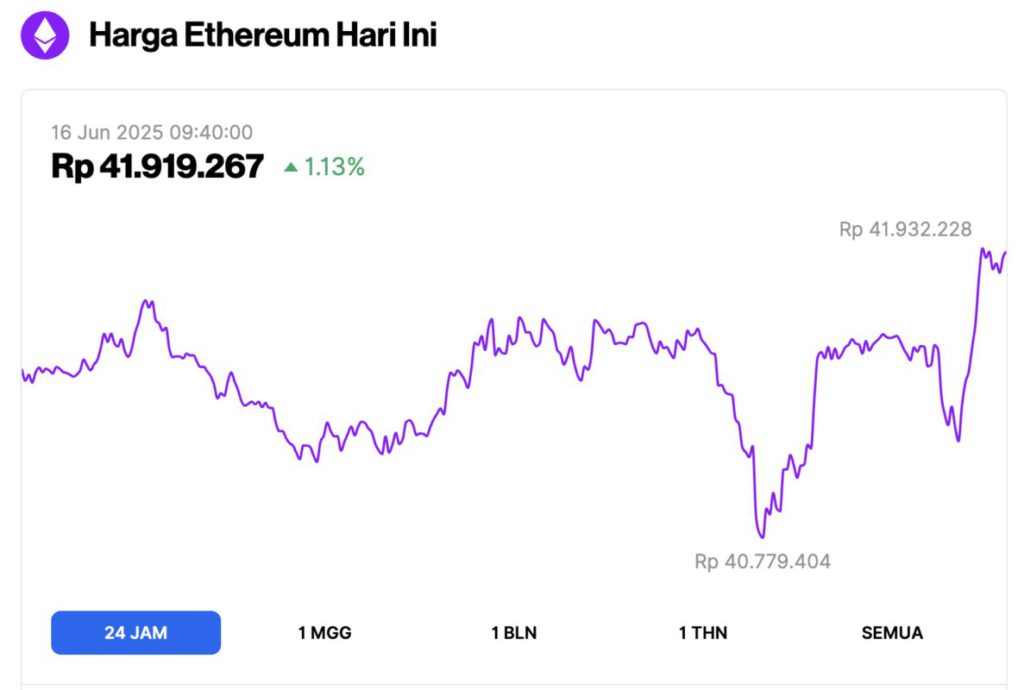

Ethereum Price Up 1.13% in 24 Hours

As of June 16, 2025, Ethereum (ETH) was trading at approximately $2,575, or around IDR 41,919,267 — marking a 1.13% gain over the past 24 hours. Throughout the day, ETH dipped to a low of IDR 40,779,404 and reached a high of IDR 41,932,228.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $310.83 billion, with daily trading volume rising 14% to $15.59 billion in the last 24 hours.

Read also: Bitcoin Holds Strong at $105K — But Is a Drop Below $103K Coming Soon?

Ethereum Faces Supply Pressure

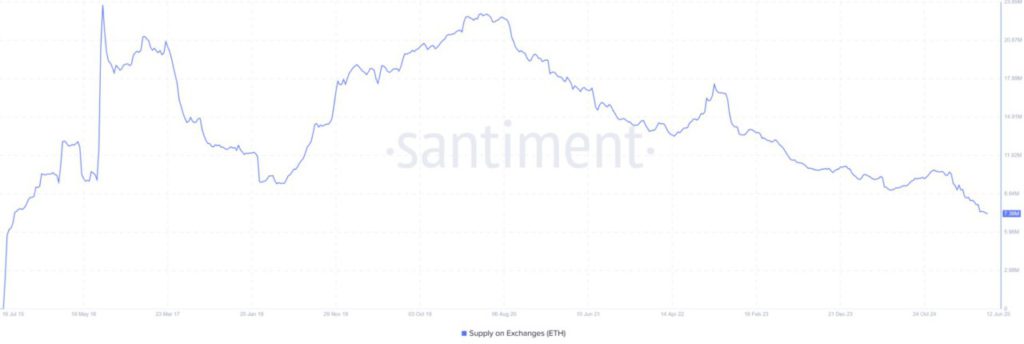

Ethereum is showing signs of coming under supply pressure, as a number of on-chain indicators point to supply tightening.

