Bitcoin (BTC) Price Prediction June 16, 2025: Could it Reach IDR 3 Billion or Plummet to IDR 1.3 Billion?

Jakarta, Pintu News – Bitcoin (BTC) prices have been stagnant again this weekend, showing a sideways movement that tends to be boring for crypto traders. Neither significant price spikes nor sharp declines have occurred over the past two days.

However, this is precisely the kind of condition to watch as it could potentially be the start of the next big move. Both bullish and bearish scenarios are still possible, depending on how BTC reacts to key levels in the next few days.

Correction Continues, Is this the End of the Bullish Trend?

Currently, Bitcoin (BTC) is still in a correction phase since reaching its highest price back in May. The slow decline in price has signaled selling pressure, although it hasn’t been strong enough to trigger a widespread crypto market panic.

Analysts expect the price to drop towards the support area in the range of IDR 1.6 billion ($99,200 equivalent) to IDR 1.5 billion ($92,800) in the near future. Even in the worst-case scenario, Bitcoin price could plunge to Rp1.3 billion ($81,340), which is considered a long-term trend-setting zone.

Read also: Gold Jewelry Price Today June 16, 2025, Up or Down? Check the list!

If the price breaks that level, then there’s a good chance that Bitcoin’s long-term uptrend will end. This could mark the beginning of a deeper bear market, with investor interest starting to shift towards altcoins or stablecoins.

But so far, the selling pressure has not been enough to break the important support. As long as BTC stays above this zone, hopes for a continuation of the bullish trend are still wide open.

Rebound Potential: Target to reach Rp2.1 Billion to Rp3.1 Billion

Although the correction is still ongoing, bullish opportunities remain if Bitcoin price is able to stay above key support levels. Analysts are optimistic that once this consolidation phase is over, BTC could rally back towards IDR 2.1 billion ($130,000) as the initial target for the next leg up.

If the cryptocurrency market sentiment is increasingly positive, then the price has the potential to continue to soar to IDR 3.1 billion ($190,000). This would reinforce the narrative that the long-term uptrend is still in place.

In this bullish scenario, Bitcoin only needs technical recovery momentum and support from new capital inflows into the crypto market. Currently, the price is still holding above the minor support in the short timeframe, which suggests that the selling pressure is still under control.

Also read: 3 Memecoins that Gained More than 19% as of June 16, 2025

If the price can break IDR 1.76 billion ($108,822) in the near future, it could be an early signal that the uptrend is ready to restart. But for the time being, this breakout signal is not yet clearly visible.

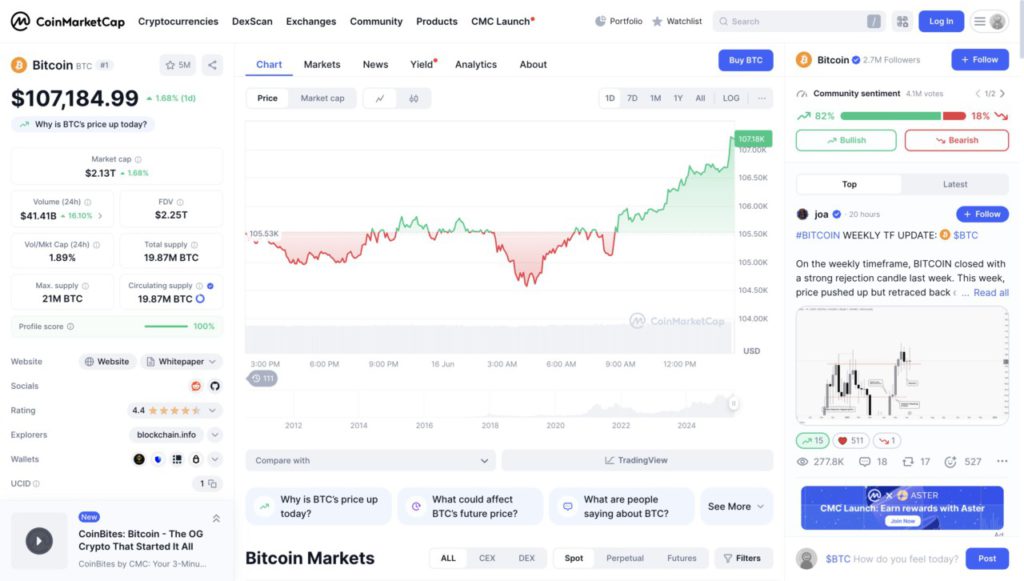

What Do Chart Patterns Say? Triangle Formation Potential Still Unclear

Some technical analysts have questioned the possibility of a triangle pattern forming on the BTC chart in the short term. But as of now, there are no technical indications strong enough to confirm the pattern is forming.

Triangle is a rare pattern and usually signals a consolidation that will be followed by a big move. For this reason, traders are asked to remain patient and observe price movements in more detail.

Patterns like this usually require additional confirmation in the form of volume and a clear breakout direction. With the current crypto market still showing relatively low volume, the potential for this pattern to form is yet to be confirmed.

Traders and investors are advised to focus on key levels and adjust their strategies according to the market direction. As long as there are no significant breakouts, volatility will remain low and movements are likely to be limited.

Conclusion

Overall, Bitcoin (BTC) is still in a correction phase with great potential in both directions. As long as the price does not break the critical support level, the long-term bullish trend is still valid.

However, traders and investors should still be on the lookout for a possible breakdown, especially if the price drops below IDR 1.3 billion. The cryptocurrency world is notoriously fast-changing, so wise decision-making is necessary in the current market conditions.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Price Prediction: Bullish and Bearish Scenarios Explained. Accessed June 16, 2025.

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.