Arthur Hayes: IPO stablecoin trading is a hot potato – is it worth it?

Jakarta, Pintu News – BitMEX founder Arthur Hayes recently warned that a new wave of stablecoin companies will attempt to replicate the success of Circle‘s IPO, but most of them are likely to fail.

In his piece published on Monday, Hayes revealed that Circle’s IPO marks the beginning of “stablecoin mania”, and new companies following in its footsteps are likely to be overvalued and ultimately fail. Hayes advises investors to treat these stocks like “hot potatoes” or unwanted items, as there will likely be a bubble bursting after the launch.

Circle IPO: Kickstarting the stablecoin mania, but with risks

Hayes emphasized that Circle, which just launched its IPO, did show impressive results, but for many companies trying to replicate their model, it could be a dead end. He predicts that after the launch of the first stablecoin IPO, there will be many “Circle copycats” trying to follow this success. However, they will most likely end up failing due to too much competition and unrealistic valuations.

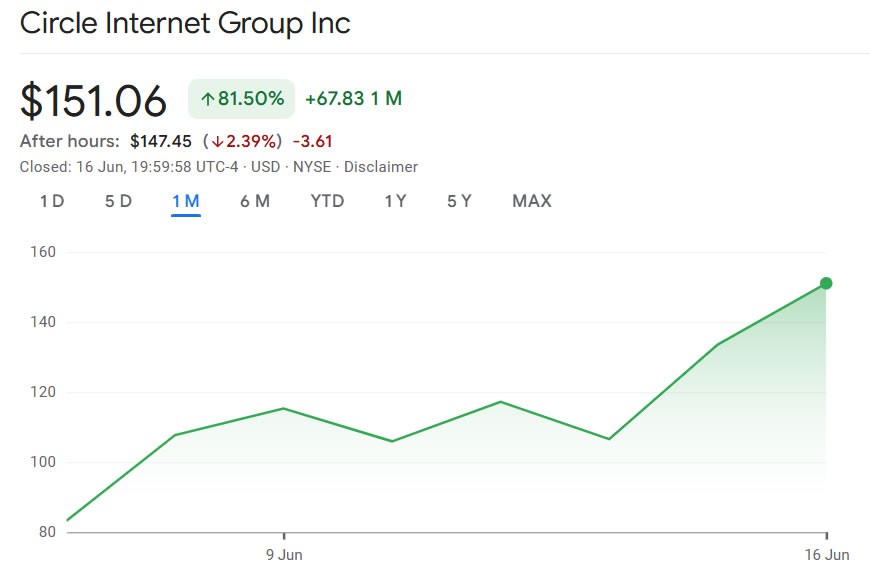

However, even though the prediction is not very optimistic, Hayes still recognizes that Circle’s IPO has brought a breath of fresh air to the stablecoin market. With a share price that has jumped more than 80% since it was listed on June 5, 2025, Circle is still showing growth potential despite the overall risk in the stablecoin market.

Read More: Company’s Bitcoin Accumulation Strategy Threatened, Stock Falls!

Arthur Hayes’ Predictions on Upcoming Stablecoin Companies

According to Hayes, the biggest challenge for new stablecoin companies is the issue of product distribution. He emphasized that there are three main distribution channels that are already controlled by incumbents such as crypto exchanges, major social media, and traditional banks. New companies that don’t have access to these distribution channels will struggle to grow and will most likely fail.

“New stablecoin companies will face huge challenges in distributing their products, while big players like Coinbase and Facebook will increasingly dominate the market with the stability and ecosystem they have built,” Hayes said. He added that new companies will either have to pay very high fees to gain access to exchanges or will have to offer huge yields to depositors, which will ultimately affect their sustainability.

Circle (CRCL) Pros and Risks as a Model for Stablecoin Companies

Although Circle made it through the IPO with its share price soaring significantly, Hayes remains of the view that the company is overvalued. One of the main reasons is that Circle has to hand over 50% of interest income to Coinbase, which shows a reliance on a large partner in running its business model. However, Circle’s (CRCL) share price continued to rise after the IPO launch and was recorded at $165 per share, which shows that the market is still very positive towards them.

For investors, although Circle is currently showing positive results, many feel that the extremely high valuation could be risky if the stablecoin market experiences a price correction or stricter regulations in the future. In addition, Circle’s reliance on third parties like Coinbase could add to the long-term uncertainty regarding the stability of their business.

Conclusion

Arthur Hayes’ take on the burgeoning stablecoin IPO phenomenon reminds us of the huge potential risks behind the hype and high valuations. While Circle has had a successful IPO, there are many challenges ahead for new stablecoin companies trying to follow in their footsteps. Investors should be cautious and monitor these developments closely, as the stablecoin market is still very much in its infancy and can quickly change as regulations and market dynamics tighten.

Also Read: Metaplanet Reaches 10,000 BTC Target: What Does It Mean for the Future of Cryptocurrency?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Arthur Hayes: Trade Stablecoin IPO Like Hot Potato. Accessed June 17, 2025.

- Featured Image: CryptoSlate

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.