One such indicator is the supply of ETH on exchanges, which recently dropped to 7.3 million ETH – the lowest level since 2015.

This decrease in supply reflects several things. First, traders are withdrawing their tokens from exchanges and moving them to cold wallets, which directly reduces selling pressure.

Secondly, this drop could also signify increased usage of the Ethereum network as ETH utility increases.

An analyst named CryptoGoos on the X platform noted that activity on the Ethereum blockchain has indeed increased sharply, having recorded the highest bridged netflows of any network in the past 24 hours.

Traders are also likely moving ETH tokens from centralized exchanges to staking platforms, indicating a desire to hold for the long term. Data from BeaconChain shows that the amount of ETH staked has jumped to 34,694,490 ETH – the highest amount in history.

With increased staking activity, the impact on the Ethereum price could be positive, as more tokens are taken out of circulation on exchanges.

If retail and institutional traders rush to buy the remaining ETH on exchanges, this could potentially trigger a significant price spike.

Read also: 3 Crypto Scooped by Whales This Week, Potential to Soar?

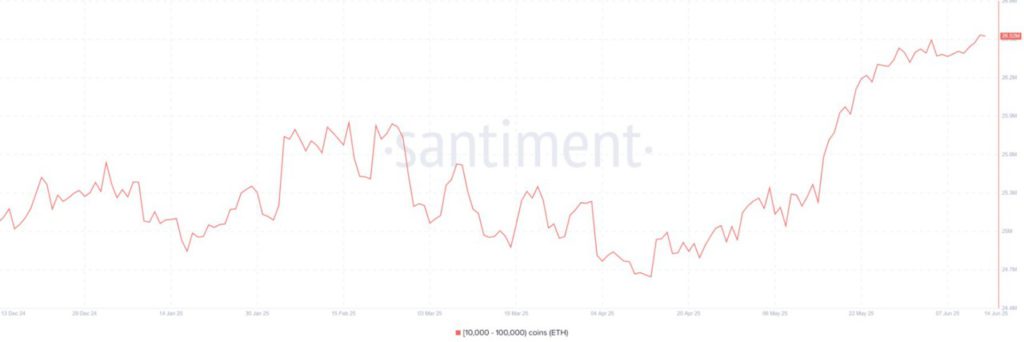

Whale Buys 1.29 Million ETH Tokens

Ethereum whales are actively accumulating ETH tokens, as seen in data from Santiment.

Address wallets holding more than 10,000 ETH have expanded their holdings significantly, with a total increase of 1.28 million tokens in just one month. The total supply held by these large wallets rose from 25.23 million tokens on May 14 to 26.52 million.

In addition to whales, institutions are also buying ETH. Recently, Sharplink Gaming bought 176,271 ETH tokens worth over $463 million, making it the largest publicly listed Ethereum holder. Meanwhile, spot ETH ETFs also experienced one of the longest periods of inflows.

When large traders make purchases while there are fewer ETH tokens available on exchanges, the likelihood of a supply squeeze increases.

What Potential Supply Scarcity Means for Ethereum Price?

A potential supply crunch is generally a positive (bullish) signal for Ethereum prices, especially when accompanied by a surge in demand.

As more ETH is withdrawn from exchanges, the price becomes more sensitive to increased demand. Therefore, if the accumulation trend continues, the price of ETH has the opportunity to experience a significant increase and possibly break the $4,000 mark.

This supply pressure can also be a trigger for price breakouts. In a recent analysis of the CoinGape page, the Ethereum price broke out of a 30-day consolidation pattern when buying and selling activity tended to be balanced.

Read also: US and China Trade Tensions Ease, These 4 Crypto Assets Are Predicted to Soar!

However, ETH fell back into that range during the recent crypto market correction. This potential supply shortage could be the catalyst that drives the price spike.

Overall, Ethereum appears to be at a tipping point, with supply on exchanges hitting historic lows. At the same time, whales and institutions continue to aggressively buy ETH tokens – this could trigger explosive price movements.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Supply Crunch Looms as Whales Stack 1.29M ETH. Accessed on June 16, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.