Will Tomorrow’s FOMC Meeting Shake Up the Crypto Market’s Recovery? Here’s What You Need to Know!

Jakarta, Pintu News – The long-awaited FOMC meeting will take place on June 17. Federal Reserve officials will gather in Washington, DC, to decide on interest rates.

After two days of meetings, the event will conclude on June 18 with a speech from Fed Chair Jerome Powell.

Interestingly, instead of facing high volatility ahead of this macroeconomic event, the crypto market is showing an uptrend today, countering the decline that occurred earlier. Let’s discuss this further.

Fed Expected to Keep Interest Rates Unchanged in FOMC Meeting

Despite Donald Trump’s call for a 1% Fed rate cut, experts believe that rates will most likely remain stable this month. The European Union has already cut interest rates three times since Trump’s inauguration.

Read also: 3 US Economic Indicators This Week That Could Shake Up the Crypto Market!

However, even if the US President makes a request to Fed Chair Jerome Powell, it is likely that no changes will occur.

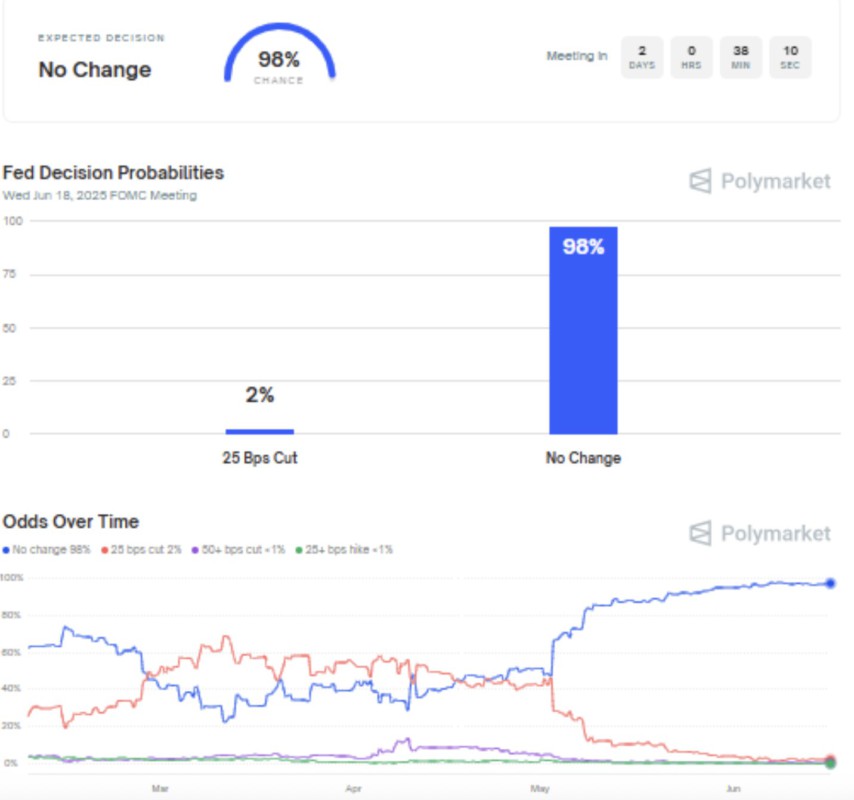

Data from Polymarket and economists’ forecasts suggest that the Federal Reserve will keep interest rates in the range of 4.25%-4.50%.

Expectations of a total rate cut this year are already diminishing. The first cut will most likely occur after the FOMC meeting in September.

This could have a negative impact on the crypto market, but as this is only a precaution, there is still hope.

Why isn’t the Fed cutting interest rates?

Market experts believe that there are significant concerns about inflation due to Trump’s tariffs.

While they acknowledge that inflation has eased, they think there is a high risk that tariffs could push prices up, which would add to inflationary pressures.

Another potential reason is the “Wait and See” strategy, where Fed officials are monitoring the economic impact of the tariffs before making any major decisions.

There are significant concerns regarding the two threats of tariffs, which could increase inflation (prices) and slow economic growth and cause unemployment.

In addition, the CPI and PPI data gave room for the Fed to hold off on cutting rates at the June FOMC meeting.

Read also: Metaplanet Reigns Supreme Over Bitcoin, Overtakes Coinbase with a Massive 10,000 BTC Stash!

Why Crypto Market Rises Despite Unlikely FOMC Meeting Outcome?

Often, macroeconomic events affect crypto performance even before they happen. However, despite predictions, the crypto market today showed a positive trend, recovering from the $1.15 liquidation crash previously triggered by the Israel-Iran conflict.

Interestingly, investors have adjusted to the current geopolitical conditions, as they believe peace will be achieved in the near future.

In addition, liquidity is starting to re-enter the market, as traders’ confidence recovers amidst the Bitcoin price surge, the hype surrounding the Solana ETF (SOL) approval, and additional advancements in the industry.

In addition, expectations for the Fed meeting are quite low as experts predict interest rates will remain unchanged. Thus, investor sentiment remains unaffected. Therefore, digital asset prices are recovering today.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. What to Expect from the FOMC Meeting as the Crypto Market Recovers. Accessed on June 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.