Understanding Dogecoin Volatility: Investment Opportunities Amid Uncertainty

Jakarta, Pintu News – Dogecoin (DOGE), the cryptocurrency popularly known as ‘memecoin’, is struggling to break through $0.2 resistance. As the crypto market attempts to stabilize after a tumultuous week, Dogecoin (DOGE) still seems to be struggling. However, there are indications that the memecoin may be starting to show signs of recovery.

Dogecoin Price Policies: Between Hope and Reality

Dogecoin (DOGE) continues to experience significant selling pressure, as evidenced by the dominance of sellers on On-Balance Volume (OBV). The swinging market structure shows a bearish tendency, with the price currently below the 78.6% Fibonacci retracement level taken from the rally in early May.

There is a liquidity cluster at the local low of $0.17, which may be tested again before starting a recovery. The pattern formed by Bitcoin (BTC) since May 23, where there is a big drop on Thursday or Friday, followed by a period of stagnation over the weekend and a recovery on Monday, may also provide clues as to what may happen to Dogecoin (DOGE) in the days ahead.

Read More: Company’s Bitcoin Accumulation Strategy Threatened, Stock Falls!

On-Chain Indicator: Buy Signal Amid Uncertainty

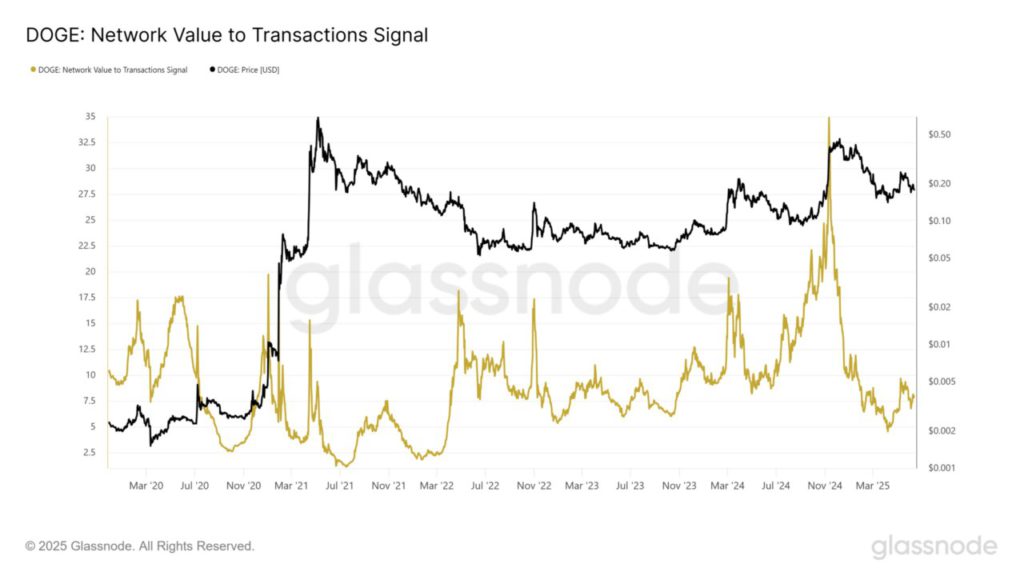

One metric that is interesting to look at is the Network Value to Transaction Signal (NVTS). NVTS, which is a modification of the NVT ratio, uses a 90-day moving average of the daily transaction volume to better serve as a leading indicator.

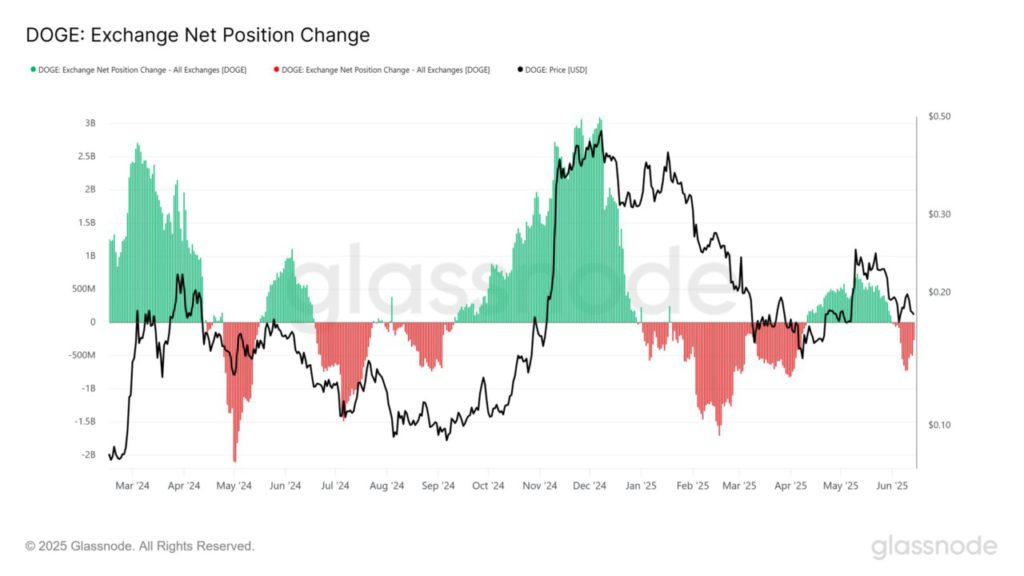

Currently, the NVTS is below the levels recorded in May-June 2024, suggesting that Dogecoin (DOGE) may be undervalued and offering a buying opportunity. The change in net position on exchanges to negative in early June, similar to what happened in January, could be an indication of accumulation.

This indicates that Dogecoin (DOGE) is flowing out of exchanges, which means fewer coins are available for sale. However, keep in mind that a negative net position change does not necessarily indicate an immediate price increase.

Investment Strategy: Dealing with Volatility Wisely

Investors interested in Dogecoin (DOGE) should prepare themselves for volatility. One strategy that can be adopted is dollar cost averaging, which allows investors to buy assets periodically at various price points to reduce the risk of volatility.

While there is potential for price increases, investors are advised to remain vigilant and consider the possibility of further declines. It is important to monitor market indicators and on-chain metrics constantly to gain a better understanding of trends that may be forming. This will help in making more informed and data-driven investment decisions.

Conclusion

In the face of an uncertain crypto market, a deep understanding of market dynamics and the use of appropriate investment strategies are essential. Dogecoin (DOGE), for all its volatility, still offers attractive opportunities for investors who are prepared to face risks and capitalize on emerging opportunities.

Also Read: Metaplanet Reaches 10,000 BTC Target: What Does It Mean for the Future of Cryptocurrency?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Dogecoin’s road to slow recovery: Here’s why investors should be ready for volatility. Accessed on June 17, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.