Bitcoin’s 656% surge reveals strong market demand

Jakarta, Pintu News – In an atmosphere of heightened geopolitical tensions between Israel and Iran, the Bitcoin (BTC) market is showing a negative reaction. Despite a price drop to below $103,000 on Friday, the major cryptocurrency is now consolidating in the range of $105,000 – $106,000. Recent analysis from Glassnode provides deep insights into the growth of the current bull cycle, highlighting Bitcoin’s (BTC) price increase of 656% since 2022.

Bitcoin Growth Analysis

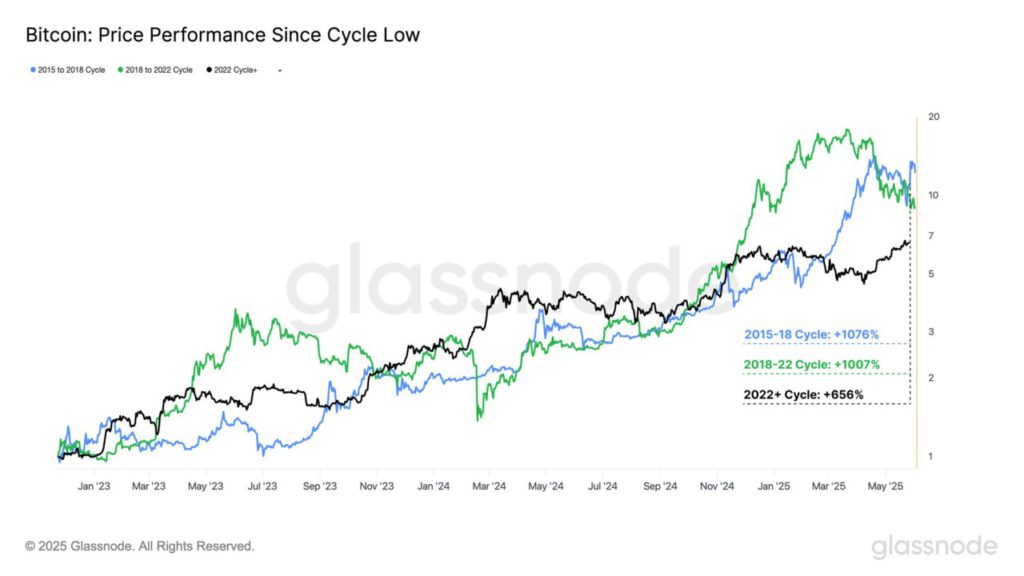

Glassnode, in a post on X on June 14, compared Bitcoin’s (BTC) price growth in the current market cycle with previous cycles. Each crypto market cycle, which lasts four years, consists of accumulation, bull market, distribution, and bear market phases. In the last two cycles, 2015-2018 and 2018-2022, Bitcoin (BTC) recorded price increases of 1,076% and 1,007% respectively.

Although the current increase of 656% has not reached the level of previous cycles, Glassnode considers this a satisfactory achievement. This growth comes amidst significant maturation of Bitcoin (BTC), with the market value reaching $2 trillion and increased exposure to institutional investors. Compared to gold which has only grown by around 192% in the last ten years, Bitcoin’s (BTC) growth demonstrates continued market demand.

Also Read: Vietnam Officially Recognizes Bitcoin and Other Digital Assets!

Current Market Dynamics

Currently, Bitcoin (BTC) is trading at $105,540 with a slight gain of 0.20% in the last 24 hours. However, the daily trading volume fell by 35.39%, signaling a significant decrease in market participation. According to a report from Sentora, the weekly fees of the Bitcoin (BTC) network fell by 3.31% due to the negative impact of recent political events and uncertain market sentiment.

In addition, inflows to exchanges increased by $2.4 billion, indicating that the number of investors looking to distribute their holdings is increasing. Although Bitcoin (BTC) reached a new record high of $111,891 on May 22, the currency experienced a significant price correction, dropping below $101,000 amid negative microeconomic events.

Investor Outlook on Bitcoin

Despite facing various challenges, sentiment among Bitcoin (BTC) investors remains bullish. Data from Coincodex shows that the Fear & Greed index stands at 63, reflecting a solid level of greed in the market. This shows that despite price fluctuations and market uncertainty, many investors still see long-term growth potential in Bitcoin (BTC).

Conclusion

Despite geopolitical challenges and market volatility, Bitcoin (BTC) continues to show resilience and significant growth. Glassnode’s analysis and current market dynamics confirm that demand for Bitcoin (BTC) remains strong, with promising prospects for the future.

Also Read: Ripple (XRP) Legal Case: Strong Arguments in Joint Motion Revealed!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin at $656 Cyclical Gain Highlights Deep Market Demand. Accessed on June 16, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.