Pi Network Dips to $0.579 (6/17): Will Pi Coin Bounce Back or Keep Falling?

Jakarta, Pintu News – Pi Network (PI) has declined nearly 6% in the past seven days, showing mixed signals from key technical indicators.

This analysis will dig deeper into the Pi Network’s potential price movements, based on indicators such as the Directional Movement Index (DMI), Chaikin Money Flow (CMF), and EMA lines.

Pi Network Price Drops 3.8% in 24 Hours

On June 17, 2025, the price of Pi Network (PI) was recorded at $0.579, a decrease of 3.8% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,267), then 1 Pi Network is IDR 9,418.

Read also: Pi Network Tightens Security for Users in China: What’s the Impact?

On a 24-hour price range, Pi Network is trading between $0.5737 to $0.6073. Despite the price drop, Pi Network’s market cap remains quite large, reaching $4.31 billion with a fully diluted valuation (FDV) of $6.63 billion.

Trading volume in the last 24 hours was recorded at $104.24 million, indicating significant market activity despite the price decline.

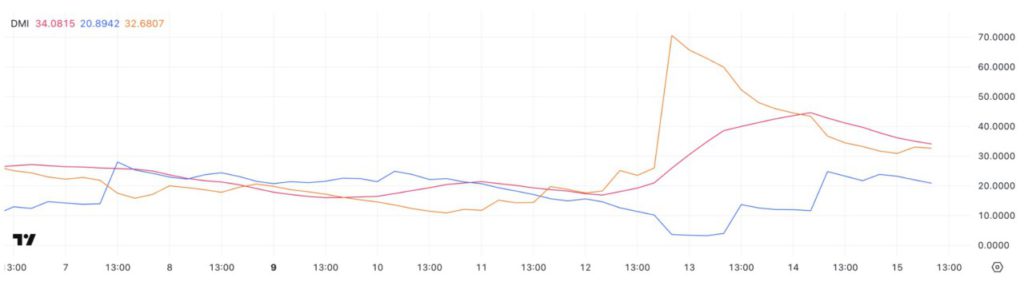

DMI Pi Network Indicator: Fading Bearish Momentum

Reporting from BeInCrypto, the Directional Movement Index (DMI) from Pi Network shows that the Average Directional Index (ADX) has dropped to 34, from 44.59 just the day before.

This drop follows a sharp rise from 16.89 three days ago, which signaled a strong trend that is now starting to weaken. ADX is a tool that measures the strength of a trend regardless of its direction.

This decline could be an indication that selling pressure is starting to ease, and that a trend change may be on the horizon. However, investors and analysts should remain vigilant as these changes could be volatile and require further confirmation from other indicators or external factors.

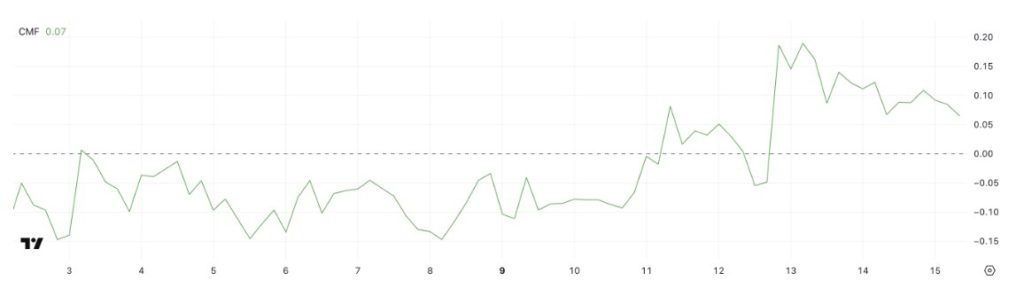

CMF Pi Network: Buying Pressure Remains

The Chaikin Money Flow (CMF) for Pi Network currently stands at 0.07, down from 0.19 two days ago but still higher than -0.05 three days ago. CMF measures the flow of money in or out of an asset based on price and volume data.

Values above 0 indicate buying pressure, while values below 0 indicate selling pressure.

Read also: Is Shiba Inu Set for a Gold Rush? SHIB Poised to Skyrocket!

Despite the decline, the positive value indicates that there is still buying pressure building. This could be a positive signal for the Pi Network, especially when combined with the bearish momentum decline of the DMI.

However, it is important to monitor this indicator further to see if the buying pressure can hold or not.

PI Price Consolidation: On the Threshold of a Big Decision

The current EMA line indicates a consolidation period for the Pi Network, after recovering from a sharp decline triggered by the escalation of the Israeli-Iranian conflict. The price is currently above the critical support level of $0.601.

If this level is broken, PI prices could drop to $0.542, and if bearish momentum increases, it may drop further towards $0.40.

On the other hand, if PI manages to break the resistance levels at $0.647 and $0.658, this could trigger a new uptrend.

Currently, the price structure shows uncertainty, with no clear control of the bullish or bearish side.

Overall, with various indicators giving mixed signals, the future of Pi Network still seems uncertain.

Investors and market watchers should pay attention to these indicators and other external factors to get a clearer picture of the direction the Pi Network will take.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network Price Slides, Holds Key Support. Accessed on June 17, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.