Bitcoin Investors Keep Calm Amid Israeli-Iranian Tensions

Jakarta, Pintu News – Despite the escalating conflict in the Middle East, the price of Bitcoin (BTC) has managed to remain relatively stable. In recent days, the cryptocurrency has been hovering around the $105,000 level, only experiencing a 0.8% drop in the past week. Recent on-chain data suggests that the price of Bitcoin (BTC) may not continue to decline, as investors don’t seem to be bothered by the rising tensions between Israel and Iran.

Investor Analysis: Calm in the Bitcoin Market

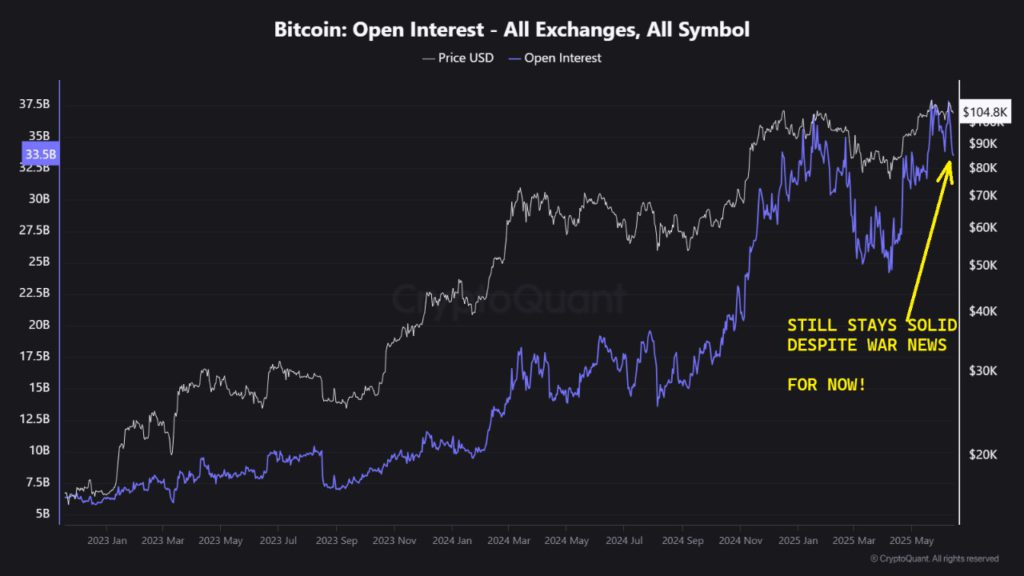

An on-chain analyst who goes by the pseudonym CryptoMe, via the CryptoQuant platform, revealed that the Bitcoin (BTC) market remains calm despite the ongoing geopolitical turmoil. The indicators in focus are the net flow of Bitcoin (BTC) to exchanges and Open Interest. Bitcoin (BTC) net flow to exchanges, which measures the difference between Bitcoin (BTC) sent to and withdrawn from centralized exchanges, is commonly used to gauge selling pressure on cryptocurrencies.

CryptoMe found that there were no significant changes in net flows, which suggests that investors are not seeking to sell their assets in a big way. In addition, the analyst also highlighted the Open Interest in centralized exchanges, which estimates the amount of capital flowing into cryptocurrencies at any given time.

Also Read: Vietnam Officially Recognizes Bitcoin and Other Digital Assets!

Open Interest and Derivatives Markets

Despite a decrease in long positions being liquidated after the price correction, Open Interest still looks strong. Investors are still keeping their positions open for now, despite the war news. CryptoMe also touched on Bitcoin (BTC) Open Interest at the Chicago Mercantile Exchange (CME), where institutions and speculators trade. Although some positions were closed and Open Interest decreased after the event, there has not been any significant outbound movement on the CME.

Bitcoin Price Outlook: What Could Happen Next?

Uncertainty still hangs over the markets, and although investors are not yet in panic mode, the situation could change if war tensions escalate further. Therefore, it is important for market participants to approach the market with caution in the next few days. Currently, the price of Bitcoin (BTC) is hovering around $104,760, reflecting a decline of almost 1% in the last 24 hours.

Cover: Bitcoin Investor Resilience Amid Uncertainty

Despite the heightened geopolitical uncertainty, Bitcoin (BTC) investors seem to be choosing to hold on and monitor the situation from time to time. The relative stability of the Bitcoin (BTC) price indicates investors’ continued confidence in the crypto asset as a store of value amidst uncertainty.

Also Read: Ripple (XRP) Legal Case: Strong Arguments in Joint Motion Revealed!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Investors Remain Calm Despite Israel-Iran Conflict. Accessed on June 16, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.